- Australia

- /

- Real Estate

- /

- ASX:SRV

Top ASX Dividend Stocks Including Servcorp To Consider

Reviewed by Simply Wall St

As the ASX200 experiences a modest rise of 0.5% to 8,582 points amidst ongoing speculation about the Reserve Bank of Australia's upcoming rate decision, investors are closely monitoring sector performances with IT and Staples leading gains. In this dynamic environment, dividend stocks can offer a stable income stream, making them an attractive option for those looking to navigate market fluctuations while benefiting from consistent returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.83% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.33% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.47% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.50% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.31% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 5.90% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.96% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.71% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 8.70% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.48% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

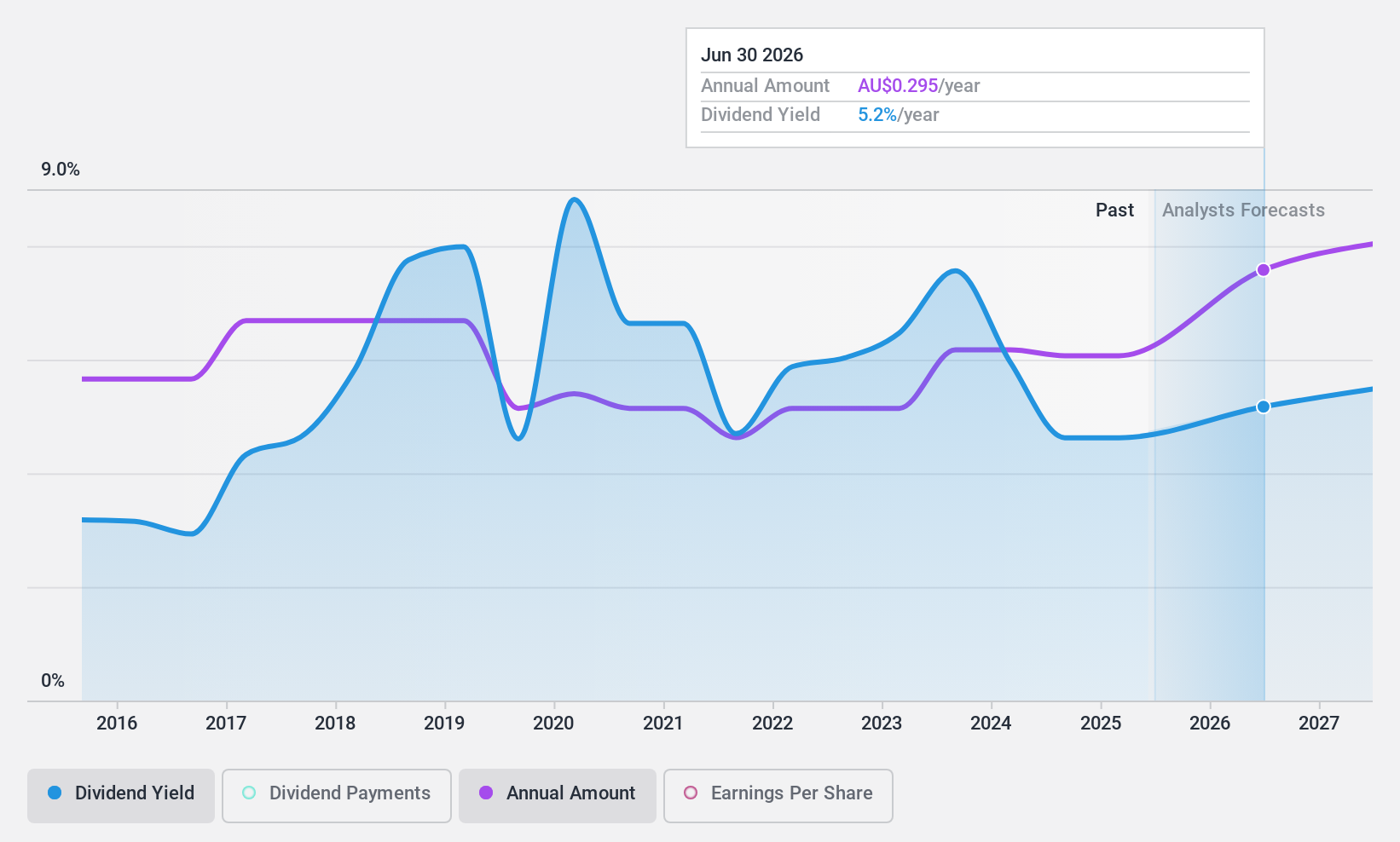

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$523.01 million.

Operations: Servcorp Limited generates revenue primarily from its Real Estate - Rental segment, amounting to A$314.89 million.

Dividend Yield: 4.5%

Servcorp offers a mixed dividend profile. While its dividends are well-covered by earnings (59.7% payout ratio) and cash flows (14.2% cash payout ratio), the yield of 4.45% is below the top tier in Australia, which stands at 6.02%. Despite recent earnings growth and trading significantly below estimated fair value, Servcorp's dividend history has been volatile over the past decade, raising concerns about reliability for income-focused investors.

- Dive into the specifics of Servcorp here with our thorough dividend report.

- The valuation report we've compiled suggests that Servcorp's current price could be quite moderate.

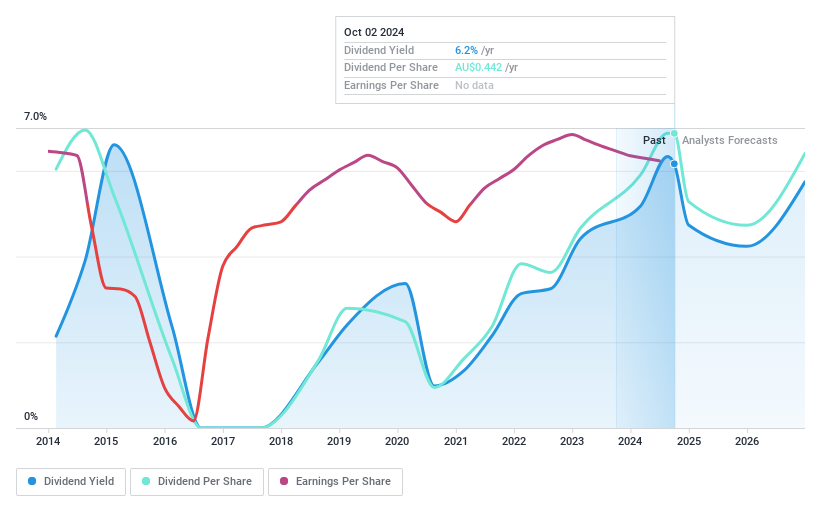

Santos (ASX:STO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Santos Limited is involved in the exploration, development, production, transportation, and marketing of hydrocarbons in Australia and Papua New Guinea with a market cap of A$22.74 billion.

Operations: Santos Limited generates revenue from several segments, including Cooper Basin ($612 million), Queensland & NSW ($1.31 billion), Western Australia ($881 million), Papua New Guinea (PNG) ($2.71 billion), and Northern Australia & Timor-Leste ($84 million).

Dividend Yield: 6.9%

Santos presents a complex dividend profile. Its 6.94% yield ranks in the top 25% of Australian payers, yet it's not well-covered by cash flows given a high cash payout ratio of 164.4%. The dividend has been volatile over the past decade, though it has grown overall. Santos trades at a significant discount to its estimated fair value and is engaged in strategic alliances, like the MOU with Tamboran for potential LNG expansion, which could impact future cash flow dynamics.

- Click here and access our complete dividend analysis report to understand the dynamics of Santos.

- According our valuation report, there's an indication that Santos' share price might be on the cheaper side.

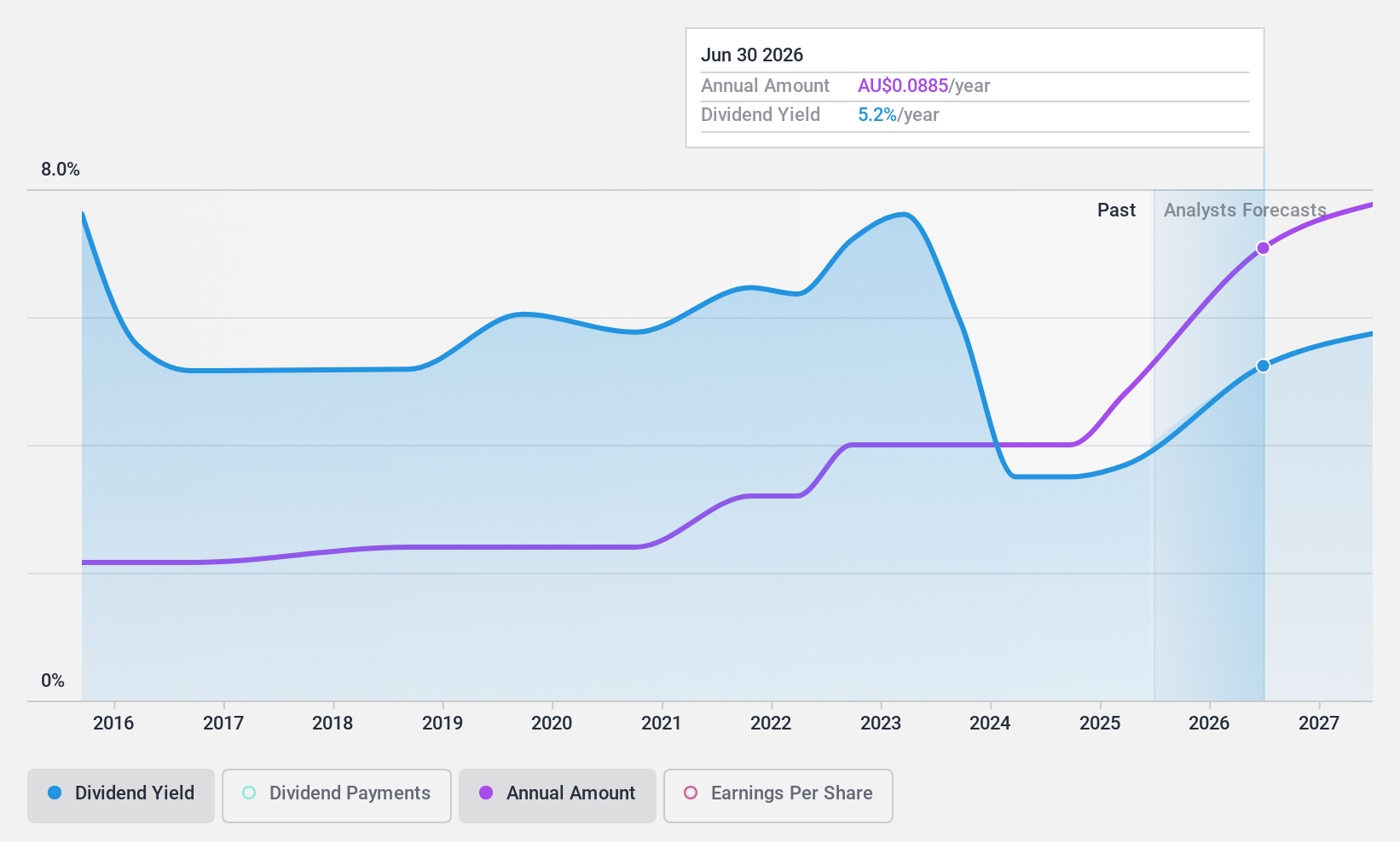

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$403.01 million.

Operations: Southern Cross Electrical Engineering Limited generates revenue of A$551.87 million from its electrical services provided to various sectors in Australia.

Dividend Yield: 3.9%

Southern Cross Electrical Engineering offers a mixed dividend profile. While its 3.93% yield is below the top quartile in Australia, dividends are well-covered by earnings and cash flows with payout ratios of 72% and 46.7%, respectively. Despite recent growth in dividends, payments have been volatile over the past decade. The stock trades at a 31.8% discount to its estimated fair value, with analysts expecting significant price appreciation, indicating potential for capital gains alongside dividends.

- Click here to discover the nuances of Southern Cross Electrical Engineering with our detailed analytical dividend report.

- Our expertly prepared valuation report Southern Cross Electrical Engineering implies its share price may be lower than expected.

Summing It All Up

- Embark on your investment journey to our 31 Top ASX Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives