- Australia

- /

- Retail REITs

- /

- ASX:CQR

Charter Hall Retail REIT (ASX:CQR): Is the Discount to Assets an Opportunity for Income Investors?

Reviewed by Simply Wall St

Charter Hall Retail REIT (ASX:CQR) has drawn fresh attention after recent news highlighted its appeal to income-focused investors. The company has reported strong earnings, maintained steady distributions, and its share price is trading below net tangible assets.

See our latest analysis for Charter Hall Retail REIT.

After a steady performance through much of the year, Charter Hall Retail REIT’s momentum has started to build, with a 6.96% share price return over the last 90 days and an impressive 32.96% total shareholder return in the past year. The stock’s recent moves reflect a combination of growing investor confidence and renewed interest in yield-focused assets, especially as expectations for cash rate cuts and resilient retail activity continue to support the sector.

If income resilience like this has you rethinking your approach, now could be the perfect time to expand your search and discover fast growing stocks with high insider ownership

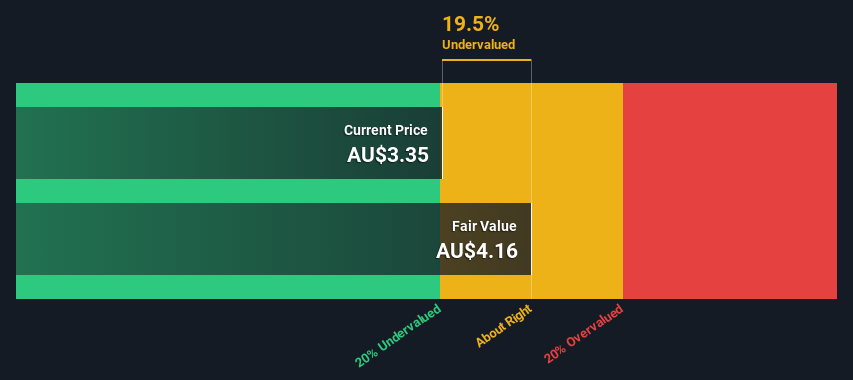

With the current discount to net tangible assets and an appealing yield, the key question remains: is Charter Hall Retail REIT undervalued at these levels, or has the market already factored in its future growth prospects?

Most Popular Narrative: 4% Undervalued

With the most widely followed narrative suggesting Charter Hall Retail REIT’s fair value is 4% higher than its latest close, the share price is positioned just below what consensus expects. This tight spread raises the stakes for investors watching for the next catalyst.

Portfolio curation, including the exit from non-core assets and the expansion of exposure to capital-efficient net lease assets with triple or double-net structures, reduces capex requirements, improves the risk profile, and enhances net operating margins. These factors are seen as driving future earnings growth.

Want to know which assumptions are powering this tight valuation gap? The narrative hints at bold margin expansion and structural shifts in revenue. Curious how far these levers can really push future earnings? Unlock the numbers and the story behind the headline value now.

Result: Fair Value of $4.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent e-commerce growth and rising refinancing risks could weaken the outlook and potentially challenge the consensus view on Charter Hall Retail REIT’s value.

Find out about the key risks to this Charter Hall Retail REIT narrative.

Another View: Our DCF Model Says Overvalued

While analyst consensus points to a fair or slightly undervalued stock, the SWS DCF model suggests Charter Hall Retail REIT is actually trading above its intrinsic value and estimates fair value at just A$3.31 per share. This sharp difference calls key growth and risk assumptions into question. Which approach do you think gets closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Charter Hall Retail REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Charter Hall Retail REIT Narrative

If you prefer hands-on analysis or want to follow your own insights, you can easily craft a personal view on Charter Hall Retail REIT in just a few minutes. Do it your way

A great starting point for your Charter Hall Retail REIT research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity slip away when there are countless unique stocks you may not have considered. See what else could boost your returns with these handpicked ideas:

- Capture reliable income streams by checking out these 21 dividend stocks with yields > 3% with yields above 3%, which can help build stability in your portfolio.

- Stay ahead of technological trends and maximize your upside by investigating these 26 AI penny stocks at the forefront of AI innovation and real-world applications.

- Ride the next financial revolution as you uncover these 81 cryptocurrency and blockchain stocks powering blockchain breakthroughs and reshaping global payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CQR

Charter Hall Retail REIT

Charter Hall Retail REIT is the leading owner of property for convenience retailers.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives