- Australia

- /

- Real Estate

- /

- ASX:CWP

Here's Why Cedar Woods Properties (ASX:CWP) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Cedar Woods Properties Limited (ASX:CWP) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Cedar Woods Properties

What Is Cedar Woods Properties's Net Debt?

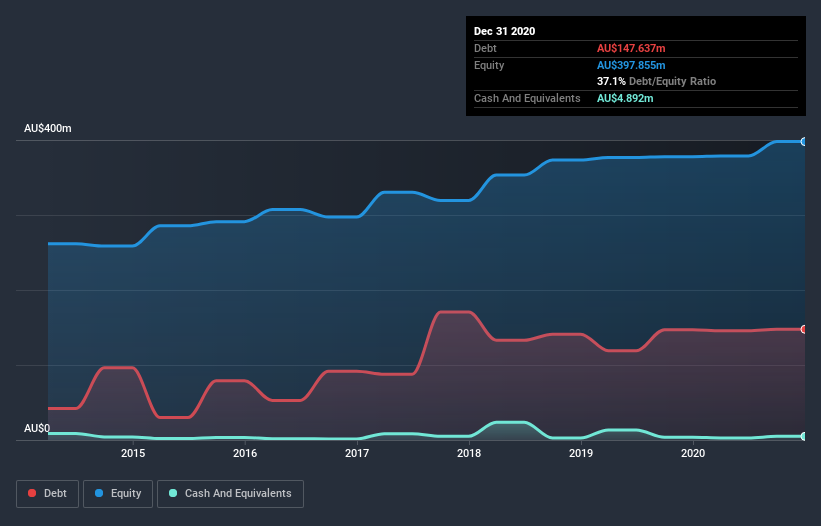

As you can see below, Cedar Woods Properties had AU$147.6m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it also had AU$4.89m in cash, and so its net debt is AU$142.7m.

How Strong Is Cedar Woods Properties' Balance Sheet?

We can see from the most recent balance sheet that Cedar Woods Properties had liabilities of AU$44.5m falling due within a year, and liabilities of AU$188.7m due beyond that. On the other hand, it had cash of AU$4.89m and AU$13.3m worth of receivables due within a year. So it has liabilities totalling AU$215.1m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Cedar Woods Properties is worth AU$587.0m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Cedar Woods Properties's net debt is 2.7 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 19.7 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. One way Cedar Woods Properties could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 19%, as it did over the last year. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Cedar Woods Properties can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Cedar Woods Properties recorded free cash flow of 39% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

When it comes to the balance sheet, the standout positive for Cedar Woods Properties was the fact that it seems able to cover its interest expense with its EBIT confidently. But the other factors we noted above weren't so encouraging. For example, its net debt to EBITDA makes us a little nervous about its debt. When we consider all the elements mentioned above, it seems to us that Cedar Woods Properties is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Cedar Woods Properties insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Cedar Woods Properties, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CWP

Cedar Woods Properties

Engages in property investment and development activities in Australia.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives