Is There More To The Story Than Probiotec's (ASX:PBP) Earnings Growth?

As a general rule, we think profitable companies are less risky than companies that lose money. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Probiotec (ASX:PBP).

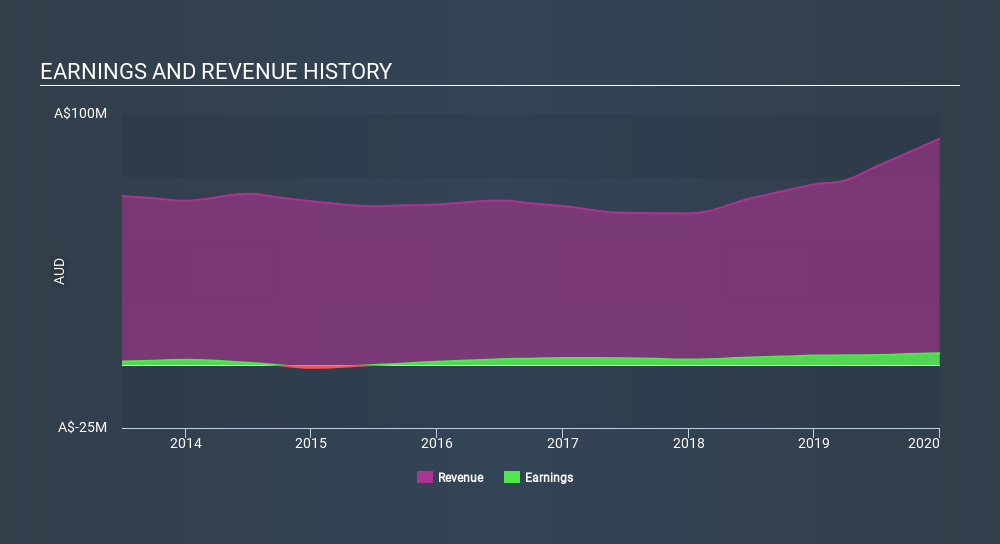

It's good to see that over the last twelve months Probiotec made a profit of AU$4.78m on revenue of AU$90.2m. Happily, it has grown both its profit and revenue over the last three years, as you can see in the chart below.

Check out our latest analysis for Probiotec

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. In this article we will consider how Probiotec's decision to issue new shares in the company has impacted returns to shareholders. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Probiotec issued 25% more new shares over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Probiotec's EPS by clicking here.

How Is Dilution Impacting Probiotec's Earnings Per Share? (EPS)

As you can see above, Probiotec has been growing its net income over the last few years, with an annualized gain of 67% over three years. But EPS was only up 40% per year, in the exact same period. And at a glance the 25% gain in profit over the last year impresses. But in comparison, EPS only increased by 26% over the same period. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So Probiotec shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Probiotec's Profit Performance

Each Probiotec share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Therefore, it seems possible to us that Probiotec's true underlying earnings power is actually less than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 40% over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, we've discovered 4 warning signs that you should run your eye over to get a better picture of Probiotec.

Today we've zoomed in on a single data point to better understand the nature of Probiotec's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:PBP

Probiotec

Engages in the development, manufacture, packing, distribution, and sale of prescription and over the counter pharmaceuticals, complementary medicines and consumer health products, and fast-moving consumer products in Australia and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives