PYC Therapeutics (ASX:PYC): Assessing Valuation After Sudden CEO Departure and Trading Halt

Reviewed by Kshitija Bhandaru

When a company asks for its shares to be placed in a trading halt, investors tend to take notice. That is exactly the spot PYC Therapeutics (ASX:PYC) finds itself in after a one-two punch: the abrupt exit of long-serving CEO Dr Rohan Hockings and the naming of Chairman Alan Tribe as interim Managing Director. The official word is that the halt is tied entirely to these board and management changes, with no new capital raise in the mix. In times like these, it is natural for shareholders to look beyond the headlines and wonder what is really changing under the hood.

Over the past year, PYC Therapeutics’ stock performance has reflected both promise and uncertainty. After a difficult stretch, shares are down 36% on a twelve-month basis, with this month alone seeing further softening. The initial momentum around drug development advancements and strategic oversight was quickly overshadowed by the leadership shake-up, highlighting just how sensitive market sentiment can be to shifts at the top. While management clarifies its direction and begins searching for a permanent CEO, investors are left weighing whether this marks a short-term setback or something more fundamental for the company’s growth story.

With the dust yet to settle, the real question is whether the market’s cautious mood now offers a buying opportunity in PYC Therapeutics or if these leadership changes are already fully reflected in the share price.

Price-to-Sales of 22.2x: Is it justified?

PYC Therapeutics is currently trading at a price-to-sales (P/S) ratio of 22.2x, which is considered expensive compared to the Australian Biotechs industry average of 11.4x and the peer average of 16.7x.

The price-to-sales ratio measures how much investors are paying for each dollar of a company's revenue. It is especially useful for early-stage or unprofitable biotech firms where traditional profit-based measures may not apply. A high P/S ratio typically signals strong future growth expectations, but it may also indicate over-optimism if the company faces challenges in achieving profitability.

Given that PYC is unprofitable and its revenue growth rate is forecast to be relatively modest, the current premium in valuation raises important questions. The market appears to be significantly overpricing the company's current revenue base compared to both its industry peers and the broader sector average.

Result: Fair Value of $2.60 (OVERVALUED)

See our latest analysis for PYC Therapeutics.However, the appointment of interim leadership and the company’s continued unprofitability remain key risks that could quickly change the market’s current outlook.

Find out about the key risks to this PYC Therapeutics narrative.Another View: What Does Our DCF Model Say?

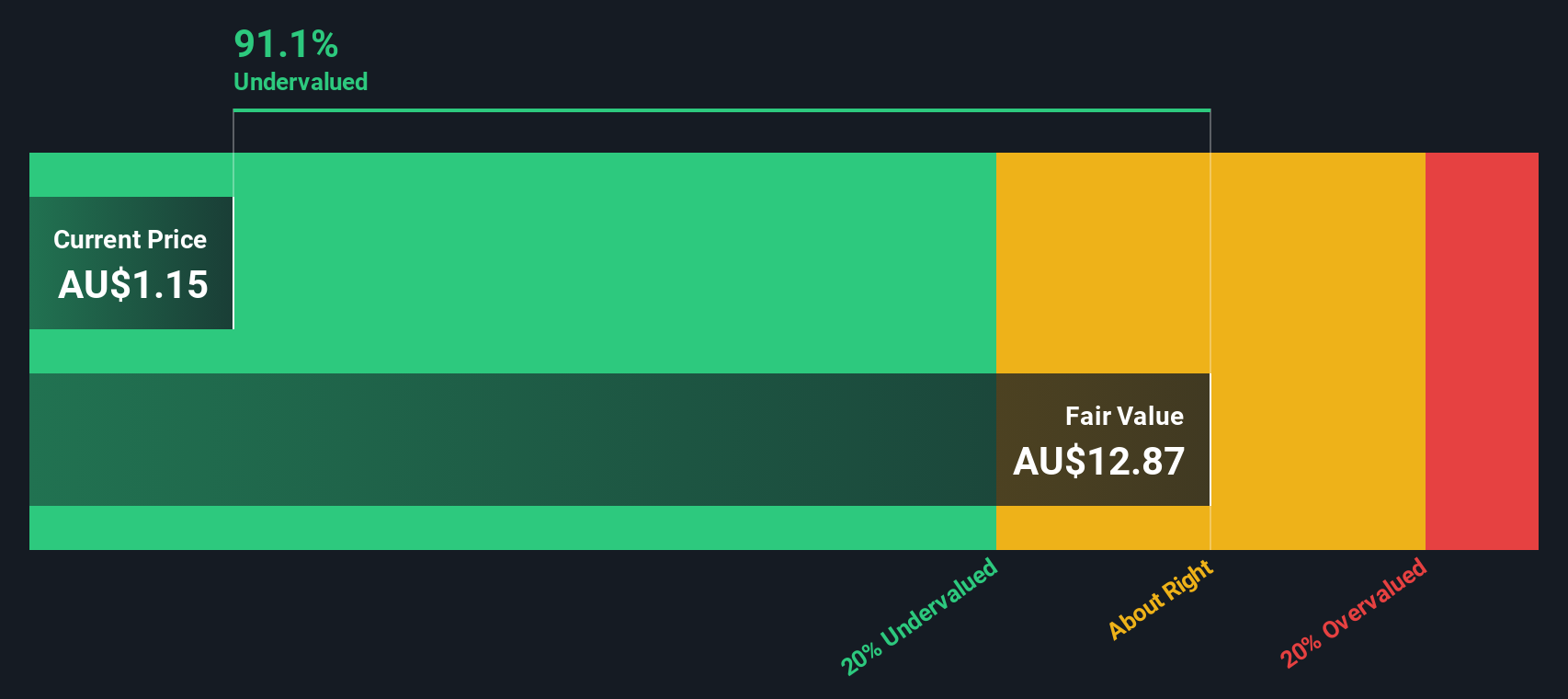

To look at the company from another angle, our SWS DCF model suggests a very different outcome. This approach weighs expected future cash flows instead of market multiples, and finds the shares to be undervalued. Is the market too pessimistic, or does the DCF model overlook something the market has identified?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PYC Therapeutics Narrative

If you see the story differently or want to dig deeper into the numbers, you have the tools to draft your own narrative in just a few minutes. Do it your way

A great starting point for your PYC Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Boost your chance of market success by checking out other smart stock picks tailored to today’s biggest investment trends.

- Tap into fast-growing tech by spotting companies pushing boundaries in artificial intelligence with our AI penny stocks.

- Secure your next potential winner by tracking undervalued businesses poised for a turnaround using our undervalued stocks based on cash flows.

- Strengthen your portfolio with steady returns from companies committed to rewarding shareholders through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PYC

PYC Therapeutics

A drug-development company, engages in the discovery and development of novel RNA therapeutics for the treatment of genetic diseases in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives