The ASX200 is set to open 0.15% lower today, reflecting mixed performances among US markets, with notable movements in the Dow and tech sector fluctuations impacting investor sentiment. In such a climate, finding stocks with strong fundamentals can be crucial for investors seeking stability and growth potential. Penny stocks, though often overlooked due to their historical reputation, can offer significant opportunities when backed by solid financials; this article will explore three promising examples that stand out for their potential value and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.88 | A$306.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$337.98M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.72 | A$225.52M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.60 | A$784.13M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.94 | A$130.6M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.165 | A$1.08B | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.34 | A$114.39M | ★★★★★☆ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bravura Solutions (ASX:BVS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bravura Solutions Limited develops, licenses, and maintains software applications for the wealth management and funds administration sectors across Australia, the United Kingdom, New Zealand, and internationally, with a market capitalization of A$685.92 million.

Operations: Bravura Solutions generates revenue from two primary segments: Wealth Management, which accounts for A$163.13 million, and Funds Administration, contributing A$87.28 million.

Market Cap: A$685.92M

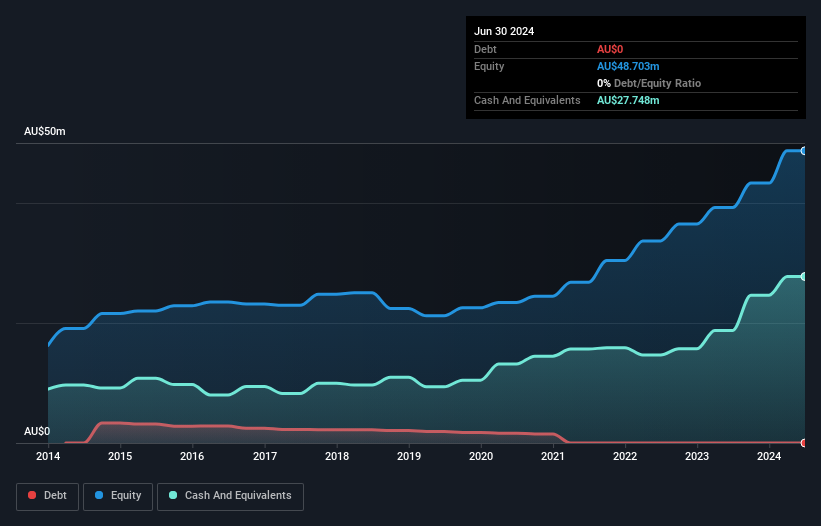

Bravura Solutions has recently turned profitable, reporting a net income of A$8.78 million for the fiscal year ending June 30, 2024, compared to a significant loss the previous year. Despite its profitability and stable weekly volatility, the company faces challenges with an inexperienced board and management team. Bravura's revenue is expected to decrease in fiscal year 2025 due to reduced license and professional services fees. The company announced a share buyback program worth A$20 million, utilizing existing cash reserves, which could positively impact shareholder value by reducing outstanding shares by up to 10%.

- Take a closer look at Bravura Solutions' potential here in our financial health report.

- Explore Bravura Solutions' analyst forecasts in our growth report.

Percheron Therapeutics (ASX:PER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Percheron Therapeutics Limited is an Australian company focused on the research and development of novel antisense pharmaceuticals, with a market cap of A$77.53 million.

Operations: The company's revenue is derived entirely from its ATL1102 segment, amounting to A$2.35 million.

Market Cap: A$77.53M

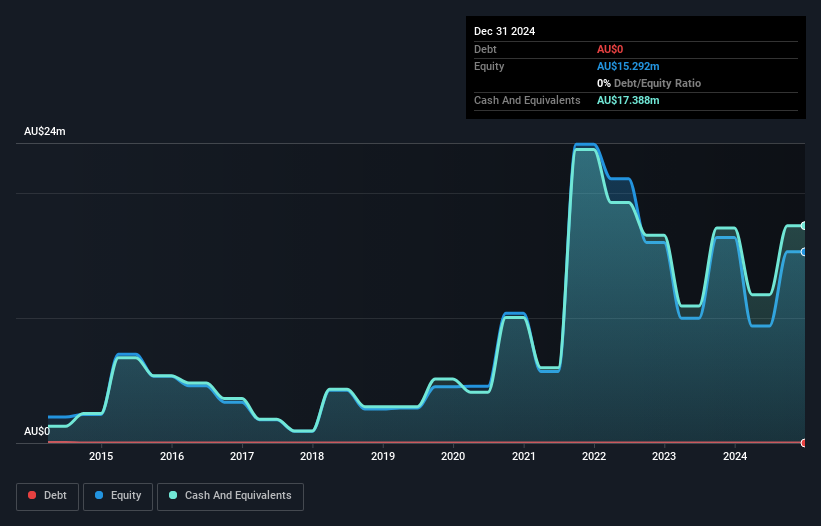

Percheron Therapeutics Limited, with a market cap of A$77.53 million, remains pre-revenue as it focuses on developing antisense pharmaceuticals. Despite unprofitability and increasing losses over the past five years, the company maintains a stable cash runway exceeding one year and is debt-free. Recent capital raises through follow-on equity offerings totaling approximately A$15 million aim to bolster financial stability. However, its American Depositary Receipts were recently delisted from OTC Equity markets due to program termination. The management team is relatively new with an average tenure of 1.3 years, indicating potential strategic shifts ahead for Percheron.

- Click here to discover the nuances of Percheron Therapeutics with our detailed analytical financial health report.

- Gain insights into Percheron Therapeutics' future direction by reviewing our growth report.

Vita Life Sciences (ASX:VLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vita Life Sciences Limited is a healthcare company that formulates, packages, distributes, and sells vitamins and supplements across Australia, Singapore, Malaysia, Thailand, Vietnam, Indonesia, and China with a market cap of A$122.32 million.

Operations: The company's revenue is primarily derived from Australia (A$46.99 million), Malaysia (A$23.63 million), and Singapore (A$6.83 million).

Market Cap: A$122.32M

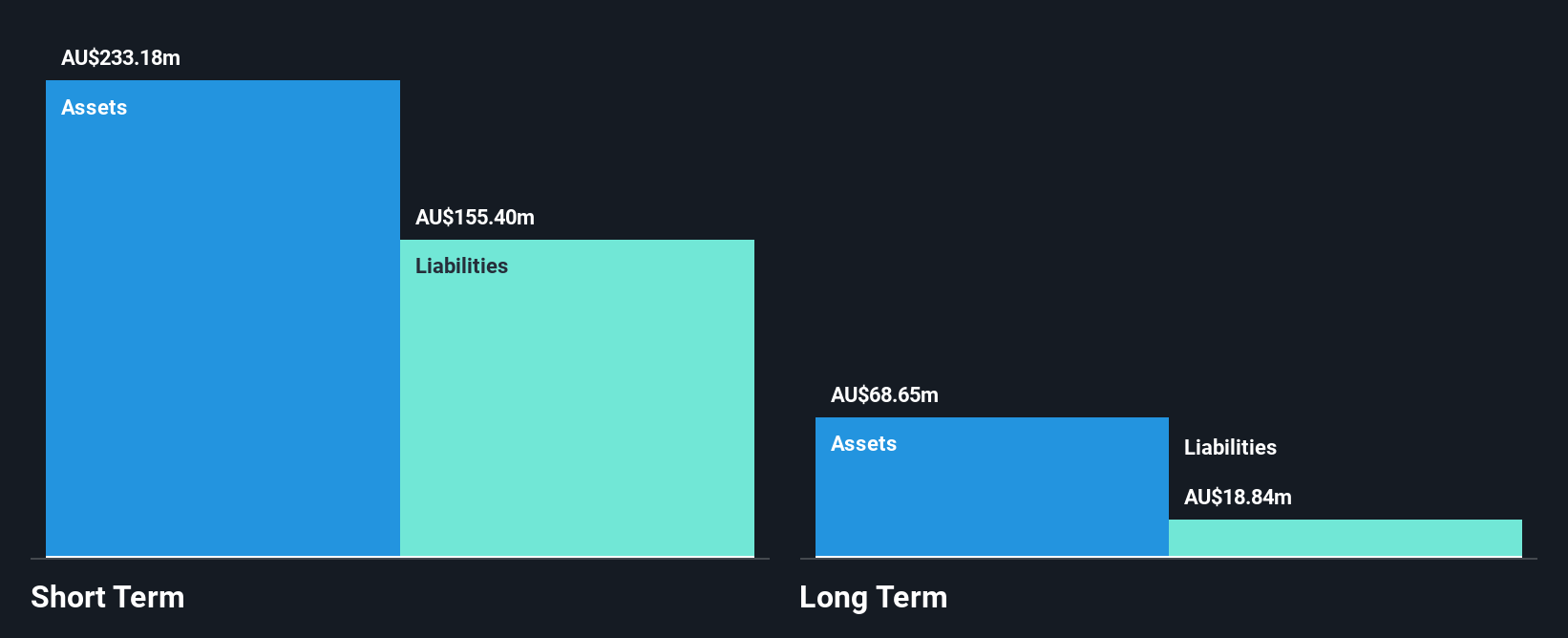

Vita Life Sciences Limited, with a market cap of A$122.32 million, shows strong financial health with short-term assets (A$56.3M) exceeding both short and long-term liabilities. The company is debt-free, which eliminates concerns about interest coverage. Earnings have grown by 19.8% annually over the past five years, with recent earnings growth accelerating to 26.6%. Despite shareholder dilution and low return on equity at 19.3%, Vita Life maintains high-quality earnings and stable profit margins that improved slightly from last year to 11.9%. The board and management team are experienced, enhancing operational stability amidst industry challenges.

- Navigate through the intricacies of Vita Life Sciences with our comprehensive balance sheet health report here.

- Evaluate Vita Life Sciences' historical performance by accessing our past performance report.

Taking Advantage

- Gain an insight into the universe of 1,035 ASX Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bravura Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BVS

Bravura Solutions

Develops, licenses, and maintains administration and management software applications for the wealth management and funds administration sectors in Australia, the United Kingdom, New Zealand, and internationally.

Flawless balance sheet with acceptable track record.