- Australia

- /

- Industrial REITs

- /

- ASX:GMG

How Goodman Group’s Shares Stack Up After Recent Share Price Dip

Reviewed by Simply Wall St

If you follow Australia’s real estate sector, chances are Goodman Group has caught your eye. Maybe you’re wondering whether to stay on board, make a move, or wait for a better price. After all, Goodman has built a strong reputation for long-term performance, but the share price hasn’t exactly been on a winning streak lately. Over the past week, the stock slipped by 2.1%, taking the 30-day drop to a notable 7.3%. Year-to-date, it’s down 8.9%, and even over the past year, it has edged 0.8% lower. But don’t miss the big picture. A longer 3-year look reveals a healthy 72.6% return, and a five-year timeline sees it up 91.5%. That kind of growth doesn’t just happen by accident.

Much of this volatility is tied to shifting global property trends and changes in investor appetite for large logistics developers. Concerns about interest rates and commercial real estate demand have certainly been swirling, but so has optimism about Goodman’s strategic land holdings and expansion into new logistics hubs around the world. So is Goodman offering genuine value right now, or is the share price still looking a bit rich?

To answer that, let’s look closer at the numbers. Goodman Group’s official valuation score is 0 out of 6, meaning the company isn’t currently considered undervalued by any of the six main checks analysts use. But there’s more to valuation than a checklist. In the sections ahead, we’ll break down those methods and explore an even smarter way to assess what Goodman Group could really be worth.

Goodman Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Goodman Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its expected future cash flows and discounting them back to today, reflecting what those cash flows are worth in present terms. For Goodman Group, this approach starts with the current Free Cash Flow, which stands at A$959.6 million. Analysts forecast these cash flows growing steadily over time, with projections showing annual figures climbing to A$2.38 billion by 2028. Beyond that, longer-range estimates using industry-standard methods expect the company's Free Cash Flow to continue rising, reaching nearly A$3.74 billion by 2035.

When these future cash flows are rolled up and discounted to the present day using the two-stage Free Cash Flow to Equity model, Goodman Group’s fair intrinsic value lands at A$31.29 per share. With the stock currently trading about 4.9% above this mark, the DCF model indicates Goodman’s shares are slightly overvalued, but only by a modest margin when compared to longer-term averages and sector benchmarks.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Goodman Group.

Approach 2: Goodman Group Price vs Earnings

For profitable companies like Goodman Group, the Price-to-Earnings (PE) ratio is a go-to valuation tool. It puts the current share price in the context of actual earnings, giving investors a straightforward way to gauge if the stock price aligns with performance. However, not all PE ratios are created equal. Growth outlook and risk play major roles in shaping what is considered “normal” for a given company or industry. Fast-growing or lower-risk firms often justify higher PE ratios, while slower or riskier players typically trade at lower ones.

Currently, Goodman Group trades at a PE ratio of 40.3x. For comparison, the average PE for its industry, Industrial REITs, is around 16.4x, and its peers sit at an average of 17.0x. These benchmarks make Goodman look pricey at first glance. However, that is not the whole story. Simply Wall St’s “Fair Ratio” model, which adjusts for specific company factors like growth prospects, risk profile, market cap, and profit margins, suggests Goodman Group’s fair PE ratio is 22.2x. This proprietary metric is more insightful than a simple industry or peer check because it accounts for what really sets Goodman apart from the pack.

Comparing Goodman’s actual PE of 40.3x to its Fair Ratio of 22.2x, the shares are much higher than what would be considered fair given its underlying outlook and metrics.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Goodman Group Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your story behind the numbers. It's how you combine your view of a company, including your assumptions about its future revenue, profit margins, and risks, into a personal fair value estimate.

Narratives connect the company's big-picture story to your unique financial forecast and, ultimately, a fair value, helping you move beyond static checklists. With Simply Wall St's Narratives feature (found on the Community page, used by millions worldwide), you can easily see how other investors are thinking, build your own scenario, and decide whether to buy or sell by comparing Fair Value to the latest Price.

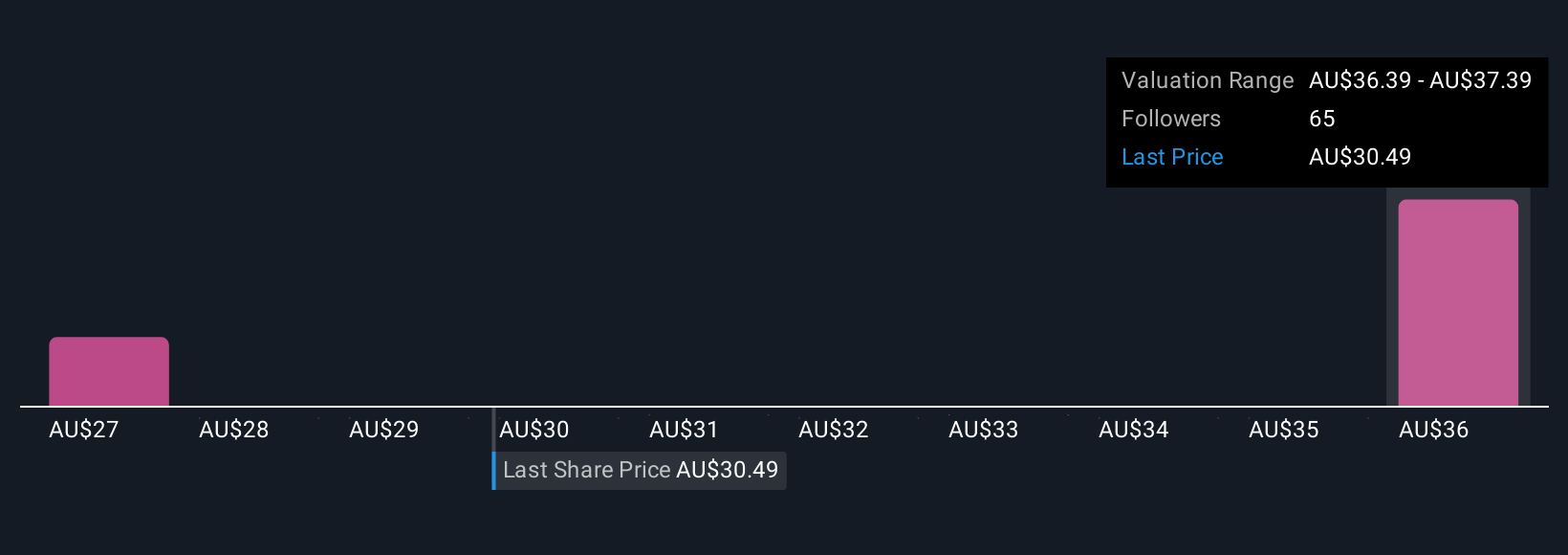

What makes Narratives powerful is how they're updated in real time. If Goodman Group releases earnings news or market conditions change, your Narrative (and its fair value) adjusts instantly. For example, some investors might see rapid data center expansion leading to a fair value near A$41.5 per share, while more cautious users foresee risks worth only A$29.0. This shows just how diverse perspectives can be, all grounded in the same robust framework.

Do you think there's more to the story for Goodman Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GMG

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives