Over the last 7 days, the Australian market has remained flat, but over the past 12 months, it has risen by an impressive 16%, with earnings projected to grow by 13% per annum in the coming years. For investors interested in smaller or newer companies, penny stocks—despite being a somewhat outdated term—remain relevant for their potential value and growth opportunities. By focusing on those with strong financial foundations, investors can uncover stocks that might offer both stability and long-term potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.995 | A$324.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$328.68M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.69 | A$93.48M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.625 | A$796.38M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.95 | A$109.66M | ★★★★★★ |

| Duratec (ASX:DUR) | A$1.34 | A$337.74M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,049 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Bathurst Resources (ASX:BRL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bathurst Resources Limited is involved in the exploration, development, and production of coal in New Zealand with a market cap of A$148.30 million.

Operations: The company's revenue is derived from two main segments: export sales totaling NZ$340.55 million and domestic sales amounting to NZ$133.38 million.

Market Cap: A$148.3M

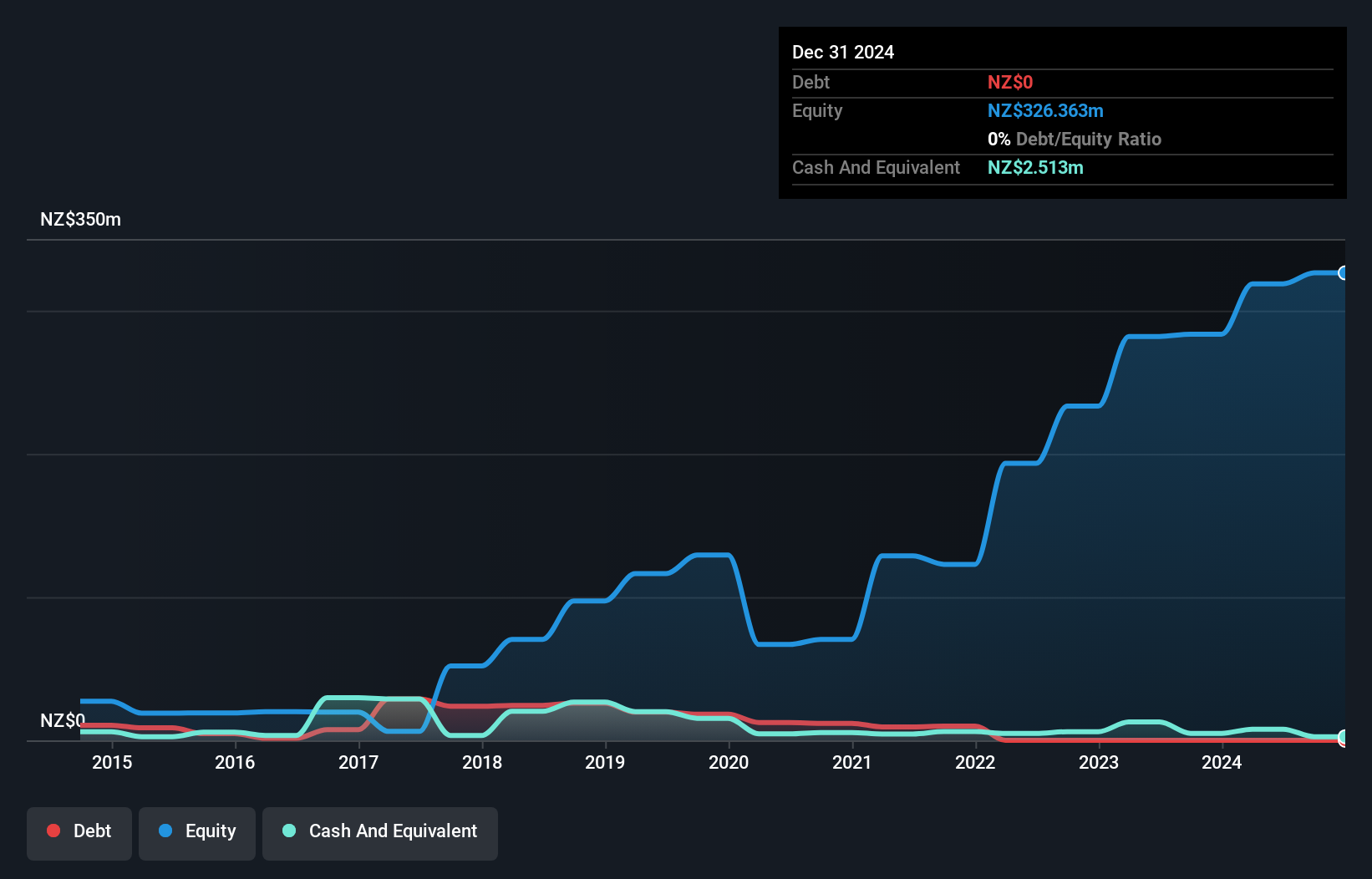

Bathurst Resources, with a market cap of A$148.30 million, derives significant revenue from export (NZ$340.55 million) and domestic sales (NZ$133.38 million) in New Zealand's coal sector. Its price-to-earnings ratio of 4.2x suggests it may be undervalued compared to the broader Australian market average of 20.3x. Despite experiencing negative earnings growth over the past year (-57.4%), Bathurst has no debt and maintains high-quality earnings with a seasoned management team averaging 7.3 years in tenure. Short-term assets cover liabilities, though long-term liabilities slightly exceed short-term assets by NZ$0.1M, indicating financial stability challenges ahead.

- Jump into the full analysis health report here for a deeper understanding of Bathurst Resources.

- Gain insights into Bathurst Resources' historical outcomes by reviewing our past performance report.

Falcon Metals (ASX:FAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Falcon Metals Limited is involved in the discovery, exploration, and development of mineral deposits in Australia with a market cap of A$27.44 million.

Operations: Currently, Falcon Metals Limited does not report any revenue segments.

Market Cap: A$27.43M

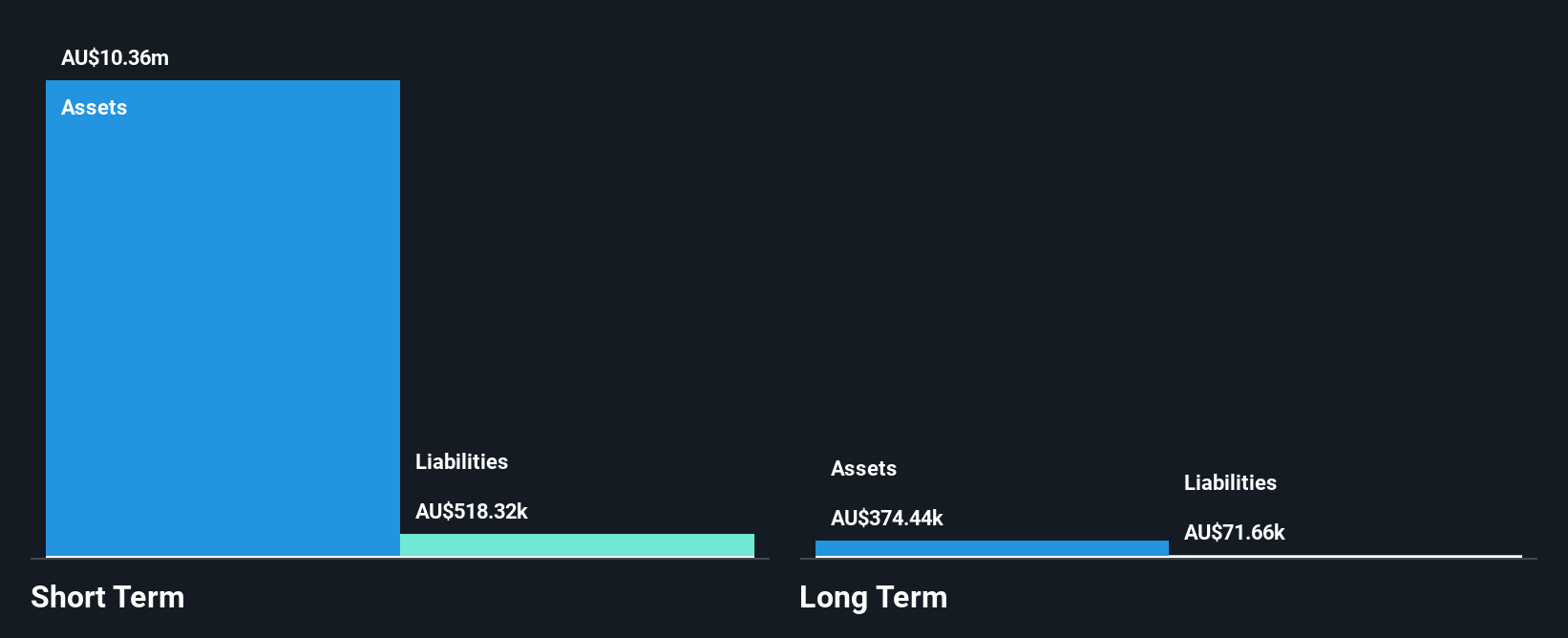

Falcon Metals Limited, with a market cap of A$27.44 million, is pre-revenue and currently unprofitable, reporting a net loss of A$5.56 million for the year ending June 30, 2024. Despite this, it benefits from being debt-free and has sufficient cash runway for over two years if current spending trends continue. The company's short-term assets significantly exceed both its short- and long-term liabilities, suggesting solid financial management in terms of liquidity. Recent presentations at industry conferences highlight ongoing engagement with stakeholders as Falcon navigates its exploration and development phase within the mining sector.

- Navigate through the intricacies of Falcon Metals with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Falcon Metals' track record.

Prescient Therapeutics (ASX:PTX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prescient Therapeutics Limited is a clinical-stage oncology company in Australia focused on developing drugs for cancer treatment, with a market cap of A$35.43 million.

Operations: The company generates revenue from its clinical-stage oncology segment, amounting to A$3.71 million.

Market Cap: A$35.43M

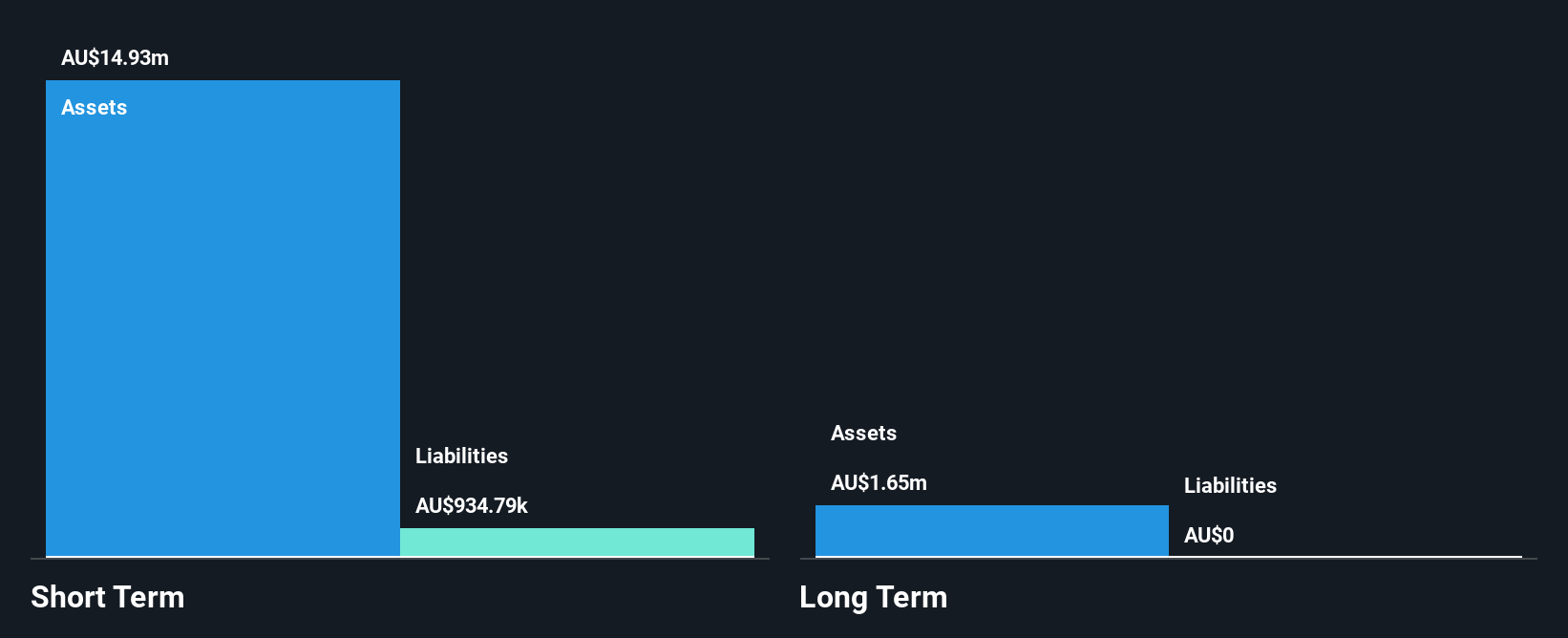

Prescient Therapeutics, with a market cap of A$35.43 million, is a pre-revenue clinical-stage oncology company. The firm has managed to maintain financial stability with more cash than total debt and short-term assets of A$18.7 million covering both short- and long-term liabilities. Despite being unprofitable and experiencing increased losses over the past five years, Prescient's seasoned management team remains intact as it undergoes leadership changes with CEO Steven Yatomi-Clarke stepping down in early 2025. The company’s recent AGM addressed key governance issues including director elections and strategic placement facilities for future growth initiatives.

- Get an in-depth perspective on Prescient Therapeutics' performance by reading our balance sheet health report here.

- Gain insights into Prescient Therapeutics' past trends and performance with our report on the company's historical track record.

Where To Now?

- Dive into all 1,049 of the ASX Penny Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PTX

Prescient Therapeutics

A clinical stage oncology company, develops drugs for the treatment of various cancers in Australia.

Slight with mediocre balance sheet.

Market Insights

Community Narratives