Can Paradigm Biopharmaceuticals' (ASX:PAR) Leadership Vision Drive Long-Term Strategic Value?

Reviewed by Sasha Jovanovic

- Paradigm Biopharmaceuticals Limited presented at the Ignite Investment Summit in Hong Kong on October 15, 2025, with Founder, MD & Executive Chairman Paul John Rennie delivering key insights.

- The company's participation at this high-profile investor event provided stakeholders with detailed updates on its strategic direction and executive leadership vision.

- We'll explore how Paradigm Biopharmaceuticals' focus on its executive leadership vision at the summit shapes its current investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Paradigm Biopharmaceuticals' Investment Narrative?

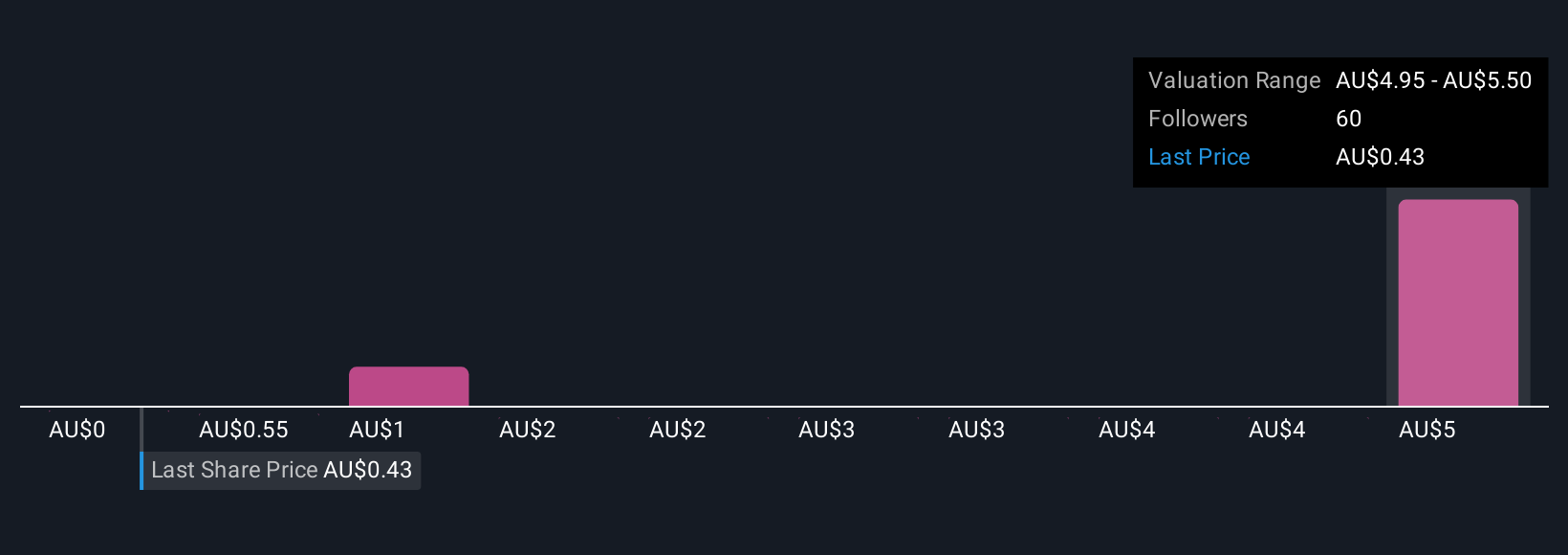

For anyone looking at Paradigm Biopharmaceuticals, the big-picture case comes down to faith in its executive leadership and conviction in the company’s path towards clinical milestones, especially with the recent Hong Kong summit spotlighting Paul John Rennie’s strategy and vision. While the event itself may not transform core business catalysts overnight, it places Paradigm’s leadership credibility and engagement with international investors front and center, potentially boosting sentiment but not fundamentally changing the immediate outlook as key catalysts still revolve around clinical progress, regulatory developments, and upcoming shareholder votes on capital structure changes. On risks, Paradigm remains unprofitable with zero revenue, has a track record of shareholder dilution, and faces inherent uncertainty in clinical trial outcomes, which still overshadow positive management messaging. In the short term, the summit appearance does little to reduce execution risks or increase near-term revenue visibility for shareholders.

However, don’t overlook the continued risk of shareholder dilution in future capital raisings. Paradigm Biopharmaceuticals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Paradigm Biopharmaceuticals - why the stock might be worth just A$0.55!

Build Your Own Paradigm Biopharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paradigm Biopharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Paradigm Biopharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paradigm Biopharmaceuticals' overall financial health at a glance.

No Opportunity In Paradigm Biopharmaceuticals?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PAR

Paradigm Biopharmaceuticals

Engages in the research and development of therapeutic products for human use in Australia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives