- Australia

- /

- Metals and Mining

- /

- ASX:EQX

3 ASX Penny Stocks With Market Caps Over A$10M To Watch

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close up 4 points at 8,540, with the local index hitting a new all-time intra-day high of 8,575. Amidst this buoyant session and a rally in gold prices, investors are increasingly looking towards smaller companies that might offer unique opportunities for growth. While the term "penny stocks" may seem outdated, these stocks still represent smaller or less-established companies that can provide value when backed by strong financials and clear growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$67.47M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.86 | A$86.33M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.475 | A$294.57M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.15 | A$342.3M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$3.01 | A$252.05M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.40 | A$168.14M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.065 | A$65.38M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.535 | A$106.04M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.875 | A$102.89M | ★★★★★★ |

Click here to see the full list of 1,030 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bulletin Resources (ASX:BNR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bulletin Resources Limited is a minerals exploration company based in Australia with a market capitalization of A$12.92 million.

Operations: The company's revenue segment is entirely derived from the exploration of minerals, amounting to A$0.21 million.

Market Cap: A$12.92M

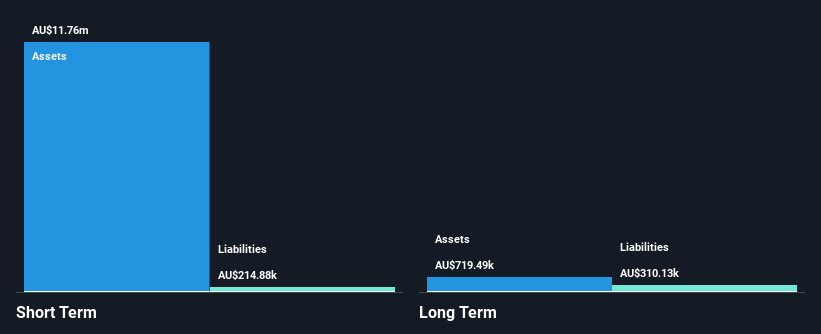

Bulletin Resources, with a market cap of A$12.92 million, operates as a pre-revenue mineral exploration company. It maintains financial stability with no debt and short-term assets of A$11.8 million exceeding its liabilities, indicating strong liquidity. The company has reduced losses over the past five years by 6% annually despite being unprofitable and having negative equity returns (-5.41%). Its weekly volatility has remained stable at 9%. While shareholders haven't faced significant dilution recently, the management's experience level remains unclear, though the board is experienced with an average tenure of seven years.

- Dive into the specifics of Bulletin Resources here with our thorough balance sheet health report.

- Gain insights into Bulletin Resources' past trends and performance with our report on the company's historical track record.

Equatorial Resources (ASX:EQX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Equatorial Resources Limited is involved in the exploration and development of iron ore properties in the Republic of Congo and the Republic of Guinea, with a market cap of A$18.40 million.

Operations: Equatorial Resources Limited did not report any revenue segments.

Market Cap: A$18.4M

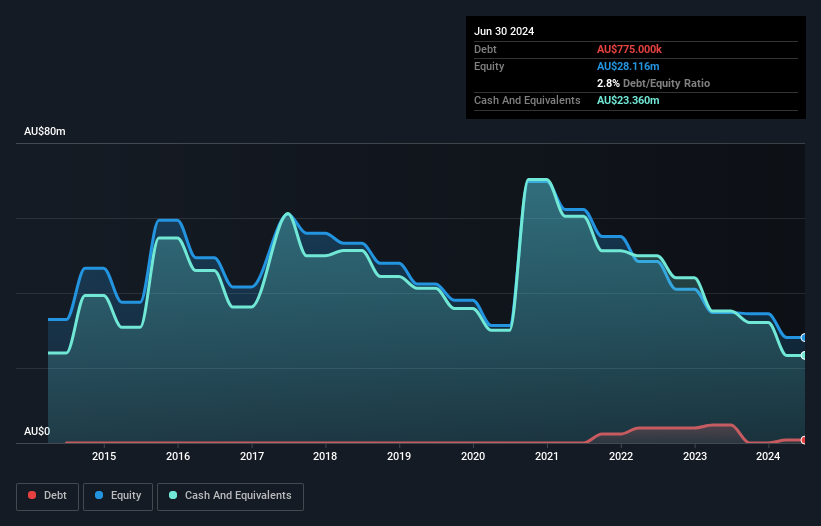

Equatorial Resources, with a market cap of A$18.40 million, is a pre-revenue company focused on iron ore exploration in Africa. Despite being debt-free for the past five years and having short-term assets of A$13.9 million that cover its liabilities, it remains unprofitable with increasing losses over the last five years at 13.7% annually and a negative return on equity (-12.56%). The management team and board are seasoned, averaging 11.9 and 14.9 years in tenure respectively, while shareholders have not experienced significant dilution recently. The company has sufficient cash runway for over three years under current conditions.

- Click here to discover the nuances of Equatorial Resources with our detailed analytical financial health report.

- Explore historical data to track Equatorial Resources' performance over time in our past results report.

Starpharma Holdings (ASX:SPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Starpharma Holdings Limited is a biopharmaceutical company focused on the research, development, and commercialization of dendrimer products for pharmaceutical and life science applications globally, with a market cap of A$43.90 million.

Operations: The company's revenue is derived from the discovery, development, and commercialization of dendrimers, amounting to A$9.76 million.

Market Cap: A$43.9M

Starpharma Holdings Limited, with a market cap of A$43.90 million, focuses on dendrimer-based biopharmaceuticals but remains unprofitable. The company has more cash than debt and maintains a sufficient cash runway for over three years based on current free cash flow. Its short-term assets of A$32.9 million comfortably cover both short-term and long-term liabilities, totaling A$8.7 million combined. Despite a negative return on equity (-29.04%), Starpharma has reduced losses at 6.5% annually over five years without significant shareholder dilution recently, while its board is experienced with an average tenure of 3.2 years.

- Get an in-depth perspective on Starpharma Holdings' performance by reading our balance sheet health report here.

- Gain insights into Starpharma Holdings' historical outcomes by reviewing our past performance report.

Make It Happen

- Investigate our full lineup of 1,030 ASX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equatorial Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EQX

Equatorial Resources

Explores for and develops iron ore properties in the Republic of Congo and the Republic of Guinea.

Flawless balance sheet with low risk.

Market Insights

Community Narratives