- Australia

- /

- Construction

- /

- ASX:GNP

Exploring July 2025's Undiscovered Gems in Australia

Reviewed by Simply Wall St

As Australia's market experiences a notable shift, with profit-taking in major stocks like Commonwealth Bank impacting the broader indices and a renewed interest in materials buoying companies such as BHP Limited, investors are keenly observing these dynamic changes. In this environment of sector rotations and economic uncertainties, identifying promising small-cap stocks that can navigate these fluctuations becomes crucial for those looking to uncover potential undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems across Australia, with a market capitalization of A$745.97 million.

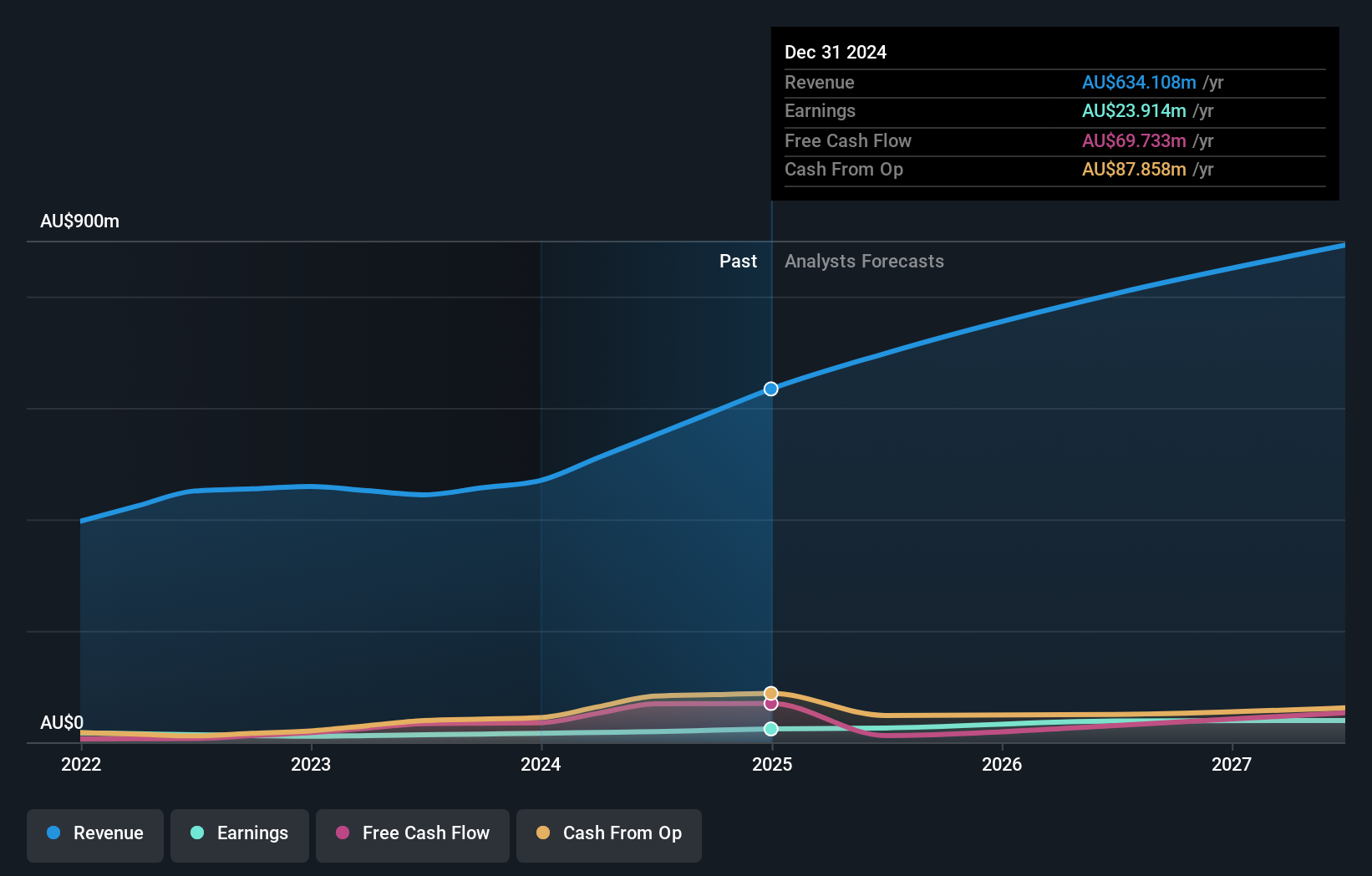

Operations: GenusPlus Group Ltd generates revenue primarily from its infrastructure segment, contributing A$372.42 million, followed by industrial and communication segments at A$187.56 million and A$86.02 million respectively.

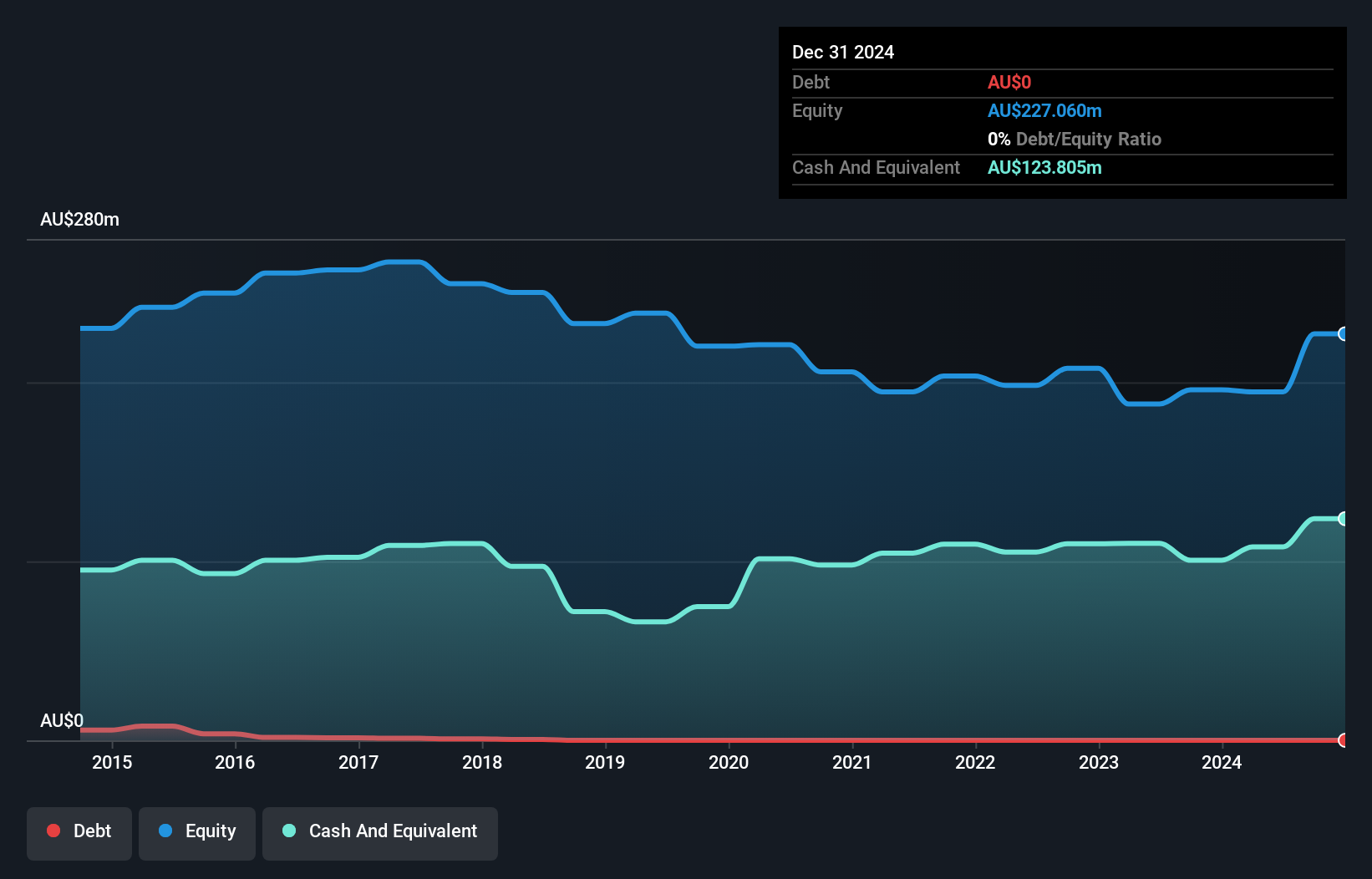

GenusPlus Group, with its strategic acquisitions and project awards like HumeLink, is poised for growth. The order backlog has surged from A$519 million to nearly A$1.5 billion, indicating strong future revenue potential. While the company enjoys a robust cash position and high-margin recurring contracts, challenges such as resourcing issues and acquisition costs could impact margins. Despite these hurdles, analysts forecast a 15% annual revenue growth over the next three years with profit margins climbing from 3.8% to 4.9%. Currently trading at A$3.59 per share, it remains fairly priced against an analyst target of A$3.34.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, as well as IT, communications, and secretarial services with a market capitalization of A$564.91 million.

Operations: Servcorp Limited generates revenue primarily from real estate rental, amounting to A$326.36 million.

Servcorp, a nimble player in the serviced office space, is making strategic moves with its expansion into Japan and the Middle East. Its proprietary Wombat system is set to bolster client retention and revenue growth. The company enjoys high-quality earnings and no debt burden, trading at 82.8% below estimated fair value. Last year saw a remarkable 241% earnings surge, outpacing industry trends significantly. However, competition in coworking spaces and reliance on mature markets pose challenges. With projected annual revenue growth of 5.5%, Servcorp seems poised for steady progress despite potential hurdles in profitability enhancement efforts.

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★★★★

Overview: United Overseas Australia Ltd, along with its subsidiaries, is involved in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia, with a market capitalization of A$1.02 billion.

Operations: United Overseas Australia Ltd generates revenue primarily through the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia. The company has a market capitalization of A$1.02 billion.

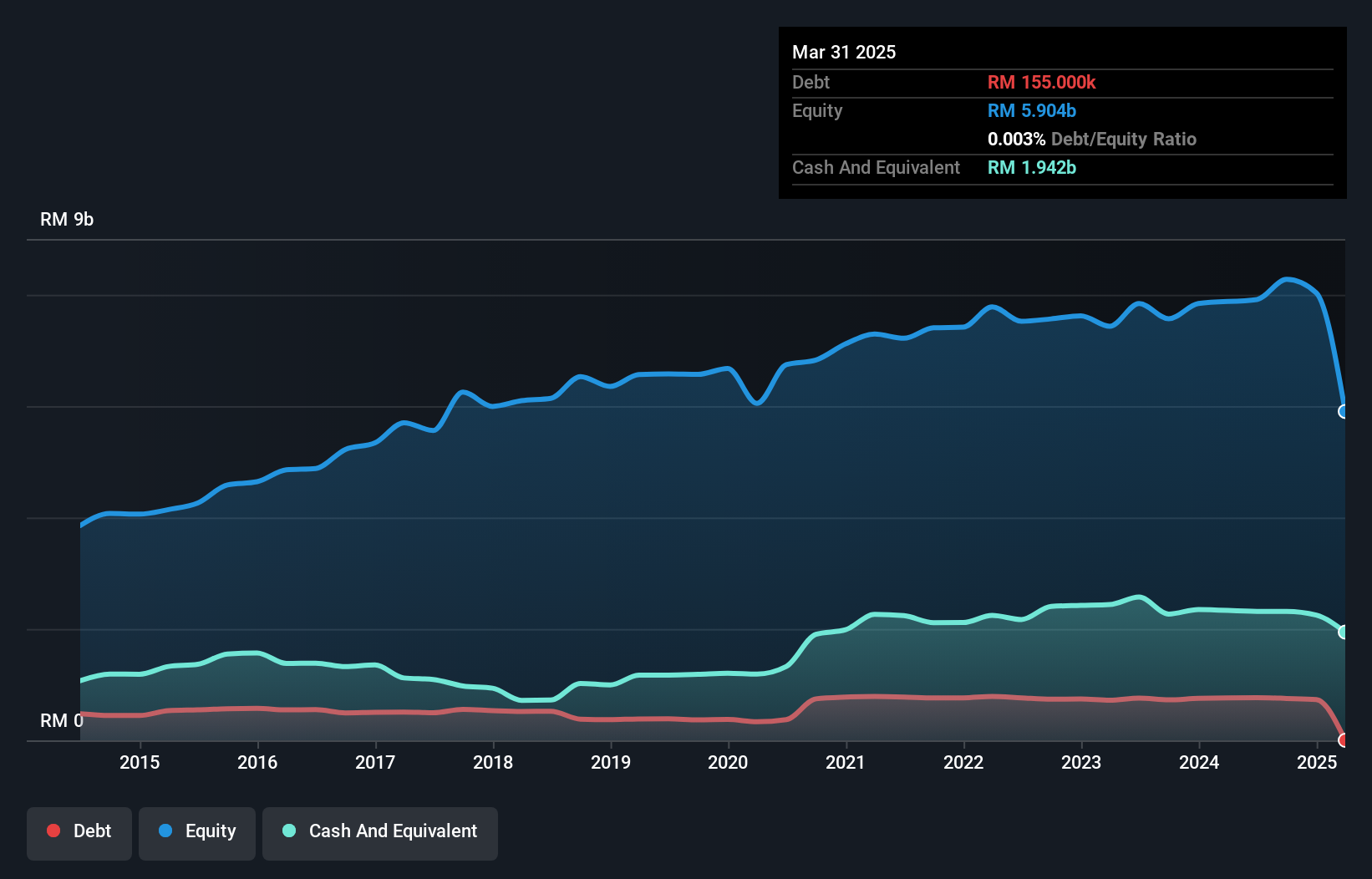

United Overseas Australia stands out with a robust financial profile, boasting a debt-to-equity ratio that has impressively dropped from 5.5 to zero over five years. Its earnings growth of 14% in the past year surpasses the Real Estate industry's -14%, highlighting its competitive edge. The company reported first-quarter sales of MYR 152 million, more than doubling from MYR 70 million last year, with net income rising to MYR 74 million from MYR 50 million. With a price-to-earnings ratio of 10x, well below the market average of 18x, it seems undervalued and poised for potential growth.

Taking Advantage

- Click this link to deep-dive into the 50 companies within our ASX Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GNP

GenusPlus Group

Engages in the installation, construction, and maintenance of power and communication systems in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives