Telix Pharmaceuticals (ASX:TLX) Confirms 2025 Revenue Forecast Between A$770 Million To A$800 Million

Reviewed by Simply Wall St

Telix Pharmaceuticals (ASX:TLX) recently confirmed its earnings guidance for FY 2025, with anticipated revenue between $770 and $800 million and an increase in R&D investment. This announcement came as the company's stock price increased by 5% last week, a significant move amid a generally flat market where the S&P 500 and Nasdaq recently retreated from record highs. While the broader market faced mixed trading, the clear corporate guidance from Telix may have added confidence to investors, distinguishing the company's shares amidst a backdrop of varied earnings results from other sectors.

You should learn about the 1 warning sign we've spotted with Telix Pharmaceuticals.

Over the last five years, Telix Pharmaceuticals has seen a remarkable total shareholder return of 1832.31%, a testament to its exponential growth trajectory in the pharmaceutical sector. Comparatively, in the past year alone, Telix has outperformed the Australian Biotechs industry, which experienced a 14.3% decline, and surpassed the broader Australian Market, which returned 8.5%. This outstanding performance highlights Telix’s ability to capitalize on market opportunities and underscores investor confidence.

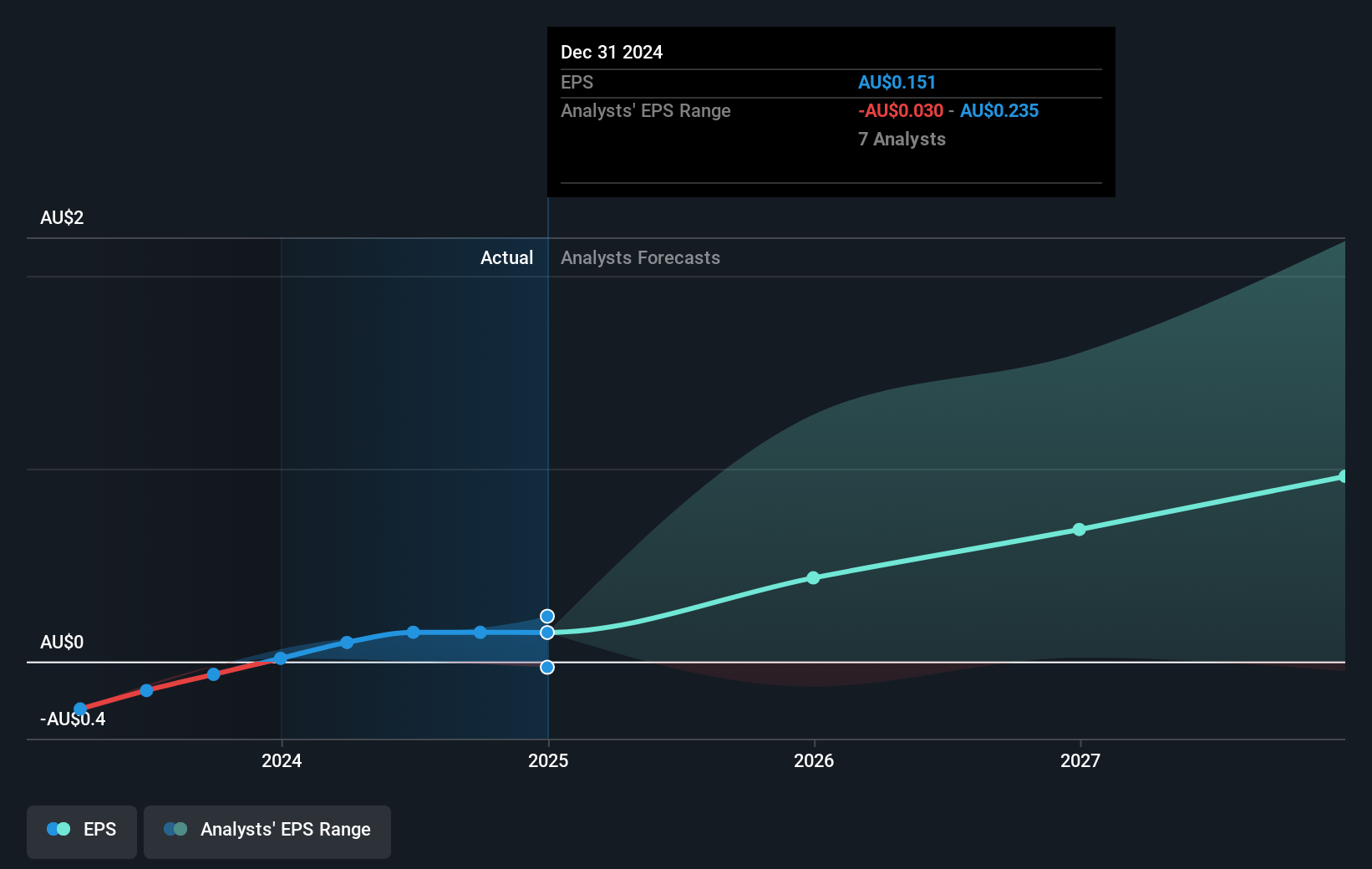

The confirmation of Telix’s fiscal year 2025 revenue guidance between $770 million and $800 million, along with an increased investment in R&D, suggests a strong commitment to future growth. This forward-looking strategy may bolster revenue and earnings forecasts, positioning Telix well for continued expansion. With a current share price of A$25.12, there remains considerable growth potential given the consensus analyst price target at A$31.93, indicating a 27.12% discount. Such a price movement could attract value-focused investors, reinforcing Telix's robust market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals for cancer and rare diseases.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives