- Australia

- /

- Specialty Stores

- /

- ASX:JBH

3 ASX Dividend Stocks With Up To 4.6% Yield For Your Portfolio

Reviewed by Simply Wall St

Amidst a challenging period for the Australian stock market, with the ASX200 recently down 0.9% and financials leading declines, investors are increasingly turning their attention to sectors that offer stability and potential income. In such volatile times, dividend stocks can provide a reliable source of returns through regular payouts, making them an attractive option for those seeking to balance risk with steady income in their portfolios.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.81% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.69% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.18% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.35% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.30% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.54% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.38% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.15% | ★★★★★☆ |

| Grange Resources (ASX:GRR) | 8.00% | ★★★★☆☆ |

| CTI Logistics (ASX:CLX) | 5.88% | ★★★★☆☆ |

Click here to see the full list of 37 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

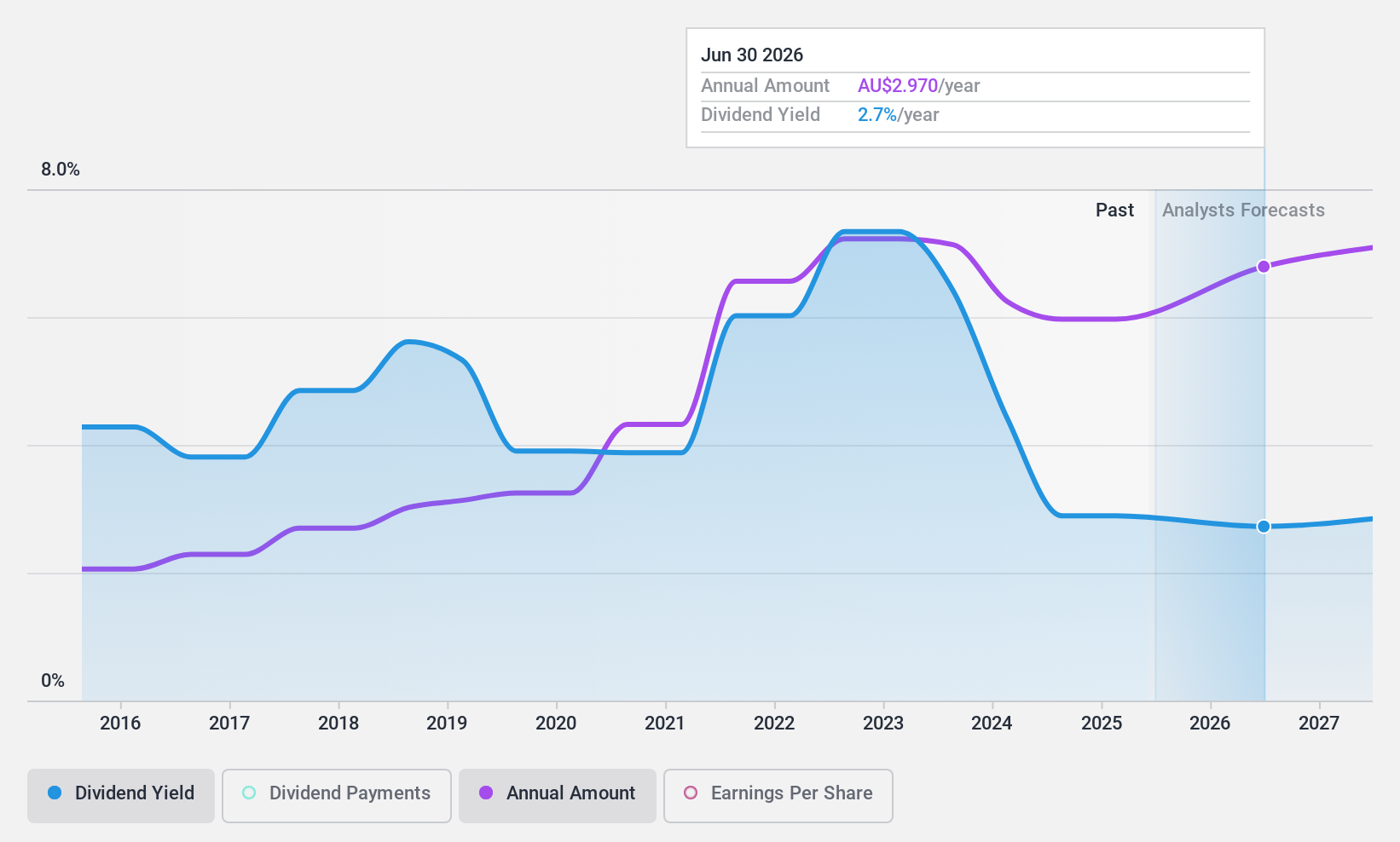

JB Hi-Fi (ASX:JBH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited is a retailer specializing in home consumer products with a market capitalization of A$8.52 billion.

Operations: JB Hi-Fi Limited generates revenue through its segments: The Good Guys (A$2.68 billion), JB Hi-Fi Australia (A$6.61 billion), and JB Hi-Fi New Zealand (A$303.40 million).

Dividend Yield: 3.2%

JB Hi-Fi's dividend profile shows a mixed picture. While the company maintains a reasonable payout ratio of 65% and its dividends are well-covered by cash flows with a cash payout ratio of 42.1%, the dividend yield is relatively low at 3.18% compared to top-tier Australian payers. Despite recent increases, JB Hi-Fi's dividends have been historically volatile and unreliable over the past decade, raising concerns about sustainability for long-term investors. Recent executive changes may impact future strategic direction but don't directly affect current dividend stability.

- Take a closer look at JB Hi-Fi's potential here in our dividend report.

- Our valuation report here indicates JB Hi-Fi may be overvalued.

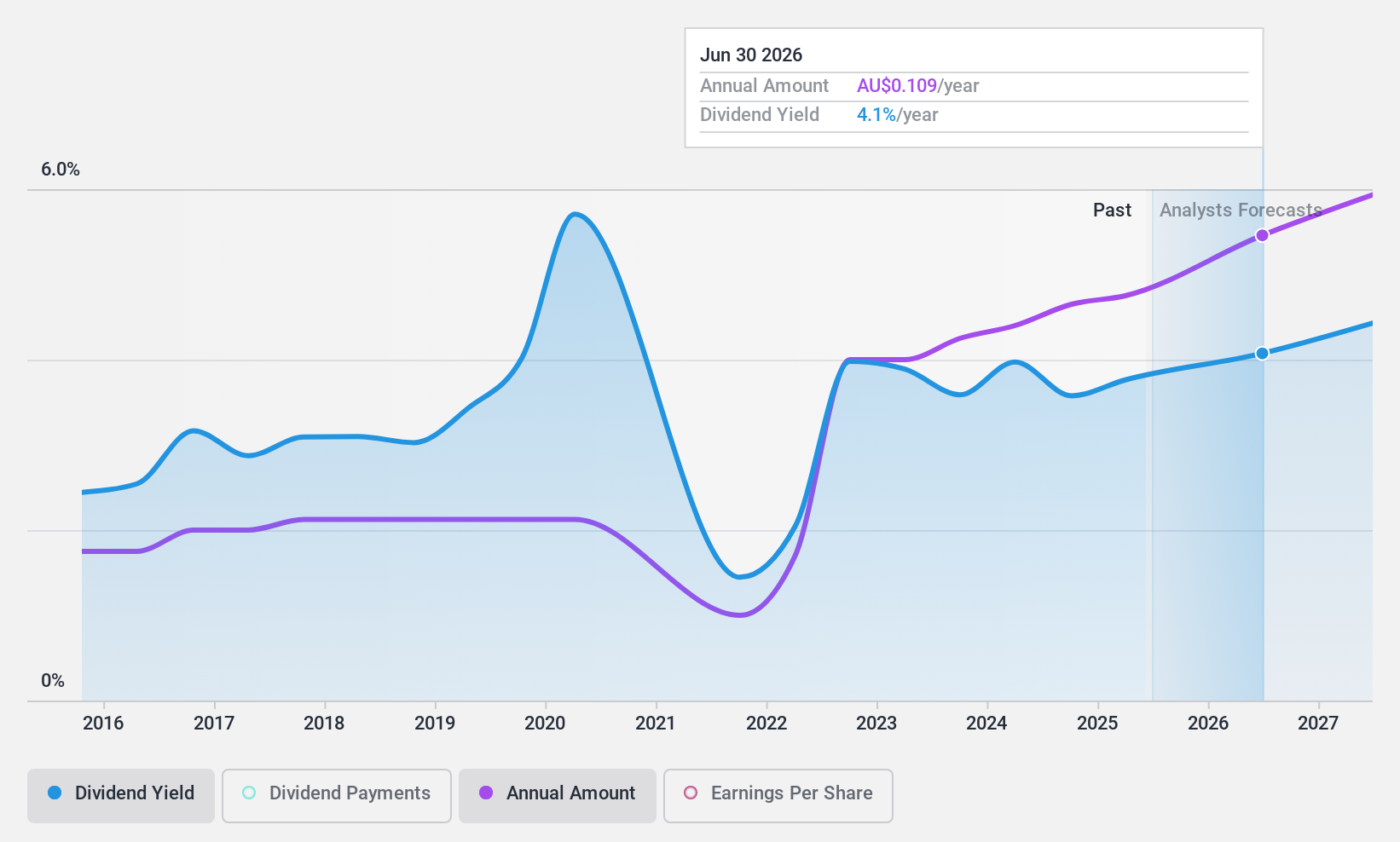

Ridley (ASX:RIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ridley Corporation Limited, with a market cap of A$811.47 million, operates in Australia providing animal nutrition solutions through its subsidiaries.

Operations: Ridley Corporation Limited generates revenue through its Bulk Stockfeeds segment, contributing A$886.59 million, and its Packaged/Ingredients segment, adding A$376.31 million.

Dividend Yield: 3.5%

Ridley Corporation's dividend profile highlights a reasonable payout ratio of 71.7% and solid cash flow coverage with a cash payout ratio of 41.3%, suggesting sustainability despite historical volatility. The dividend yield is modest at 3.51%, below Australia's top-tier payers, yet recent increases indicate potential growth. Strategic moves, like the share buyback program worth A$20 million, aim to enhance shareholder value amidst executive board changes that could influence future strategy without immediate impact on dividends.

- Click here to discover the nuances of Ridley with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ridley shares in the market.

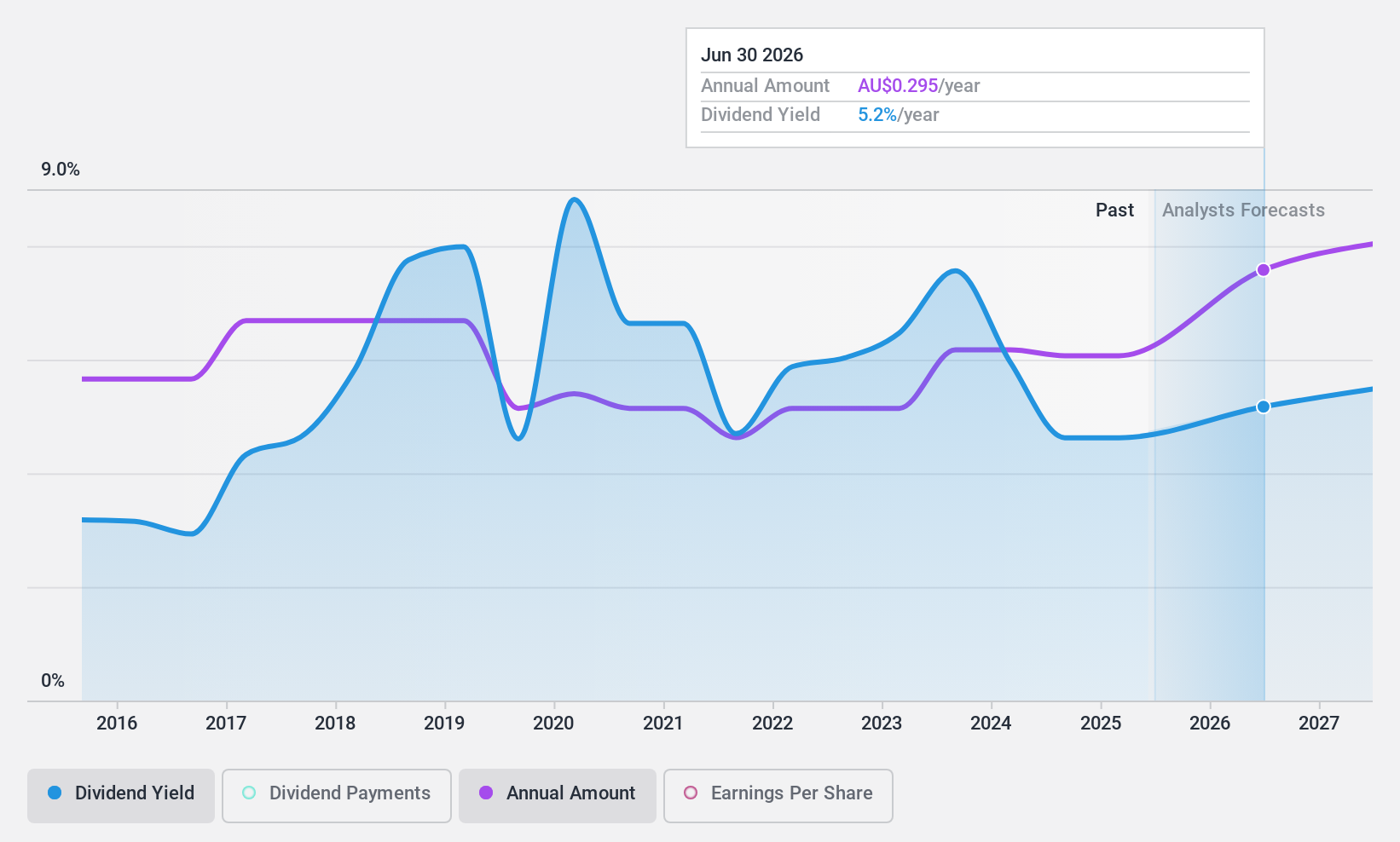

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$495.30 million.

Operations: Servcorp Limited generates revenue primarily from its Real Estate - Rental segment, which amounts to A$314.89 million.

Dividend Yield: 4.7%

Servcorp's dividend profile is supported by a low cash payout ratio of 14.2%, indicating strong coverage by cash flows, while its earnings payout ratio remains reasonable at 59.7%. Despite a history of volatility, recent increases in dividends to A$0.25 per share for fiscal year 2024 and guidance for no less than A$0.26 in fiscal year 2025 suggest potential stability and growth. However, its current yield of 4.69% is below the top tier in Australia.

- Get an in-depth perspective on Servcorp's performance by reading our dividend report here.

- Our valuation report unveils the possibility Servcorp's shares may be trading at a discount.

Turning Ideas Into Actions

- Delve into our full catalog of 37 Top ASX Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JBH

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives