For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Cedar Woods Properties (ASX:CWP). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Our free stock report includes 3 warning signs investors should be aware of before investing in Cedar Woods Properties. Read for free now.How Quickly Is Cedar Woods Properties Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Cedar Woods Properties has managed to grow EPS by 29% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Cedar Woods Properties is growing revenues, and EBIT margins improved by 3.0 percentage points to 15%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

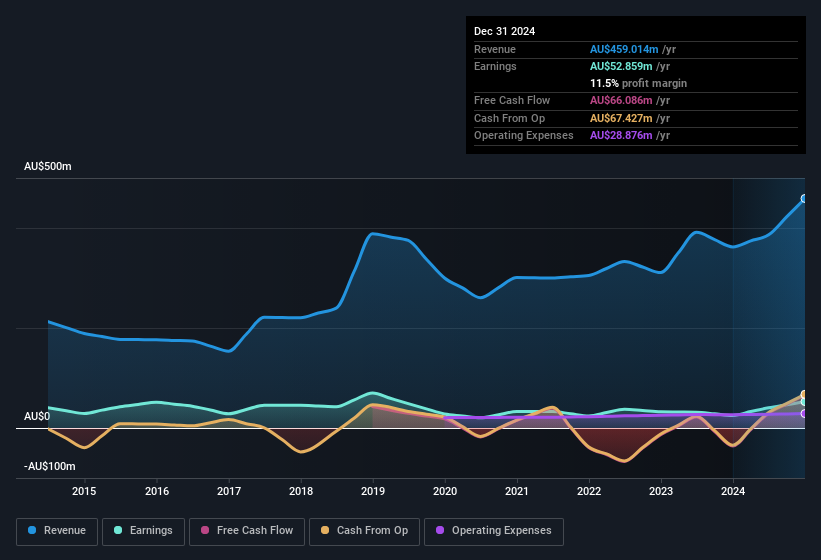

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

View our latest analysis for Cedar Woods Properties

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Cedar Woods Properties' forecast profits?

Are Cedar Woods Properties Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, Founder & Chairman William Hames spent AU$171k acquiring shares, doing so at an average price of AU$4.86. Strong buying like that could be a sign of opportunity.

On top of the insider buying, it's good to see that Cedar Woods Properties insiders have a valuable investment in the business. To be specific, they have AU$71m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 14% of the company; visible skin in the game.

Should You Add Cedar Woods Properties To Your Watchlist?

For growth investors, Cedar Woods Properties' raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 3 warning signs for Cedar Woods Properties that you should be aware of.

The good news is that Cedar Woods Properties is not the only stock with insider buying. Here's a list of small cap, undervalued companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CWP

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives