Non-Executive Chair of the Board Alan Tribe Just Bought A Handful Of Shares In PYC Therapeutics Limited (ASX:PYC)

Whilst it may not be a huge deal, we thought it was good to see that the PYC Therapeutics Limited (ASX:PYC) Non-Executive Chair of the Board, Alan Tribe, recently bought AU$81k worth of stock, for AU$0.14 per share. Nevertheless, it only increased their shareholding by a minuscule percentage, and it wasn't a massive purchase by absolute value, either.

Check out our latest analysis for PYC Therapeutics

The Last 12 Months Of Insider Transactions At PYC Therapeutics

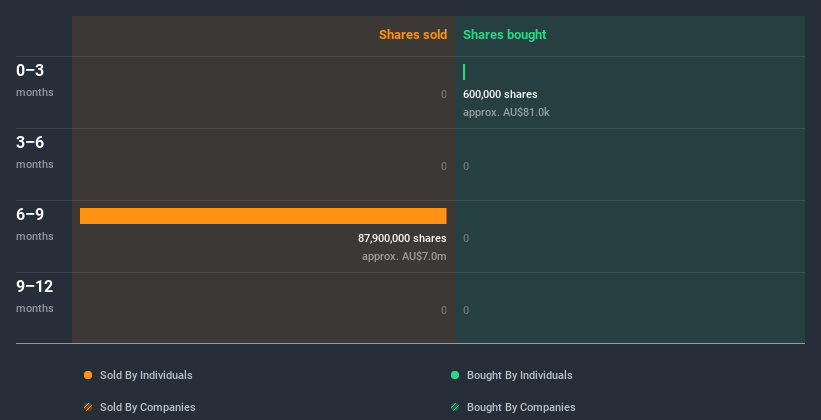

Over the last year, we can see that the biggest insider sale was by the Independent Non-Executive Director, Bernard Hockings, for AU$7.0m worth of shares, at about AU$0.08 per share. That means that even when the share price was below the current price of AU$0.14, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. It is worth noting that this sale was only 25% of Bernard Hockings's holding. Bernard Hockings was the only individual insider to sell over the last year.

The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that PYC Therapeutics insiders own 54% of the company, worth about AU$229m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At PYC Therapeutics Tell Us?

It's certainly positive to see the recent insider purchase. On the other hand the transaction history, over the last year, isn't so positive. The high levels of insider ownership, and the recent buying by an insider suggests they are well aligned and optimistic. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. When we did our research, we found 4 warning signs for PYC Therapeutics (2 are concerning!) that we believe deserve your full attention.

Of course PYC Therapeutics may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade PYC Therapeutics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PYC

PYC Therapeutics

A drug-development company, engages in the discovery and development of novel RNA therapeutics for the treatment of genetic diseases in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026