- Australia

- /

- Real Estate

- /

- ASX:AU1

Further Upside For The Agency Group Australia Limited (ASX:AU1) Shares Could Introduce Price Risks After 40% Bounce

The Agency Group Australia Limited (ASX:AU1) shareholders have had their patience rewarded with a 40% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

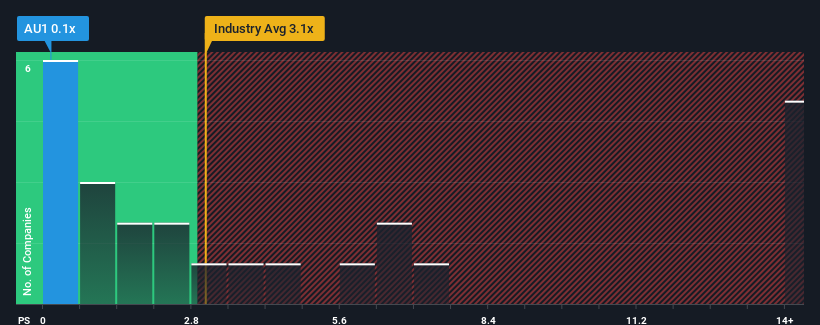

Even after such a large jump in price, Agency Group Australia may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Real Estate industry in Australia have P/S ratios greater than 2.8x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Agency Group Australia

What Does Agency Group Australia's Recent Performance Look Like?

The revenue growth achieved at Agency Group Australia over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Agency Group Australia's earnings, revenue and cash flow.How Is Agency Group Australia's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Agency Group Australia's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. The latest three year period has also seen an excellent 51% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to decline by 3.6% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it very odd that Agency Group Australia is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Bottom Line On Agency Group Australia's P/S

Even after such a strong price move, Agency Group Australia's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at the figures, it's surprising to see Agency Group Australia currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Plus, you should also learn about these 3 warning signs we've spotted with Agency Group Australia (including 2 which are potentially serious).

If these risks are making you reconsider your opinion on Agency Group Australia, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AU1

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives