- Australia

- /

- Specialized REITs

- /

- ASX:NSR

Does National Storage REIT’s Expansion Signal Real Value After a 6% Share Price Dip?

Reviewed by Bailey Pemberton

- Curious whether National Storage REIT might be a hidden gem or an overhyped pick? Let's take a closer look at what could be shaping its true value.

- The stock has seen a dip of 6.2% over the last week and is down 4.8% over the past year, although its five-year return still stands strong at 56.3%.

- Recent news highlights the company's ongoing expansion efforts with strategic property acquisitions and enhanced sustainability initiatives. Both of these have stirred fresh interest from investors. These developments add important context to the recent share price movement as the market weighs future growth potential against emerging risks.

- Right now, National Storage REIT scores just 2 out of 6 on our valuation checks, so there are plenty of questions to answer about its current price. Up next, we will break down the usual valuation approaches, and at the end, we'll introduce an even better way to work out what this stock is truly worth.

National Storage REIT scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: National Storage REIT Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate the true value of a company by projecting its future adjusted funds from operations and discounting those cash flows back to their present value. In the case of National Storage REIT, this approach uses a 2 Stage Free Cash Flow to Equity model, relying on both analyst forecasts and longer-term extrapolations.

Over the next five years, analyst estimates drive the cash flow projections. Future potential is informed by steady growth expectations after that. For example, free cash flow is expected to reach A$249 million in 2030, compared to lower estimates in earlier years. By 2035, projections see free cash flow growing to over A$333 million. These later years are based on slightly more conservative growth rates extrapolated by Simply Wall St.

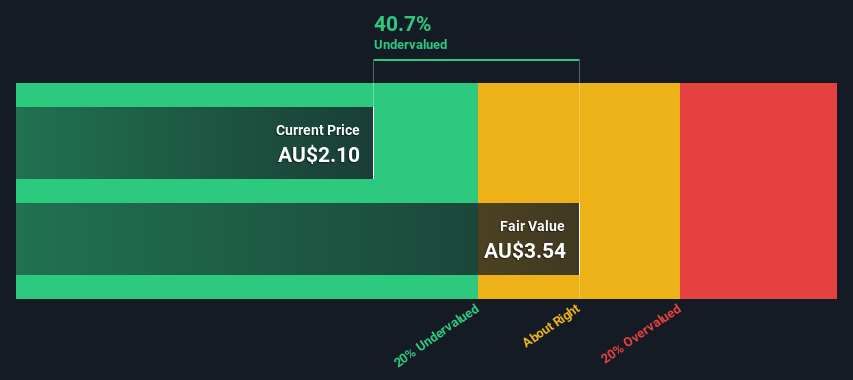

After discounting these future cash flows back to today, the DCF model calculates an intrinsic fair value of A$3.77 per share. This suggests the stock is currently trading at a 39.7% discount to its estimated true worth. According to this model, National Storage REIT appears strongly undervalued based on its projected cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests National Storage REIT is undervalued by 39.7%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: National Storage REIT Price vs Earnings

The price-to-earnings (PE) ratio is a key metric for valuing profitable companies, as it relates a company’s share price to its actual earnings. It provides a quick snapshot of how much investors are willing to pay for each dollar of earnings a company generates. A higher PE typically suggests higher growth expectations, while a lower PE can point to lower anticipated growth or higher risks. The right or "fair" PE for any stock depends on factors like future growth prospects, profit margins, size, and risk profile.

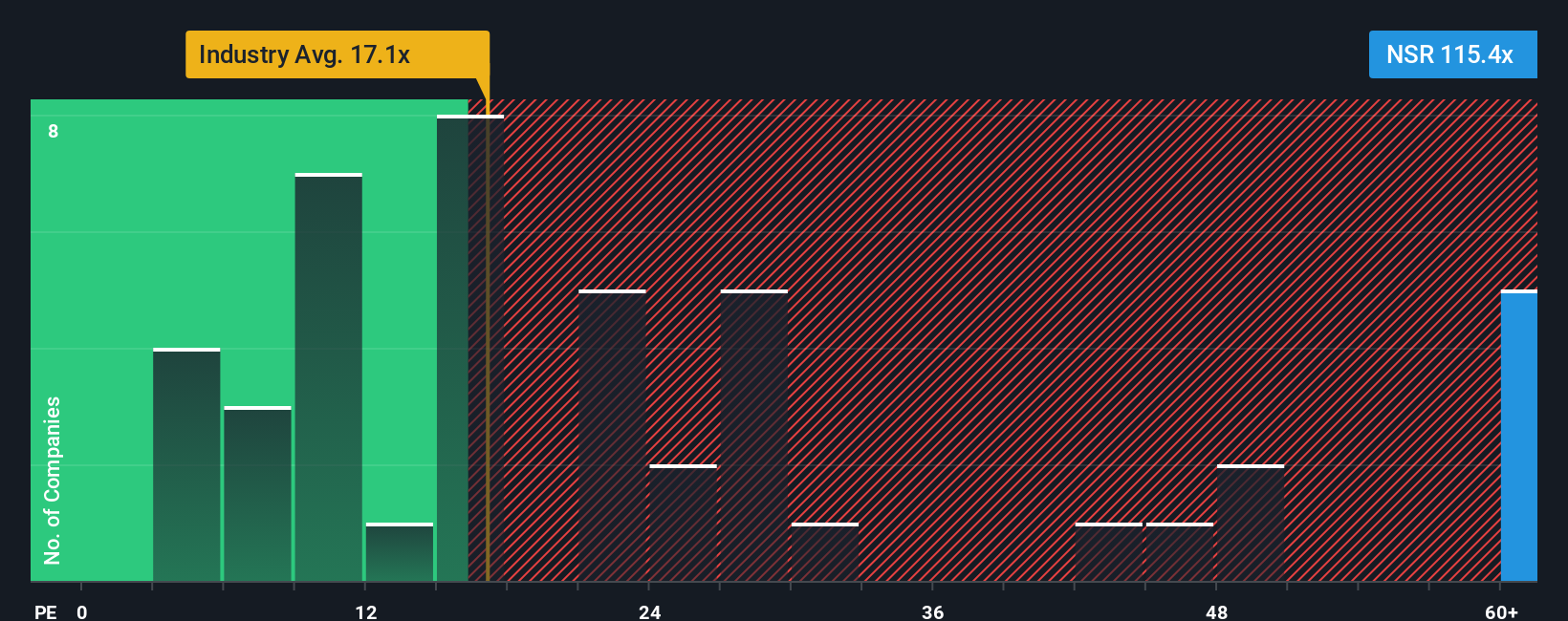

National Storage REIT currently trades at a PE ratio of 115.9x. For perspective, this is significantly higher than the Specialized REITs industry average of 17.3x, and also much higher than its selected peer group average of 11.4x. These figures signal that the market is demanding a heavy premium for the company’s earnings compared to both its industry and peers.

However, simple comparisons with industry averages can be misleading. Simply Wall St's proprietary "Fair Ratio" model incorporates important factors such as the company’s size, earnings growth, profit margins, industry, and risk. This approach calculates a Fair Ratio of 22.4x for National Storage REIT, reflecting what would be a reasonable multiple given all these elements combined. This measure helps cut through superficial comparisons by factoring in the unique situation of the business.

Comparing the company's actual PE to its Fair Ratio, National Storage REIT’s PE of 115.9x is well above the 22.4x fair value benchmark. This suggests the stock is currently trading at a premium and may be overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your National Storage REIT Narrative

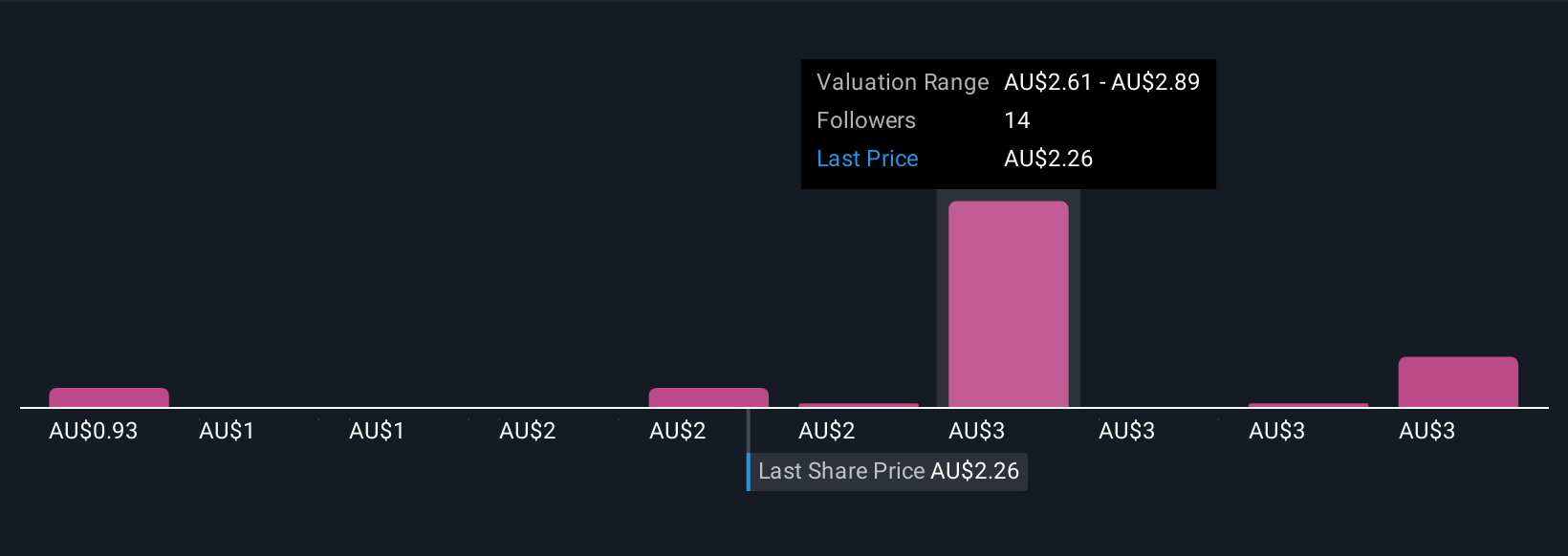

Earlier, we mentioned there’s an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative moves beyond the numbers, allowing you to connect your own story or outlook about a company with specific financial forecasts and a calculated fair value. On Simply Wall St’s Community page, millions of investors use Narratives because they transform complex data into a simple, visual framework: your assumptions drive the numbers, and the numbers map to a personalized fair value.

This approach makes it easy to compare your Fair Value to the current market price, guiding smarter decisions on when to buy or sell. Narratives adapt dynamically as news or earnings are released, ensuring your insights always reflect the latest information. For example, one National Storage REIT investor might build a Narrative expecting strong post-pandemic growth resulting in a higher fair value. Another could anticipate market pressures leading to a much lower estimate. Narratives put you in the driver’s seat by fusing your beliefs with real financial models, giving you a clear edge in your investment process.

Do you think there's more to the story for National Storage REIT? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 275 locations providing tailored storage solutions to more than 94,500 residential and commercial customers.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion