Darren Steinberg became the CEO of Dexus (ASX:DXS) in 2012, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Dexus pays its CEO appropriately, considering its funds from operations growth and total shareholder returns.

View our latest analysis for Dexus

How Does Total Compensation For Darren Steinberg Compare With Other Companies In The Industry?

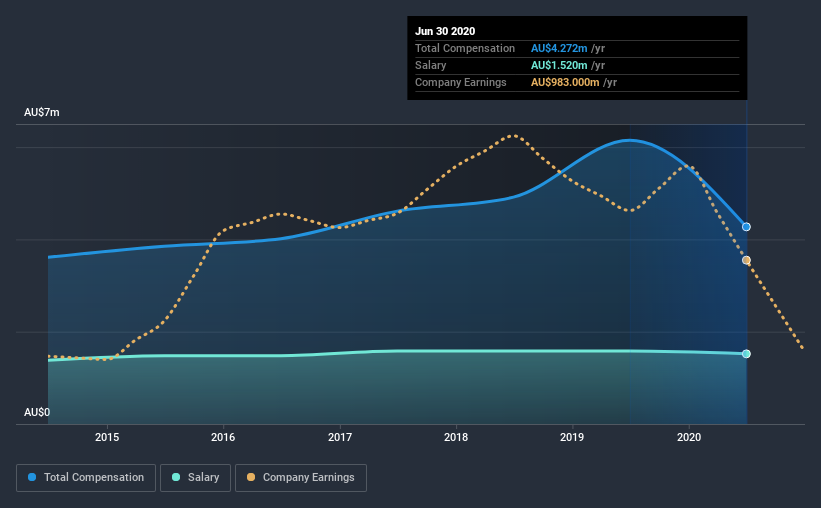

At the time of writing, our data shows that Dexus has a market capitalization of AU$9.4b, and reported total annual CEO compensation of AU$4.3m for the year to June 2020. We note that's a decrease of 30% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$1.5m.

For comparison, other companies in the same industry with market capitalizations ranging between AU$5.2b and AU$15b had a median total CEO compensation of AU$3.8m. So it looks like Dexus compensates Darren Steinberg in line with the median for the industry. Furthermore, Darren Steinberg directly owns AU$8.6m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$1.5m | AU$1.6m | 36% |

| Other | AU$2.8m | AU$4.6m | 64% |

| Total Compensation | AU$4.3m | AU$6.1m | 100% |

Talking in terms of the industry, salary represented approximately 54% of total compensation out of all the companies we analyzed, while other remuneration made up 46% of the pie. Dexus pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Dexus' Growth Numbers

Over the past three years, Dexus has seen its funds from operations (FFO) grow by 4.2% per year. Its revenue is down 18% over the previous year.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest FFO growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Dexus Been A Good Investment?

Dexus has not done too badly by shareholders, with a total return of 8.0%, over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As previously discussed, Darren is compensated close to the median for companies of its size, and which belong to the same industry. However, FFO and total shareholder return are solid yet uninspiring. Considering the steady performance, it's tough to call out CEO compensation as too high, but shareholders might want to see more robust growth metrics before agreeing to a future raise.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Dexus that investors should look into moving forward.

Important note: Dexus is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Dexus, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade DEXUS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DXS

DEXUS

Dexus (ASX: DXS) is a leading Australasian fully integrated real asset group, managing a high-quality Australasian real estate and infrastructure portfolio valued at $54.5 billion.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives