Syntara (ASX:SNT) shareholder returns have been fantastic, earning 305% in 1 year

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. While not every stock performs well, when investors win, they can win big. For example, the Syntara Limited (ASX:SNT) share price is up a whopping 305% in the last 1 year, a handsome return in a single year. On top of that, the share price is up 31% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. On the other hand, longer term shareholders have had a tougher run, with the stock falling 3.6% in three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Syntara

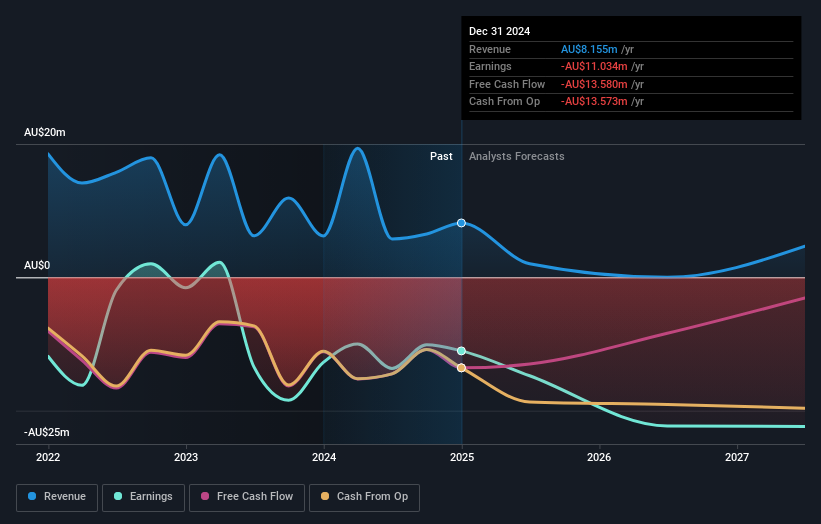

Given that Syntara didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Syntara saw its revenue grow by 31%. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 305% in the last year. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on Syntara.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Syntara stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Syntara shareholders have received a total shareholder return of 305% over one year. That's better than the annualised return of 6% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for Syntara you should be aware of, and 2 of them are a bit concerning.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SNT

Syntara

Operates as a clinical-stage drug development company that targets extracellular matrix dysfunction through amine oxidase chemistry and other technologies to develop novel medicines for blood cancers and conditions linked to inflammation and fibrosis in Australia.

Flawless balance sheet with medium-low risk.

Market Insights

Community Narratives