David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Lendlease Group (ASX:LLC) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out the opportunities and risks within the AU Real Estate industry.

What Is Lendlease Group's Net Debt?

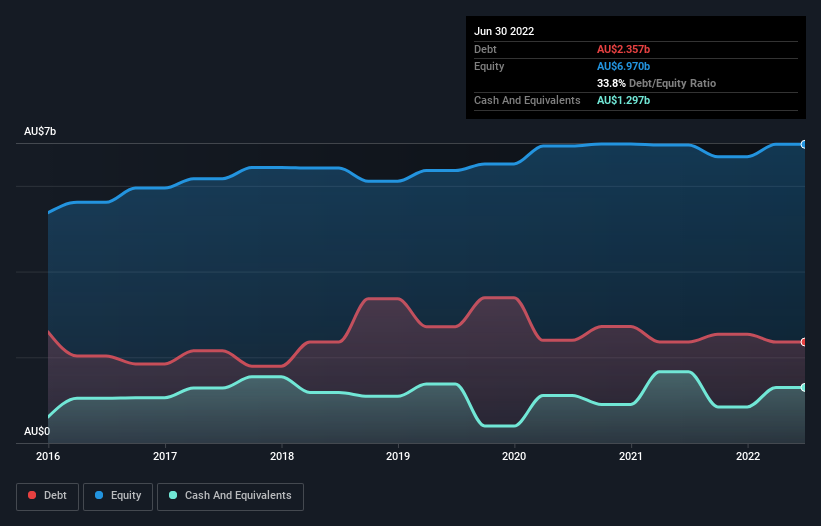

The chart below, which you can click on for greater detail, shows that Lendlease Group had AU$2.36b in debt in June 2022; about the same as the year before. However, it does have AU$1.30b in cash offsetting this, leading to net debt of about AU$1.06b.

A Look At Lendlease Group's Liabilities

The latest balance sheet data shows that Lendlease Group had liabilities of AU$5.35b due within a year, and liabilities of AU$4.78b falling due after that. Offsetting these obligations, it had cash of AU$1.30b as well as receivables valued at AU$2.03b due within 12 months. So its liabilities total AU$6.80b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's AU$5.04b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Lendlease Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Lendlease Group saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

Caveat Emptor

Over the last twelve months Lendlease Group produced an earnings before interest and tax (EBIT) loss. Indeed, it lost AU$22m at the EBIT level. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of AU$920m over the last twelve months. So suffice it to say we consider the stock to be risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Lendlease Group insider transactions.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LLC

Lendlease Group

Operates as an integrated real estate and investment company in Australia, Asia, Europe, and the Americas.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives