- Australia

- /

- Real Estate

- /

- ASX:CWP

Top ASX Dividend Stocks For December 2025

Reviewed by Simply Wall St

As the Australian market experiences a modest rebound, ending the week in positive territory, investors are eyeing sectors like Communication and Real Estate for their recent gains. In this environment of cautious optimism, dividend stocks can offer stability and income potential, making them an attractive choice for those looking to navigate the current market dynamics.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 8.08% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.02% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.82% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.79% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.71% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.61% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.59% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.16% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.57% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.65% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

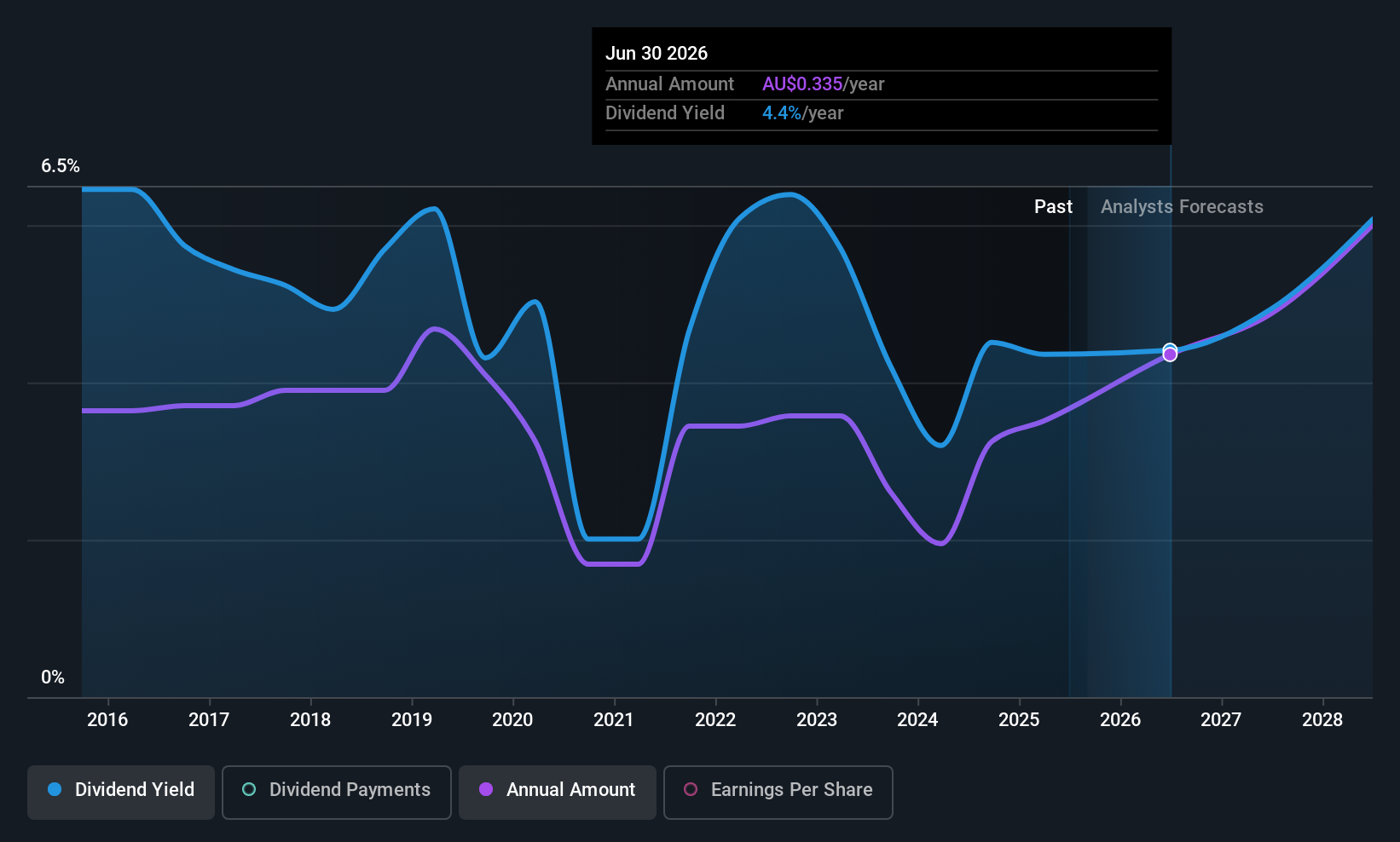

Cedar Woods Properties (ASX:CWP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cedar Woods Properties Limited is an Australian company that develops and invests in properties, with a market cap of A$741.01 million.

Operations: Cedar Woods Properties Limited generates revenue primarily through its property development and investment activities, amounting to A$465.94 million.

Dividend Yield: 3.3%

Cedar Woods Properties offers a mixed dividend profile. While its dividend yield of 3.33% is below the top quartile in Australia, payments are covered by earnings and cash flows with payout ratios of 49.7% and 72.8%, respectively. However, dividends have been volatile over the past decade, experiencing significant fluctuations, which may concern income-focused investors. Recent inclusion in the S&P Global BMI Index could enhance visibility among investors despite recent insider selling activity.

- Navigate through the intricacies of Cedar Woods Properties with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Cedar Woods Properties is trading behind its estimated value.

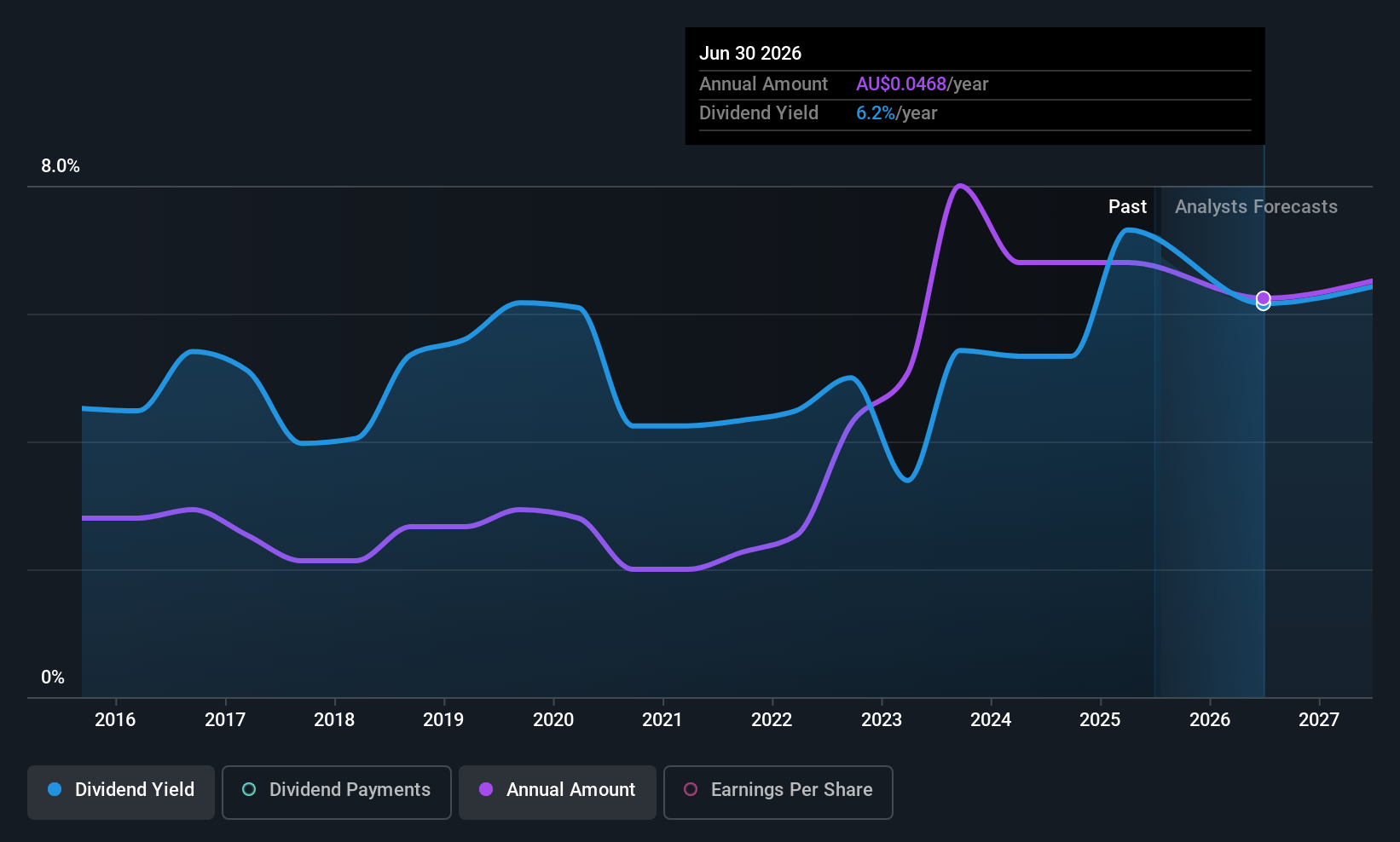

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lindsay Australia Limited operates in the transport, logistics, and rural supply sectors serving the food processing, food services, fresh produce, and horticulture industries across Australia with a market cap of A$251.55 million.

Operations: Lindsay Australia Limited generates revenue through its segments, which include Rural (A$168.12 million), Hunters (A$110.37 million), and Transport (A$586.41 million).

Dividend Yield: 5.5%

Lindsay Australia's dividend profile presents a mixed picture. While the dividend yield of 5.51% is slightly below the top quartile, payments are well covered by cash flows with a low cash payout ratio of 26%. Despite an increase in dividends over the past decade, their volatility and recent shareholder dilution may concern investors seeking stable income. Profit margins have decreased from last year, but earnings growth is forecast at 18.65% annually.

- Delve into the full analysis dividend report here for a deeper understanding of Lindsay Australia.

- Our comprehensive valuation report raises the possibility that Lindsay Australia is priced lower than what may be justified by its financials.

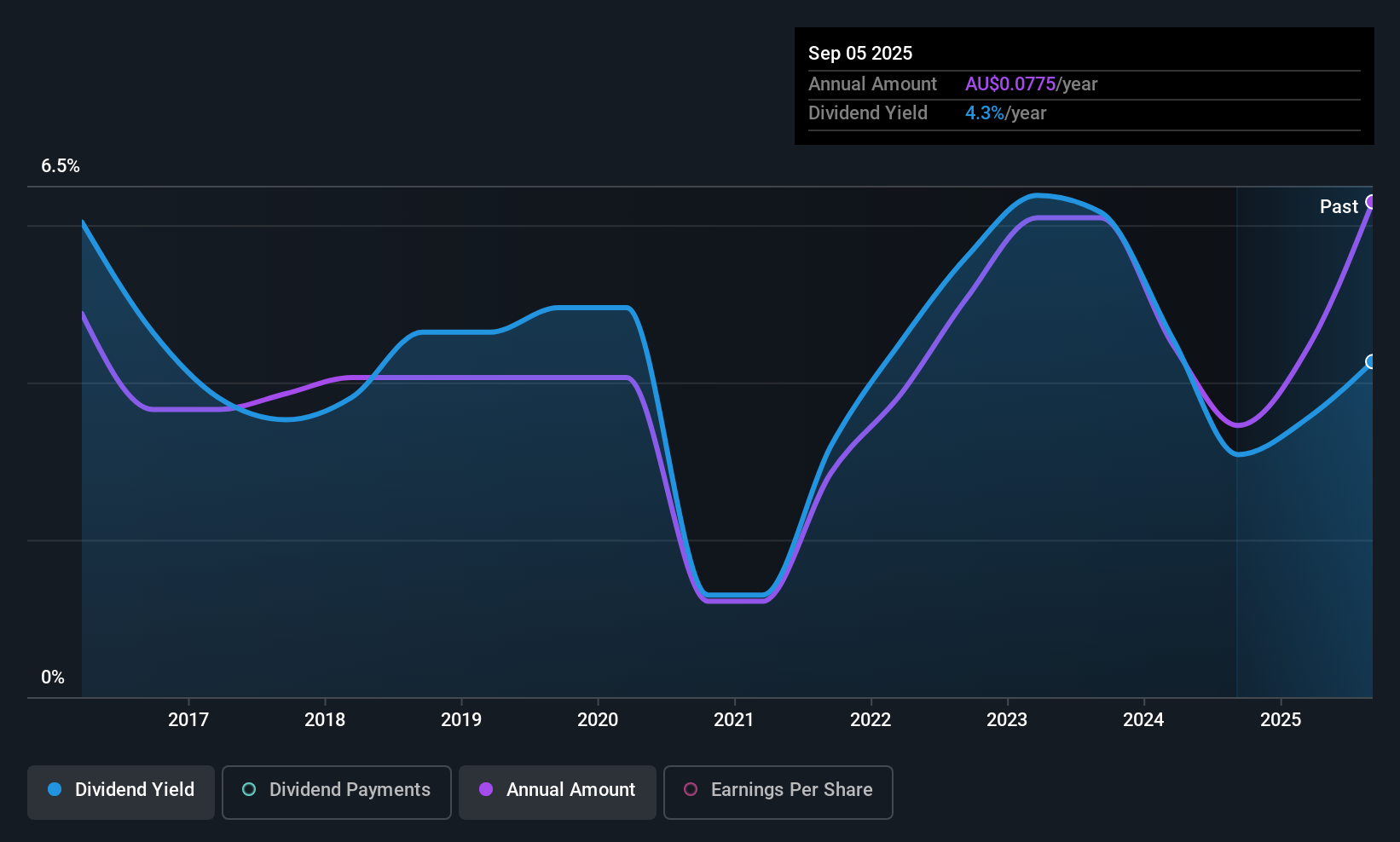

Peet (ASX:PPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peet Limited acquires, develops, and markets residential land in Australia, with a market cap of A$929.30 million.

Operations: Peet Limited generates revenue through three main segments: Funds Management (A$56.39 million), Joint Arrangements (A$51.88 million), and Company Owned Projects (A$313.24 million).

Dividend Yield: 3.9%

Peet's dividend profile is complex, with payments covered by both earnings and cash flows, indicated by a payout ratio of 62.1% and a cash payout ratio of 34.1%. However, the dividends have been volatile over the past decade despite some growth. The company's dividend yield at 3.9% is below the top quartile in Australia, and it faces challenges such as high debt levels and recent executive changes following an organizational restructure.

- Click to explore a detailed breakdown of our findings in Peet's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Peet shares in the market.

Where To Now?

- Embark on your investment journey to our 32 Top ASX Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CWP

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion