The Australian market has recently reached an all-time high, driven by a strong rally in the mining sector and expectations of potential rate cuts by the Reserve Bank of Australia, although the tech sector faced some challenges due to external factors. In this environment, identifying high growth tech stocks requires careful consideration of their resilience and potential to thrive despite broader market fluctuations.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| WiseTech Global | 20.26% | 22.91% | ★★★★★★ |

| Wrkr | 56.40% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Immutep | 70.42% | 43.18% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 18.78% | 55.55% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Data#3 Limited is an IT solutions and services provider operating in Australia, Fiji, and the Pacific Islands with a market capitalization of A$1.19 billion.

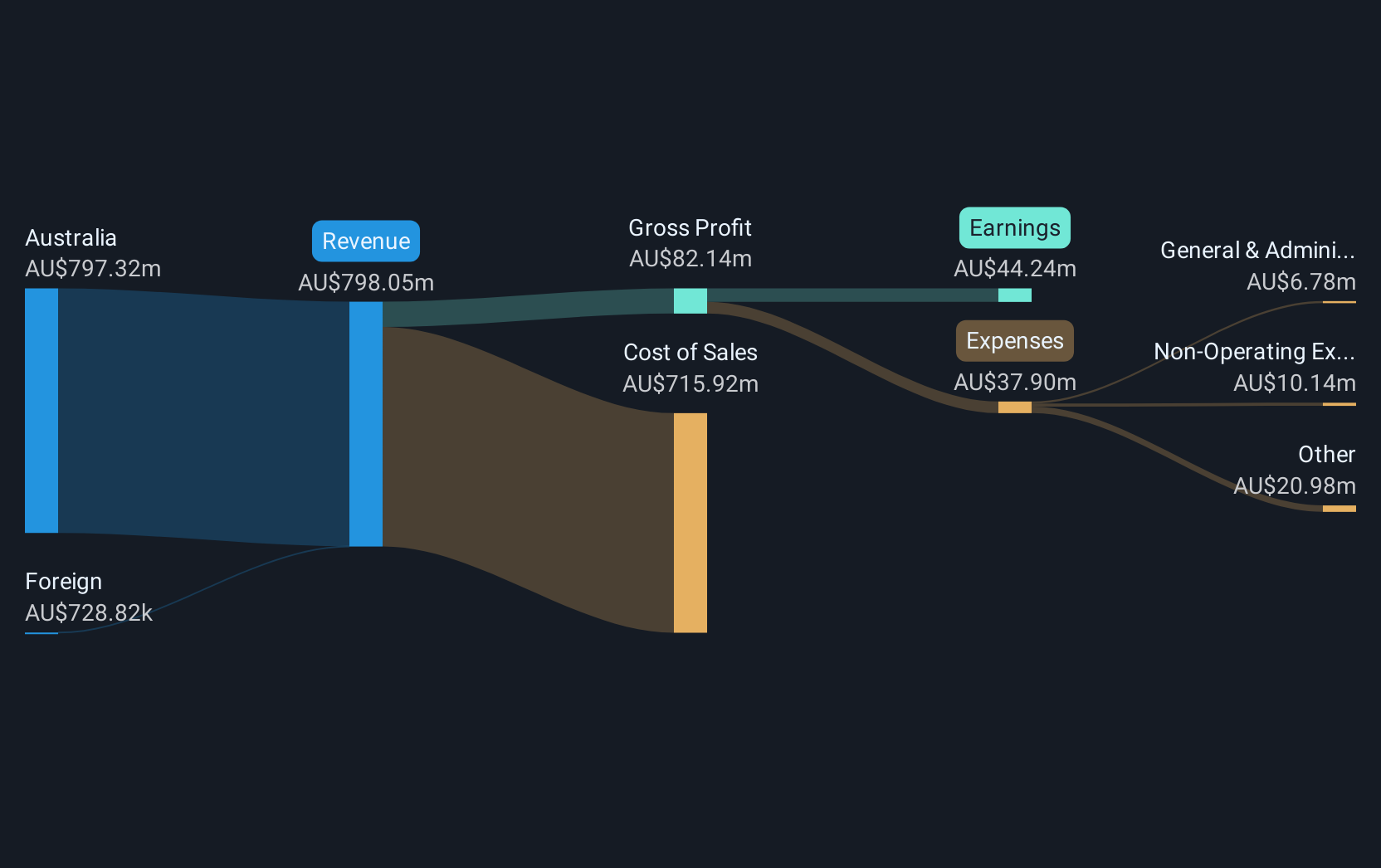

Operations: The company's primary revenue stream is from its role as a value-added IT reseller and IT solutions provider, generating A$798.05 million. The business focuses on delivering comprehensive IT services across its operational regions.

Data#3, a contender in Australia's tech landscape, recently enhanced its board with seasoned professionals, signaling a strategic push to fortify its market position. With revenue growth forecasted at 20.4% annually, surpassing the Australian market's 5.5%, and earnings set to rise by 10.2% each year, Data#3 is aligning itself well within the high-growth tech sector. The company also maintains robust R&D commitments, essential for sustaining innovation and competitiveness in a rapidly evolving industry. This focus on governance and continuous development could be pivotal as Data#3 strives to outpace both industry and broader market growth rates.

- Unlock comprehensive insights into our analysis of Data#3 stock in this health report.

Understand Data#3's track record by examining our Past report.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PYC Therapeutics Limited is an Australian drug-development company focused on discovering and developing novel RNA therapeutics for treating genetic diseases, with a market cap of A$758.24 million.

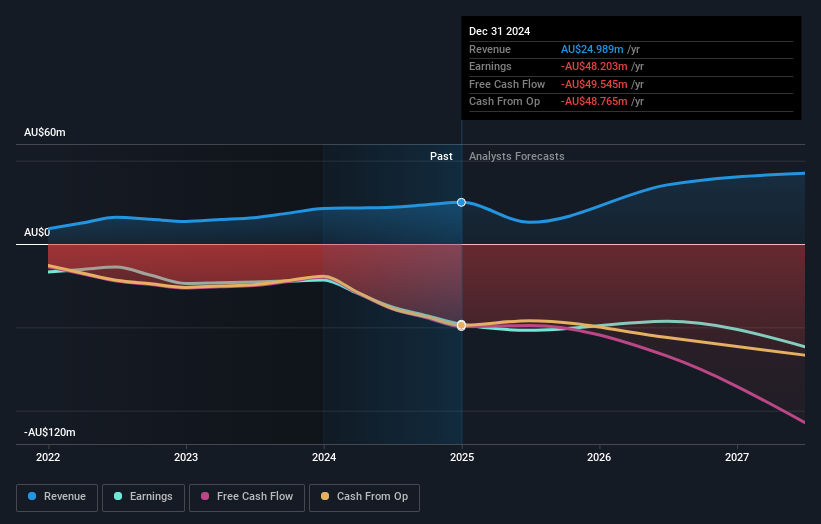

Operations: The company generates revenue primarily from its discovery and development of novel RNA therapeutics, amounting to A$24.99 million.

PYC Therapeutics, amidst Australia's bustling tech scene, recently initiated a Phase 1a study for PYC-003, marking a significant stride in its clinical development. This move underscores the company's robust commitment to R&D, crucial for pioneering treatments in biotechnology. Although currently unprofitable with revenue growth projected at 12.6% annually—slightly above the national average of 5.5%—PYC is poised for profitability within three years with expected earnings growth of 24.3%. This trajectory reflects not only PYC’s potential to lead in high-growth sectors but also its strategic focus on innovative healthcare solutions that could reshape industry standards and patient outcomes globally.

- Dive into the specifics of PYC Therapeutics here with our thorough health report.

Evaluate PYC Therapeutics' historical performance by accessing our past performance report.

WiseTech Global (ASX:WTC)

Simply Wall St Growth Rating: ★★★★★★

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions, with a market cap of A$36.36 billion.

Operations: WiseTech Global Limited focuses on delivering software solutions tailored for the logistics execution sector, generating revenue primarily through its Internet Software & Services segment, which amounts to $698.66 million.

WiseTech Global, an Australian software powerhouse, is making strategic moves to bolster its board and expand through acquisitions, signaling robust growth prospects. With a recent announcement on June 18, 2025, about the appointment of seasoned leaders Sandra Hook and Rob Castaneda as independent non-executive directors, WiseTech is poised to enhance its governance and innovation strategy. This follows their active pursuit of E2open Parent Holdings, with discussions revealed on May 2 indicating a potential $3.5 billion acquisition aimed at enriching their logistics software capabilities. Financially, WiseTech demonstrates strong performance with a revenue growth rate at 20.3% annually and earnings expected to surge by 22.9% per year—both metrics outpacing the broader Australian market rates of 5.5% and 10.9%, respectively.

- Get an in-depth perspective on WiseTech Global's performance by reading our health report here.

Gain insights into WiseTech Global's past trends and performance with our Past report.

Where To Now?

- Click this link to deep-dive into the 46 companies within our ASX High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DTL

Data#3

Engages in the provision of information technology (IT) solutions and services in Australia, Fiji, and the Pacific Islands.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives