- Australia

- /

- Retail REITs

- /

- ASX:BWP

What BWP Trust (ASX:BWP)'s Strong 2025 Results Mean for Shareholders and Sector Positioning

Reviewed by Simply Wall St

- BWP Trust recently announced its financial results for the year ended June 30, 2025, reporting A$203.3 million in sales and a net income of A$265.58 million, both up significantly from the previous year.

- Alongside the rise in profits, the Trust’s basic earnings per share from continuing operations increased to A$0.3722, highlighting stronger operational performance.

- We'll examine how BWP Trust’s robust revenue and earnings growth could influence its long-term investment outlook and sector positioning.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BWP Trust Investment Narrative Recap

For someone considering a position in BWP Trust, the core belief centers around the sustained strength of its long-term tenant base, predictable rental income, and an experienced management team. The latest result showed significant uplifts in both sales and net income, but the presence of a large one-off gain means this result does not materially shift the most important short-term catalyst: achieving stable, quality recurring income as Bunnings lease terms reset. The largest risk, slower revenue growth if tenants change their store networks, remains firmly in play.

Among BWP Trust’s recent announcements, the most relevant is its declared ordinary dividend of A$0.0945 per unit for the second half of 2025. This highlights management’s ongoing commitment to steady distributions, but investors should be mindful that distribution growth expectations could be influenced by large, non-recurring items in reported profits. The long-term ability to maintain and increase these dividends will depend on underlying rental growth trends and property occupancy levels.

However, even as BWP Trust’s revenue and profits gain a boost, investors should take note of the risk that comes if its largest tenant ever...

Read the full narrative on BWP Trust (it's free!)

BWP Trust's narrative projects A$221.5 million revenue and A$169.4 million earnings by 2028. This requires 2.9% yearly revenue growth and a A$96.2 million decrease in earnings from the current A$265.6 million.

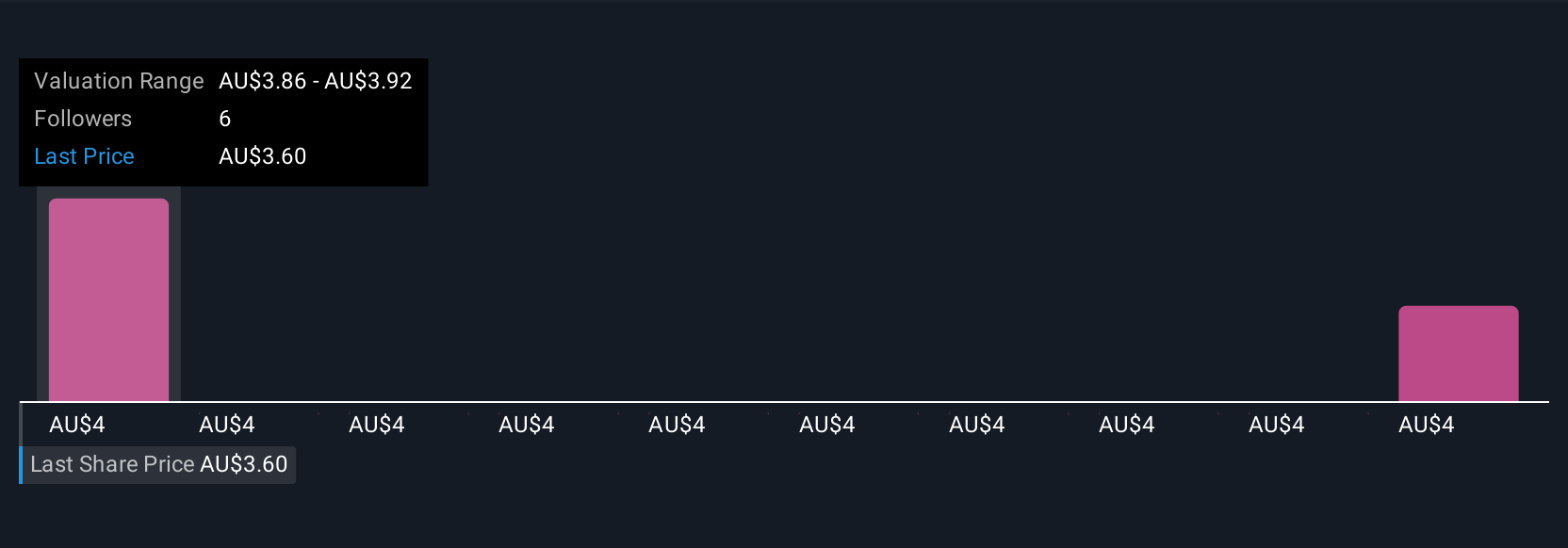

Uncover how BWP Trust's forecasts yield a A$3.86 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted two fair value estimates for BWP Trust ranging from A$3.86 to A$4.38 per share. While opinions vary, it is worth weighing these in the context of BWP Trust’s substantial reliance on Bunnings for rental income, which may influence how future risks and catalysts are priced in the stock.

Explore 2 other fair value estimates on BWP Trust - why the stock might be worth just A$3.86!

Build Your Own BWP Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BWP Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free BWP Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BWP Trust's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWP Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BWP

BWP Trust

Established and listed on the Australian Securities Exchange (‘ASX’) in 1998, BWP Trust (‘BWP’ or ‘the Trust’) is a real estate investment trust investing in and managing commercial properties throughout Australia.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026