- Australia

- /

- Real Estate

- /

- ASX:PPC

Undiscovered Gems In Australia To Explore In December 2025

Reviewed by Simply Wall St

As the Australian market experiences a modest uplift, buoyed by precious metals and a stronger Aussie dollar, investors are keenly observing the potential for growth in small-cap stocks amid these dynamic conditions. In this environment, identifying promising companies that can thrive despite broader market fluctuations is key to uncovering hidden opportunities within Australia's vibrant economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Argosy Minerals | NA | -12.81% | -19.89% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Value Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian-listed investment company with a market cap of A$730.45 million, focusing on generating long-term capital growth through a concentrated portfolio of high-conviction ideas from leading fund managers.

Operations: Revenue from investment activities amounts to A$161.68 million. The company's net profit margin is 22.5%, reflecting the profitability of its concentrated portfolio strategy.

Hearts and Minds Investments, a standout in the Australian market, showcases impressive earnings growth of 110% over the past year, outpacing the Capital Markets industry average of 13%. With a price-to-earnings ratio at 6.8x compared to the broader market's 21.6x, it seems attractively valued. Despite its lack of free cash flow positivity recently, this company boasts high-quality earnings and remains debt-free for five years. Recent leadership changes with Ms Natalie Climo as Company Secretary could signal strategic shifts ahead. As profitability isn't an issue here, Hearts and Minds holds potential for those seeking promising investment avenues in Australia.

Peet (ASX:PPC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Peet Limited is an Australian company that acquires, develops, and markets residential land, with a market capitalization of approximately A$933.98 million.

Operations: Revenue for Peet primarily comes from Company Owned Projects, contributing A$313.24 million, followed by Funds Management and Joint Arrangements at A$56.39 million and A$51.88 million respectively.

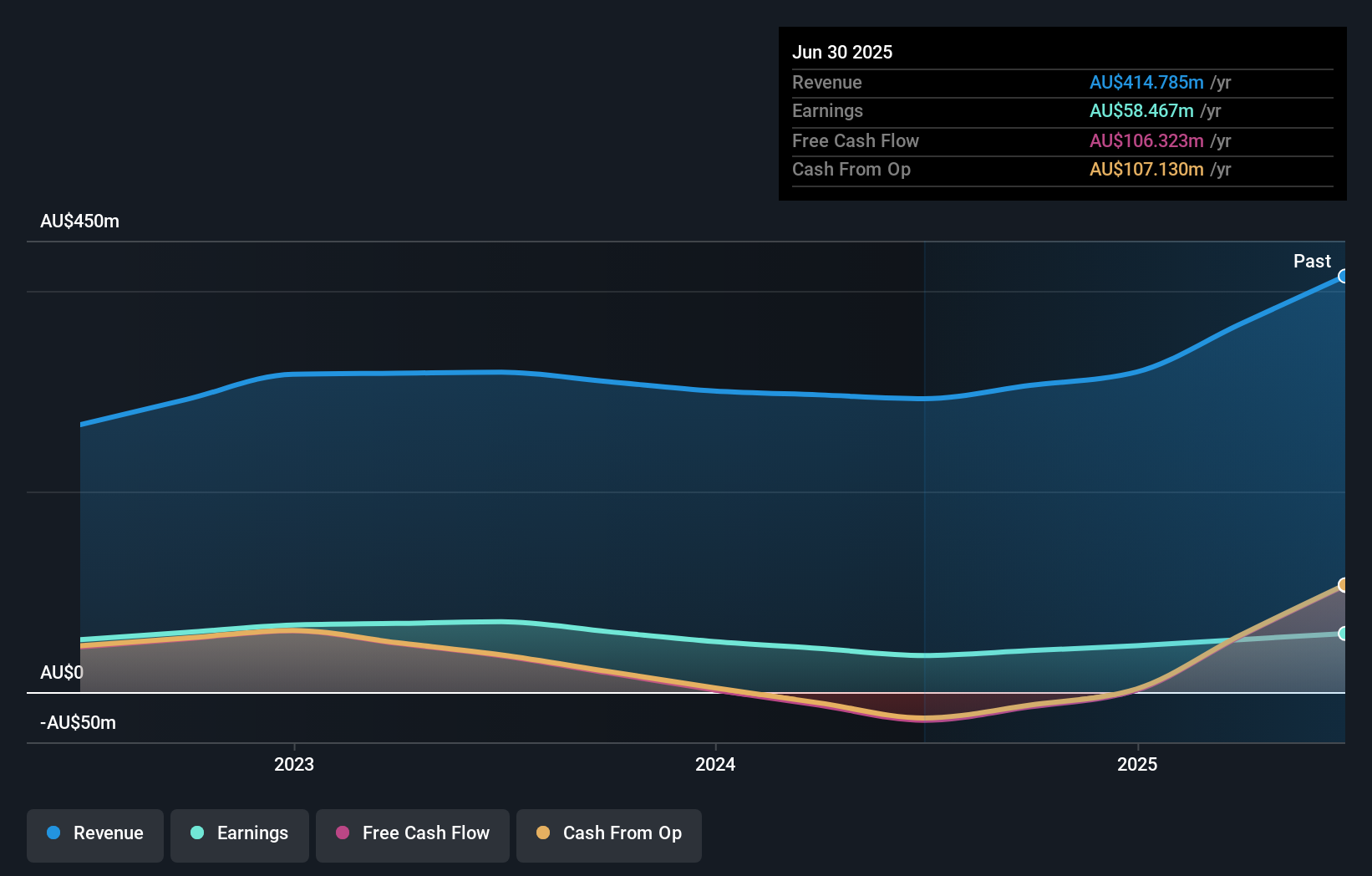

Peet, a notable player in the real estate sector, has demonstrated robust financial performance with earnings growth of 60% over the past year, outpacing the industry average of 31.8%. The debt to equity ratio has improved from 57.1% to 53.5% over five years, though net debt remains high at 45.8%. Despite significant insider selling recently, Peet's interest payments are well-covered by EBIT at a multiple of 10.7x and it trades at an attractive valuation—82.9% below estimated fair value—suggesting potential upside for investors considering its high-quality earnings profile and positive free cash flow status.

- Take a closer look at Peet's potential here in our health report.

Evaluate Peet's historical performance by accessing our past performance report.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services across various regions including Australia, New Zealand, Southeast Asia, the United States, Europe, the Middle East, North Asia, and internationally with a market cap of A$703.99 million.

Operations: Servcorp Limited generates revenue primarily through its real estate rental segment, which accounts for A$349.86 million. The company's financial performance is reflected in its market capitalization of approximately A$704 million.

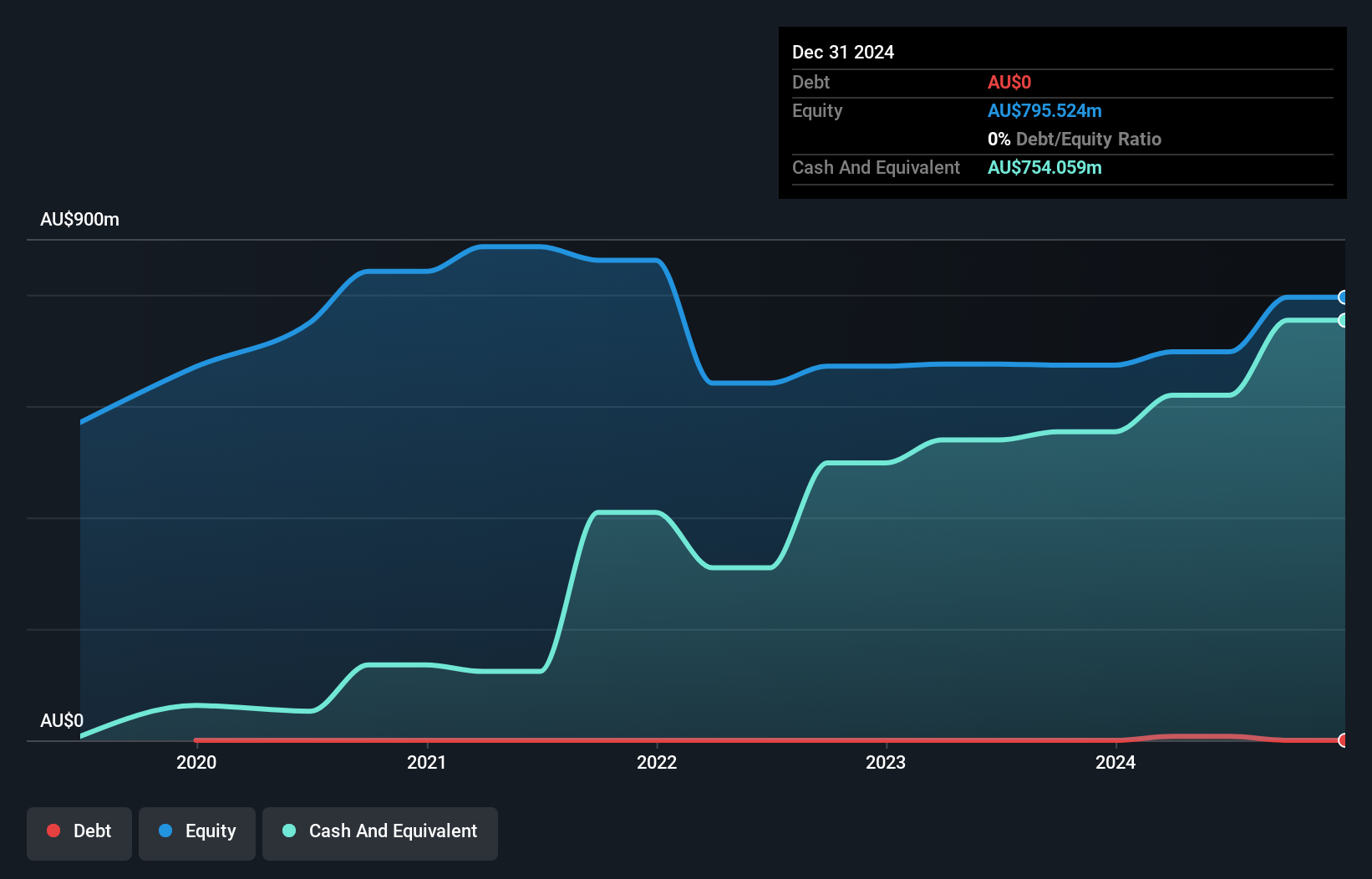

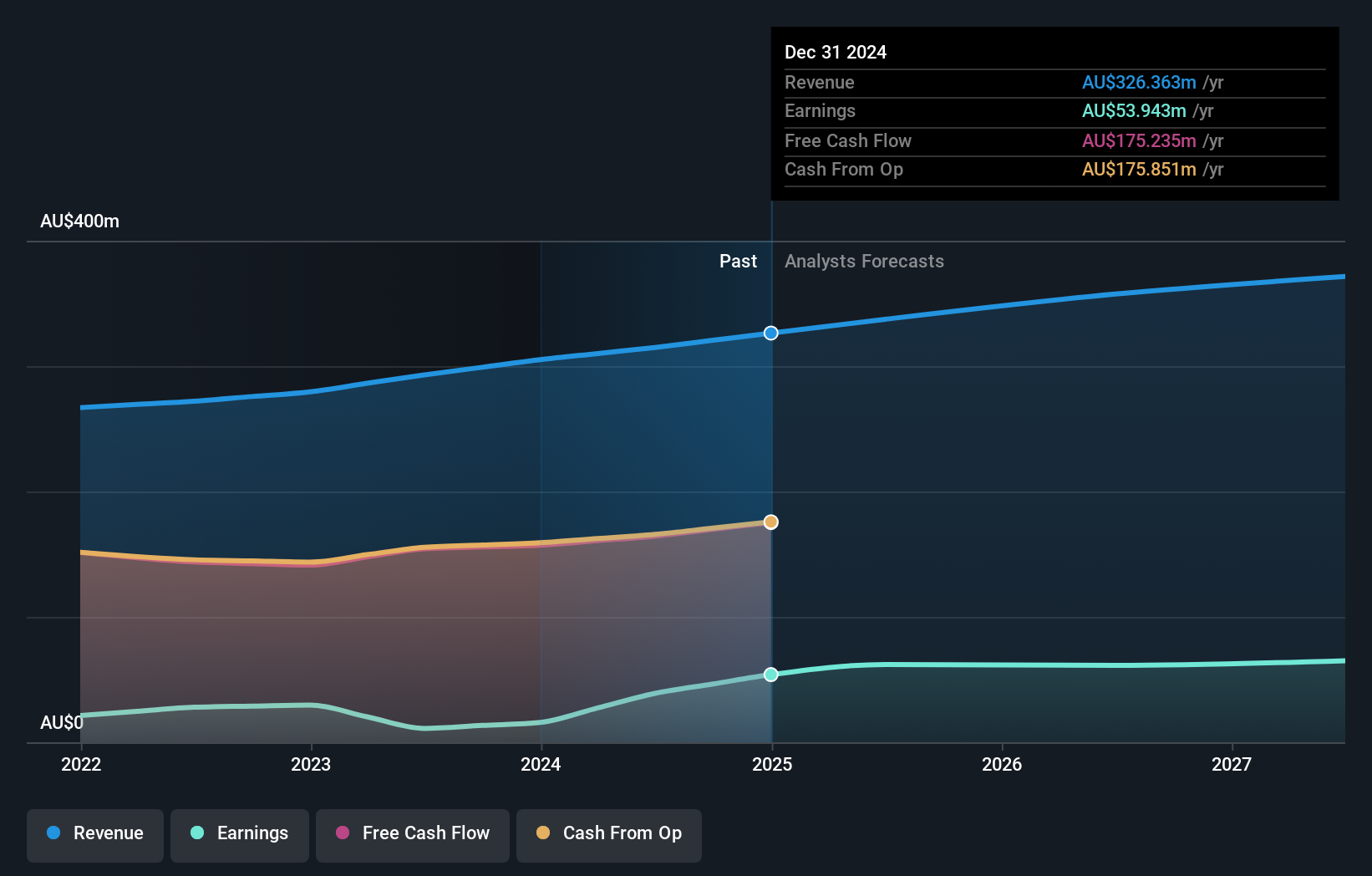

Servcorp has carved a niche in the flexible workspace industry, bolstered by its debt-free status and robust earnings growth of 36.1% over the past year, outpacing the real estate sector's 31.8%. The company trades at A$6.8, slightly below its fair value estimate of A$7.2, hinting at potential upside as it expands globally and invests in IT infrastructure to meet rising demand for coworking spaces. While analysts forecast a steady revenue increase of 5.5% annually with improved profit margins, challenges like high operational costs and competition in markets such as Japan remain pertinent concerns for future performance stability.

Turning Ideas Into Actions

- Gain an insight into the universe of 58 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPC

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion