If You Had Bought Paradigm Biopharmaceuticals (ASX:PAR) Stock Five Years Ago, You Could Pocket A 534% Gain Today

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. To wit, the Paradigm Biopharmaceuticals Limited (ASX:PAR) share price has soared 534% over five years. If that doesn't get you thinking about long term investing, we don't know what will. It's even up 10% in the last week.

It really delights us to see such great share price performance for investors.

View our latest analysis for Paradigm Biopharmaceuticals

Paradigm Biopharmaceuticals recorded just AU$3,076,369 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Paradigm Biopharmaceuticals has the funding to invent a new product before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Of course, if you time it right, high risk investments like this can really pay off, as Paradigm Biopharmaceuticals investors might know.

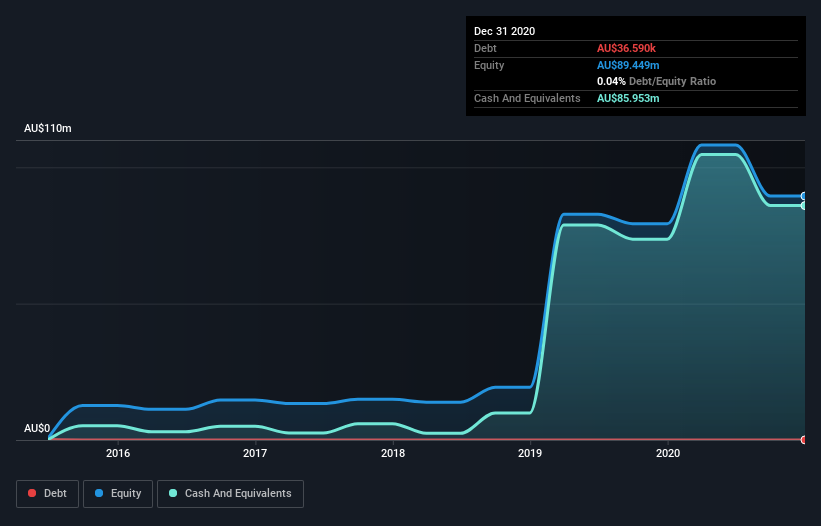

When it last reported its balance sheet in December 2020, Paradigm Biopharmaceuticals could boast a strong position, with cash in excess of all liabilities of AU$80m. That allows management to focus on growing the business, and not worry too much about raising capital. And given that the share price has shot up 41% per year, over 5 years , it's fair to say investors are liking management's vision for the future. You can click on the image below to see (in greater detail) how Paradigm Biopharmaceuticals' cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Paradigm Biopharmaceuticals' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Paradigm Biopharmaceuticals hasn't been paying dividends, but its TSR of 550% exceeds its share price return of 534%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Paradigm Biopharmaceuticals had a tough year, with a total loss of 25%, against a market gain of about 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 45%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Paradigm Biopharmaceuticals .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade Paradigm Biopharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PAR

Paradigm Biopharmaceuticals

Engages in the research and development of therapeutic products for human use in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives