Can You Imagine How Chuffed Charter Hall Group's (ASX:CHC) Shareholders Feel About Its 182% Share Price Gain?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For instance the Charter Hall Group (ASX:CHC) share price is 182% higher than it was three years ago. That sort of return is as solid as granite. And in the last month, the share price has gained 5.9%.

See our latest analysis for Charter Hall Group

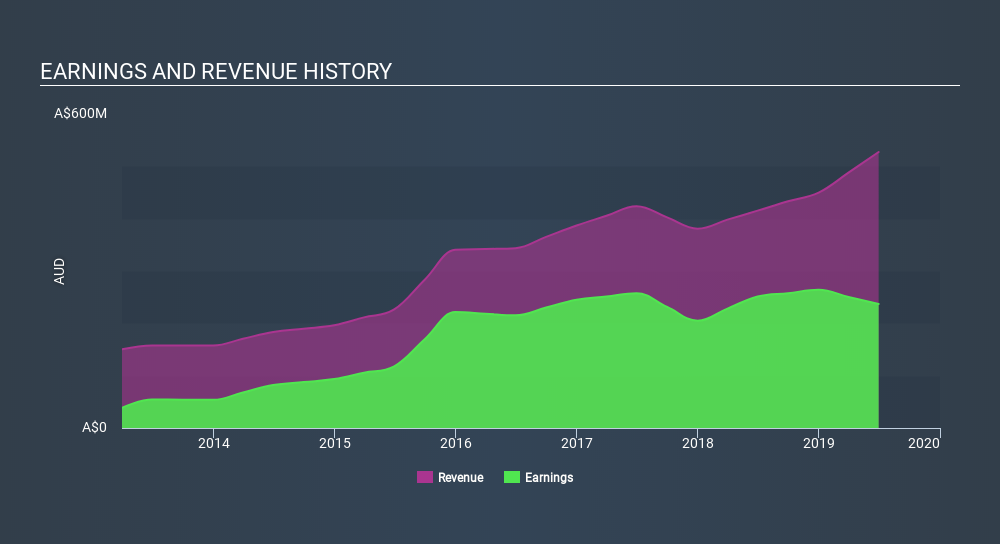

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, Charter Hall Group actually saw its earnings per share (EPS) drop 1.1% per year.

Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. Therefore, it makes sense to look into other metrics.

It could be that the revenue growth of 11% per year is viewed as evidence that Charter Hall Group is growing. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Charter Hall Group in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Charter Hall Group's TSR for the last 3 years was 221%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Charter Hall Group shareholders have received a total shareholder return of 73% over one year. Of course, that includes the dividend. That's better than the annualised return of 28% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Charter Hall Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Charter Hall Group , and understanding them should be part of your investment process.

Charter Hall Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:CHC

Charter Hall Group

Charter Hall is Australia’s leading fully integrated diversified property investment and funds management group.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives