- Australia

- /

- Metals and Mining

- /

- ASX:WC8

ASX Penny Stock Highlights: Energy Transition Minerals And Two Other Picks

Reviewed by Simply Wall St

As the ASX 200 faces a potential decline, reflecting broader global market jitters, investors are keenly observing opportunities that may arise amidst these fluctuations. Penny stocks, while often considered niche investments, can still present intriguing growth prospects when backed by strong financial fundamentals. In this context, we will highlight three penny stocks that demonstrate financial resilience and potential for long-term success in the Australian market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.80 | A$232.15M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.735 | A$95.97M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.58 | A$774.33M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$220.22M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.44M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,048 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Energy Transition Minerals (ASX:ETM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Energy Transition Minerals Ltd is engaged in mineral exploration and evaluation activities in Australia, with a market cap of A$40.85 million.

Operations: The company's revenue segment is derived from Mineral Exploration and Evaluation, amounting to A$0.049 million.

Market Cap: A$40.85M

Energy Transition Minerals Ltd, with a market cap of A$40.85 million, is engaged in mineral exploration and remains pre-revenue, generating only A$0.049 million from its activities. The company has been unprofitable, with losses increasing by 12.8% annually over the past five years. Despite this, it maintains a stable cash runway for over two years and holds no debt liabilities. Recent earnings reported for the half year show slight revenue growth to A$0.264 million but still reflect a net loss of A$2.39 million compared to the previous year’s loss of A$2.49 million, indicating ongoing financial challenges amidst operational progress.

- Click here and access our complete financial health analysis report to understand the dynamics of Energy Transition Minerals.

- Review our historical performance report to gain insights into Energy Transition Minerals' track record.

Proteomics International Laboratories (ASX:PIQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Proteomics International Laboratories Ltd is a medical technology company specializing in proteomics across Australia, New Zealand, the United States, Europe, India, and South East Asia with a market cap of A$89.08 million.

Operations: The company generates revenue of A$3.28 million from its operational activities in the medical technology sector.

Market Cap: A$89.08M

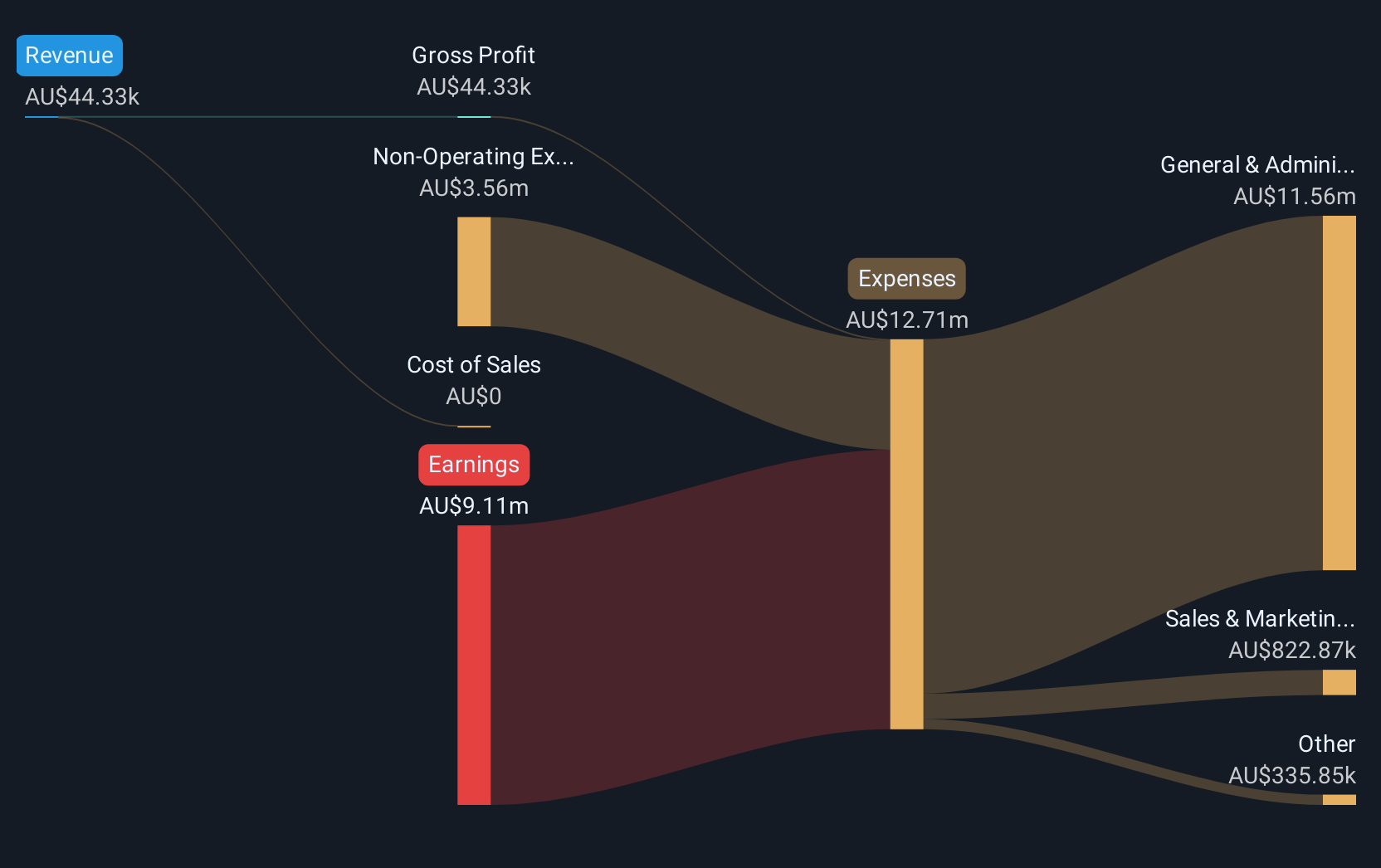

Proteomics International Laboratories, with a market cap of A$89.08 million, operates in the medical technology sector and generates revenue of A$3.28 million, indicating it is not pre-revenue but remains unprofitable. The company has no debt and possesses short-term assets exceeding its liabilities, suggesting a stable financial position despite shareholder dilution over the past year. Recent board changes include appointing experienced directors like Aaron Brinkworth and James Williams, potentially strengthening strategic oversight. Revenue is forecast to grow significantly at 40.2% annually; however, profitability remains elusive in the near term as losses have increased by 28.9% annually over five years.

- Navigate through the intricacies of Proteomics International Laboratories with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Proteomics International Laboratories' future.

Wildcat Resources (ASX:WC8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wildcat Resources Limited is a mineral exploration company operating in Australia with a market capitalization of A$290.59 million.

Operations: The company generates revenue from its operations in Australia, amounting to A$0.0021 million.

Market Cap: A$290.59M

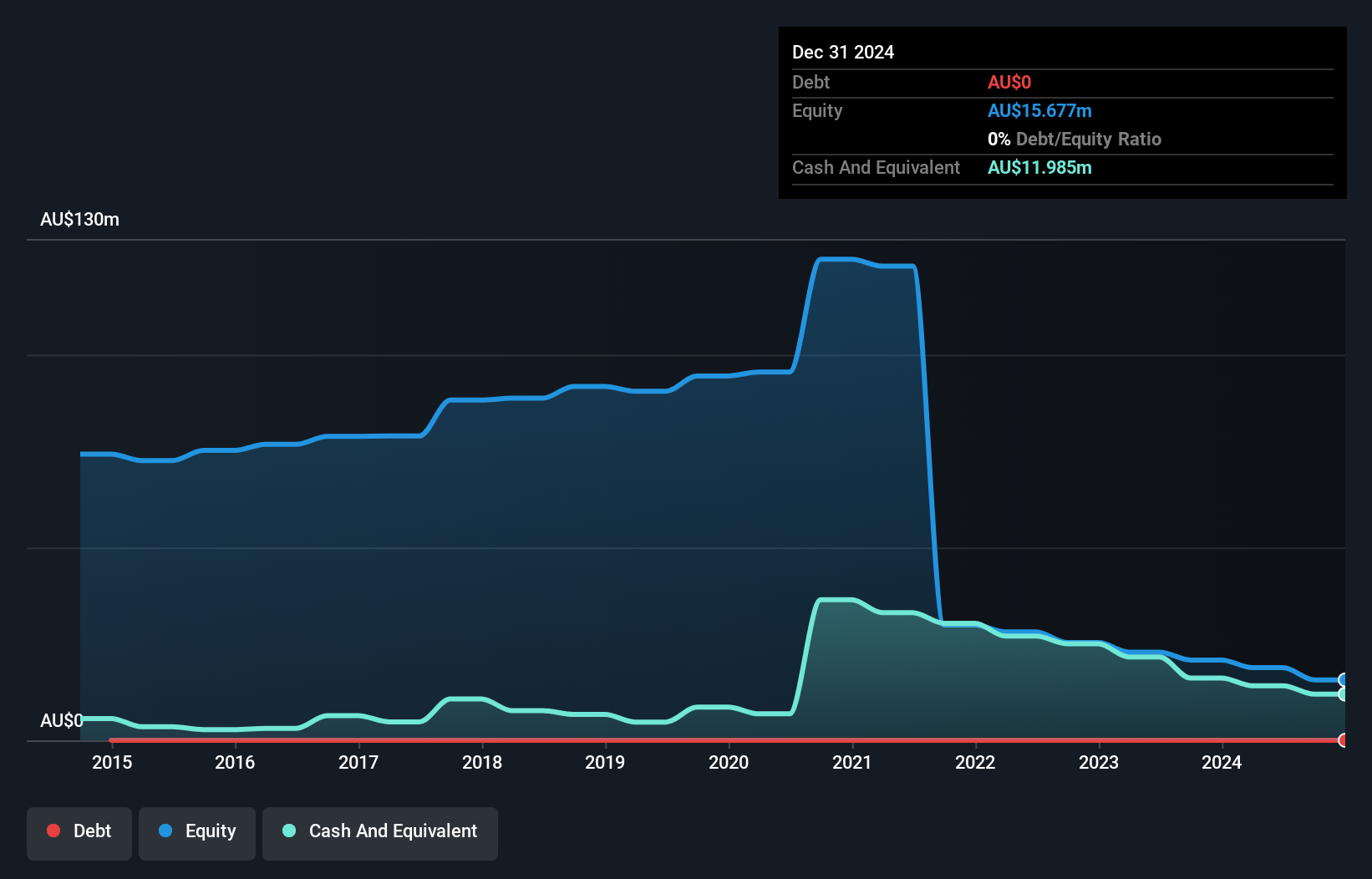

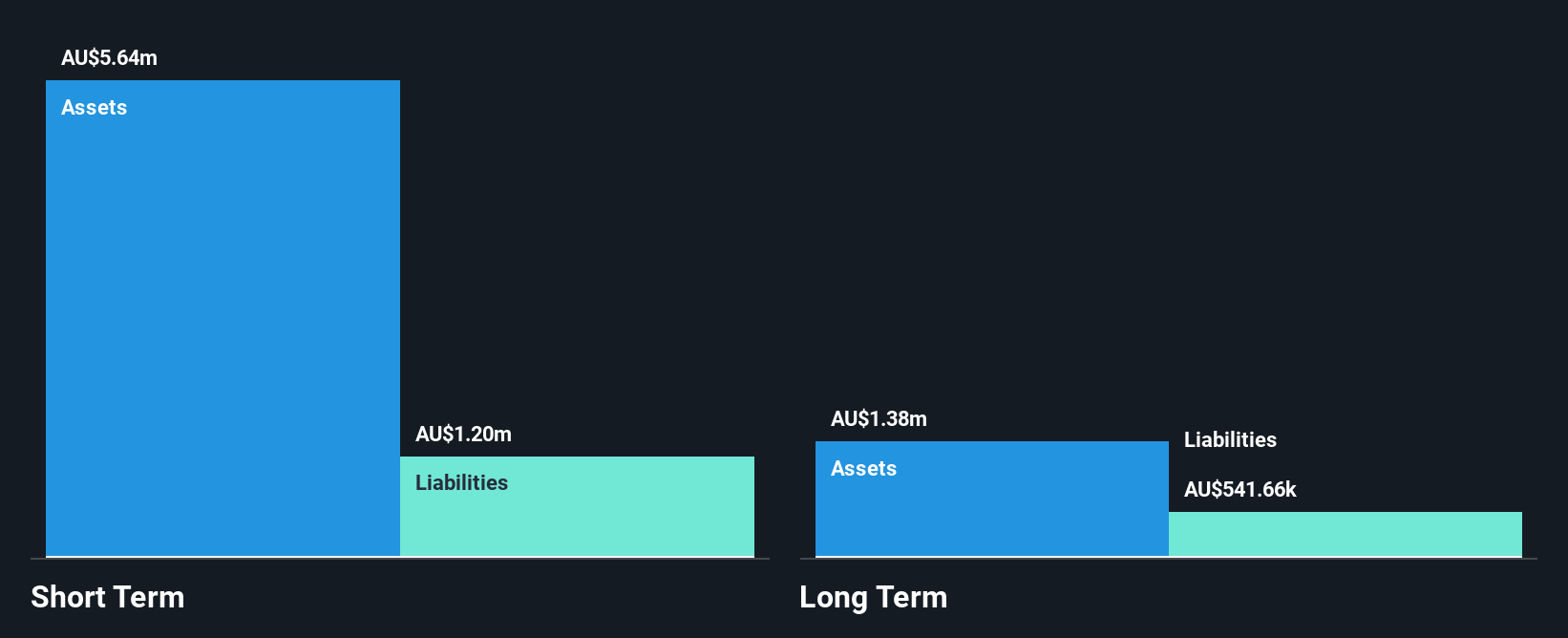

Wildcat Resources, with a market cap of A$290.59 million, is a pre-revenue mineral exploration company in Australia. Despite being debt-free and having short-term assets of A$78.9 million that cover its liabilities, the company faces challenges with unprofitability and shareholder dilution over the past year. The management team and board are relatively inexperienced, which could impact strategic decision-making. Although added to the S&P Global BMI Index recently, Wildcat's earnings are forecasted to decline by 4.9% annually over three years without a clear path to profitability in the near term amidst high stock volatility.

- Jump into the full analysis health report here for a deeper understanding of Wildcat Resources.

- Gain insights into Wildcat Resources' future direction by reviewing our growth report.

Next Steps

- Click this link to deep-dive into the 1,048 companies within our ASX Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wildcat Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WC8

Wildcat Resources

Operates as a mineral exploration company in Australia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives