- Australia

- /

- Retail REITs

- /

- ASX:HDN

Assessing HomeCo Daily Needs REIT (ASX:HDN) Valuation After Recent Investor Interest

Reviewed by Kshitija Bhandaru

If you’re watching HomeCo Daily Needs REIT (ASX:HDN), chances are you’re questioning whether the latest moves in the share price are hinting at something bigger beneath the surface. While there hasn’t been a headline event to drive trading, the steady ebb and flow we’ve seen recently is prompting a closer look at whether the market might be reassessing this REIT’s fundamentals. For income seekers and value-focused investors alike, these quiet stretches can be just as important as major announcements, especially when they set the stage for a larger re-rating down the line.

Looking at the past year, HomeCo Daily Needs REIT has managed a return of nearly 17%, part of an impressive 47% total return over the last three years. Shorter-term momentum hasn’t been as strong, but the past month saw a slight lift after some sideways movement. This recent performance follows a mildly positive annual revenue growth rate and a slight decline in net income, showing that while the REIT is still expanding its top line, there’s some pressure on profitability. Nothing dramatic has hit the newswires, but a year of solid gains has definitely caught investor interest, and now people are wondering about what comes next.

So, after this year’s gains, should investors be weighing up a fresh opportunity to buy HomeCo Daily Needs REIT, or is the market already pricing in all the future growth?

Most Popular Narrative: 5% Undervalued

The consensus narrative currently sees HomeCo Daily Needs REIT as modestly undervalued, indicating a potential edge for value-focused investors. This view is based on updated forecasts for profit margins, earnings, and expected future multiples, weighing organic growth opportunities against near-term margin pressure.

The acceleration of omnichannel retailing and last-mile delivery needs is increasing demand for strategically located centers as fulfilment and pick-up points, enhancing tenant demand (including from e-commerce and traditional retailers) and positioning HomeCo to capture rising rents and maintain high occupancy rates. This supports both revenue growth and NOI stability.

Curious what is fueling analyst optimism in this subtle re-rate? Here is the twist: projected growth may hinge on a handful of pivotal earnings assumptions and a higher future profit multiple than you might expect. Want to know which quantitative levers could tip the scales? Find out the intriguing numbers powering the narrative’s fair value estimation—what could surprise you?

Result: Fair Value of $1.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including the persistent growth of online shopping and the potential for higher interest rates. Either of these factors could quickly shift sentiment.

Find out about the key risks to this HomeCo Daily Needs REIT narrative.Another View: Discounted Cash Flow Reality Check

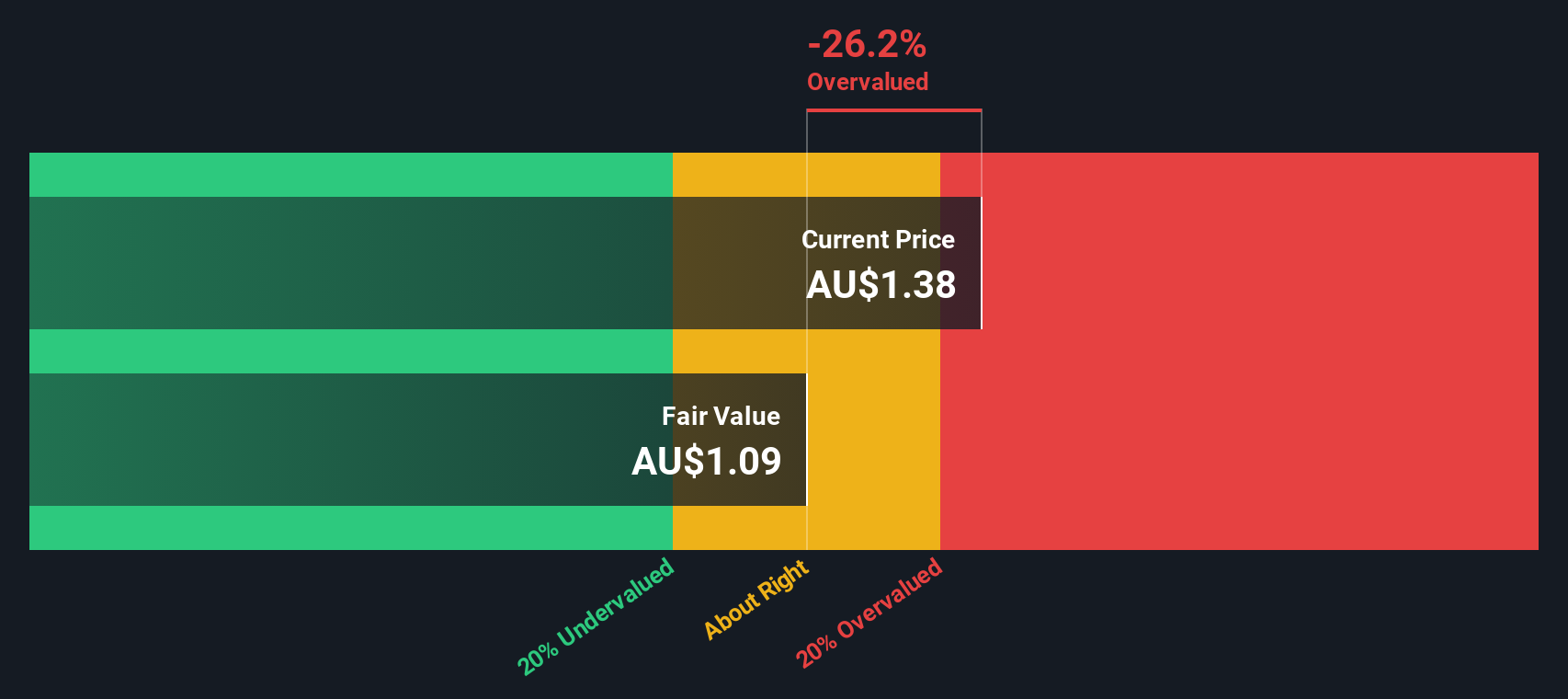

While the market sees HomeCo Daily Needs REIT as undervalued based on expected earnings, our SWS DCF model comes to a different conclusion and suggests the shares may actually be priced above fair value. Could the cash flow fundamentals be telling a more cautious story about long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HomeCo Daily Needs REIT Narrative

If you see things differently, or would rather dive into the numbers yourself, it takes just a few minutes to craft your own perspective. Do it your way

A great starting point for your HomeCo Daily Needs REIT research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Don't let the next big opportunity pass you by. Go beyond REITs and uncover breakthrough ideas to strengthen your portfolio using these tailored stock lists from Simply Wall Street:

- Accelerate your wealth-building by targeting companies priced below their long-term potential with our list of undervalued stocks based on cash flows.

- Ride the wave of healthcare innovation by tapping into tomorrow’s medical breakthroughs, all starting with healthcare AI stocks.

- Seize early-stage momentum and spot businesses transforming entire industries. Kick things off with our curated group of penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HomeCo Daily Needs REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HDN

HomeCo Daily Needs REIT

An Australian Real Estate Investment Trust listed on the ASX with a mandate to invest in convenience-based assets across the target sub-sectors of Neighbourhood Retail, Large Format Retail and Health & Services.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives