Here's Why We Think Charter Hall Long WALE REIT (ASX:CLW) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Charter Hall Long WALE REIT (ASX:CLW). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Charter Hall Long WALE REIT

Charter Hall Long WALE REIT's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Charter Hall Long WALE REIT has grown EPS by 6.5% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

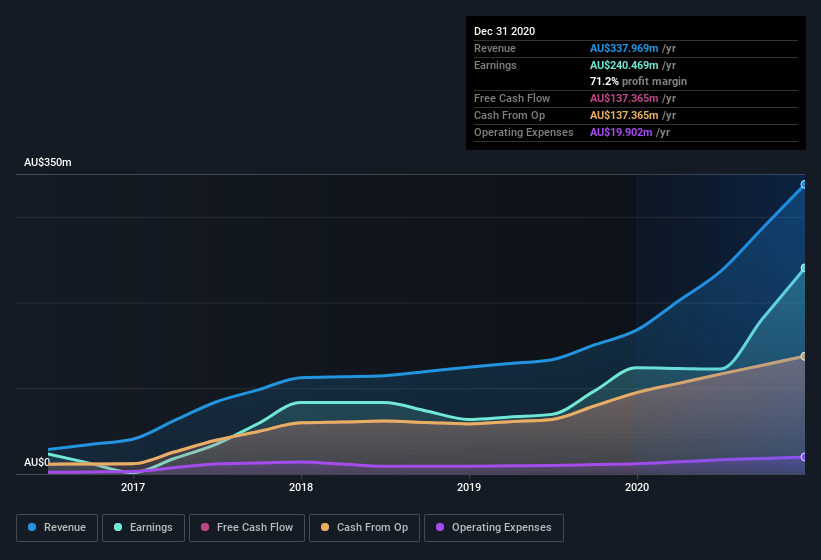

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Charter Hall Long WALE REIT's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Charter Hall Long WALE REIT shareholders can take confidence from the fact that EBIT margins are up from 73% to 87%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Charter Hall Long WALE REIT's future profits.

Are Charter Hall Long WALE REIT Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Charter Hall Long WALE REIT top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the MD, Group CEO & Director, David Harrison, paid AU$86k to buy shares at an average price of AU$4.32.

Is Charter Hall Long WALE REIT Worth Keeping An Eye On?

One positive for Charter Hall Long WALE REIT is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Charter Hall Long WALE REIT seems free from that morose affliction. The icing on the cake is that an insider bought shares during the year, which inclines me to put this one on a watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Charter Hall Long WALE REIT , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Charter Hall Long WALE REIT, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Charter Hall Long WALE REIT, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CLW

Charter Hall Long WALE REIT

An Australian Real Estate Investment Trust (REIT) listed on the ASX and investing in high quality Australasian real estate assets that are predominantly leased to corporate and government tenants on long term leases.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success