The Australian market has been experiencing positive investor sentiment, with the ASX200 trading higher and sectors like Materials and Financials leading the charge, although Information Technology has faced some challenges alongside Utilities. In this environment, identifying high-growth tech stocks involves looking for companies that can navigate current market dynamics effectively while capitalizing on technological advancements and innovation.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 6.81% | 19.84% | ★★★★☆☆ |

| Pureprofile | 13.56% | 32.42% | ★★★★☆☆ |

| Pro Medicus | 19.53% | 21.56% | ★★★★★☆ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| Life360 | 16.26% | 40.50% | ★★★★★☆ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| Kinatico | 12.26% | 51.47% | ★★★★☆☆ |

| Immutep | 70.84% | 42.55% | ★★★★★☆ |

| PYC Therapeutics | 12.55% | 24.30% | ★★★★★☆ |

| Xero | 12.82% | 23.77% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

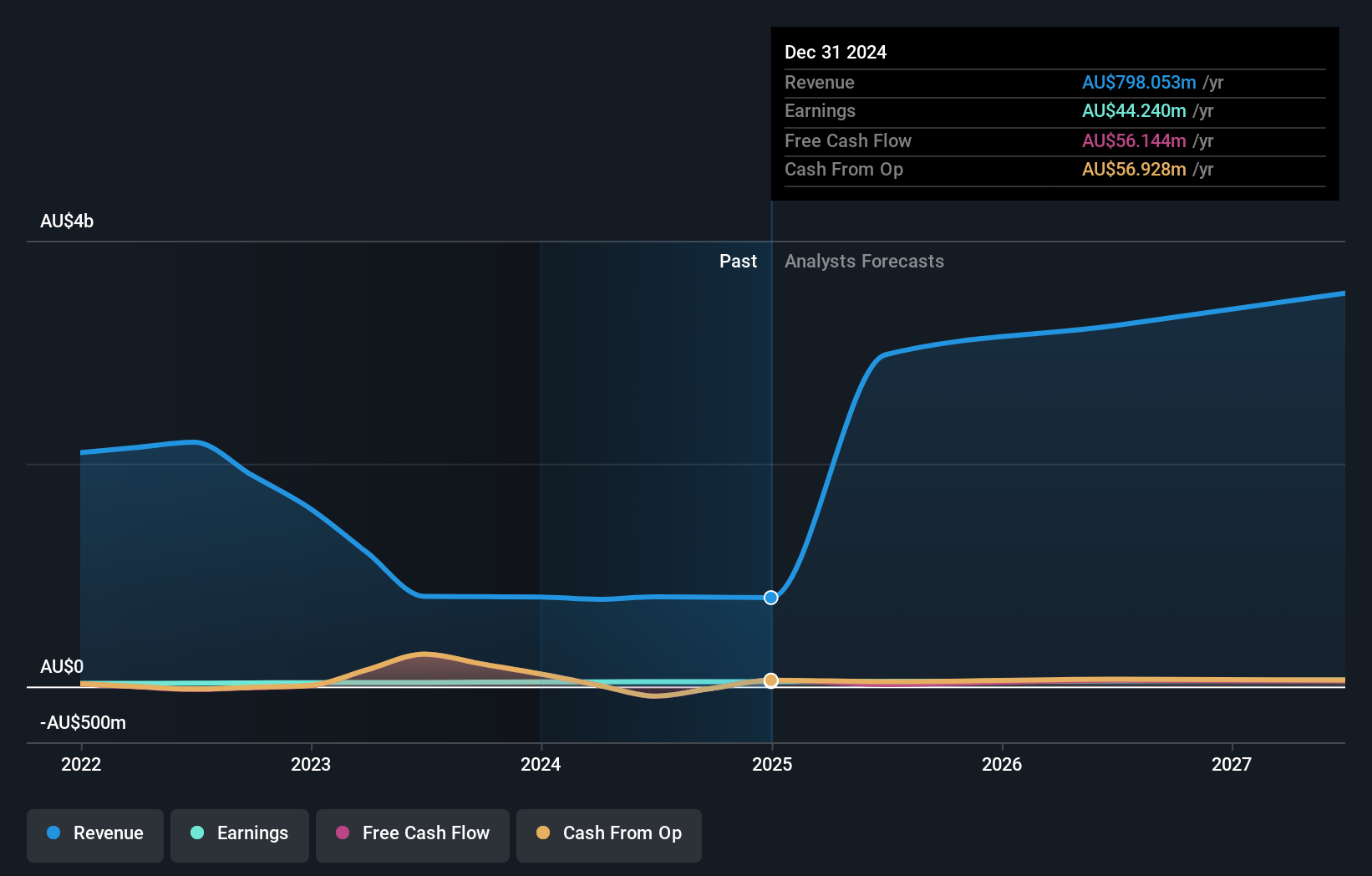

Overview: Data#3 Limited is an IT solutions and services provider operating in Australia, Fiji, and the Pacific Islands with a market capitalization of A$1.17 billion.

Operations: The company generates revenue primarily as a value-added IT reseller and solutions provider, with this segment contributing A$798.05 million. The business operates across Australia, Fiji, and the Pacific Islands.

Data#3, a prominent name in Australian tech, is poised for robust growth with its revenue expected to surge by 20.1% annually, outpacing the national market's 5.6%. This growth trajectory is complemented by a forecasted return on equity of an impressive 60% in three years. The recent strategic board appointments of Diana Eilert and Laurence Baynham further bolster its leadership, blending deep industry experience and fresh perspectives crucial for navigating the evolving tech landscape. While its earnings growth projection of 10.1% trails slightly behind the broader Australian market's 10.9%, Data#3 maintains a competitive edge with quality earnings and positive free cash flow, indicating strong financial health and operational efficiency.

- Take a closer look at Data#3's potential here in our health report.

Gain insights into Data#3's historical performance by reviewing our past performance report.

Infomedia (ASX:IFM)

Simply Wall St Growth Rating: ★★★★☆☆

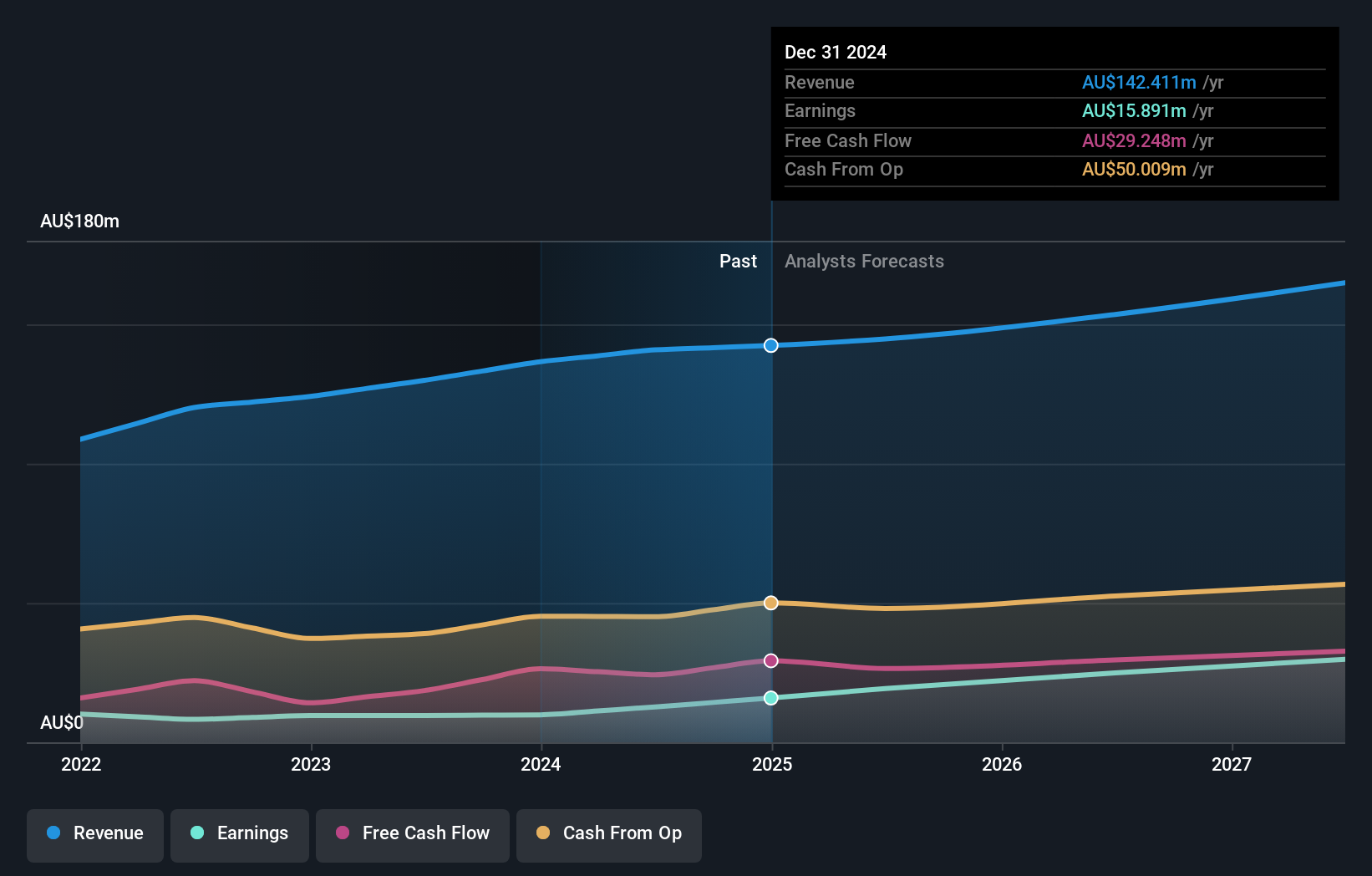

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market capitalization of A$635.90 million.

Operations: Infomedia generates revenue primarily through its publishing of periodicals, contributing A$142.41 million to its financial performance. The company's offerings focus on the automotive sector, providing essential digital tools that enhance parts cataloguing and service quoting processes for clients globally.

Infomedia, an Australian tech firm, is set to grow its revenue by 6.8% annually, outpacing the broader market's 5.6%. This growth is supported by a robust R&D investment strategy that consistently enhances its software solutions, with recent figures showing a significant allocation of funds towards innovation. The company’s earnings have surged by 19.8% per year, reflecting effective capital management and strategic initiatives like the recent acquisition agreement with TPG Growth Capital Asia Limited for AUD 650 million. This move could further solidify Infomedia's market position by expanding its service offerings and potentially increasing shareholder value through strategic synergies.

- Navigate through the intricacies of Infomedia with our comprehensive health report here.

Evaluate Infomedia's historical performance by accessing our past performance report.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★★☆

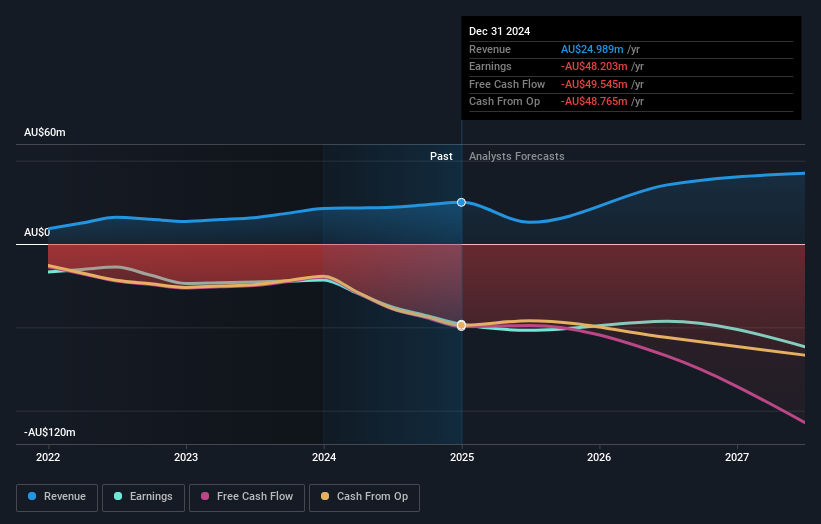

Overview: PYC Therapeutics Limited is an Australian drug-development company focused on discovering and developing novel RNA therapeutics to treat genetic diseases, with a market cap of approximately A$734.91 million.

Operations: PYC Therapeutics generates revenue primarily through the discovery and development of novel RNA therapeutics, amounting to approximately A$24.99 million. The company focuses on addressing genetic diseases using innovative RNA-based treatments.

PYC Therapeutics, navigating through the competitive landscape of biotech, demonstrates a promising trajectory with an expected revenue growth rate of 12.6% annually, outpacing the Australian market average of 5.6%. Despite current unprofitability, forecasts indicate a shift towards profitability within three years, supported by an anticipated earnings growth of 24.3% per year. This growth is underpinned by strategic R&D investments aimed at pioneering treatments in genetic medicine, although it's crucial to note that shareholders have experienced dilution over the past year. As PYC moves towards its profitability milestones, its robust projected return on equity at 27.5% signals potential for substantial financial health improvement, aligning with its innovative thrust in a high-stakes industry.

- Click here to discover the nuances of PYC Therapeutics with our detailed analytical health report.

Examine PYC Therapeutics' past performance report to understand how it has performed in the past.

Make It Happen

- Navigate through the entire inventory of 21 ASX High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives