Here's Why Some Shareholders May Not Be Too Generous With Patrys Limited's (ASX:PAB) CEO Compensation This Year

Under the guidance of CEO James Campbell, Patrys Limited (ASX:PAB) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 15 November 2022. We present our case of why we think CEO compensation looks fair.

Check out the opportunities and risks within the AU Biotechs industry.

Comparing Patrys Limited's CEO Compensation With The Industry

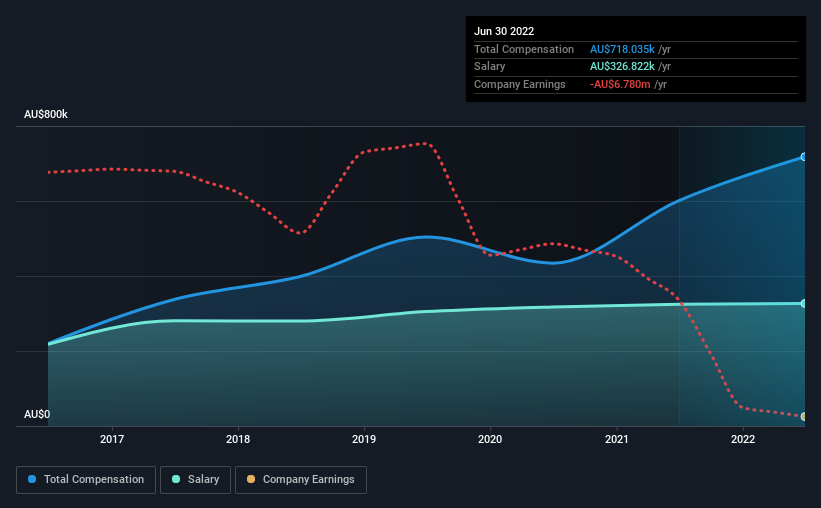

According to our data, Patrys Limited has a market capitalization of AU$39m, and paid its CEO total annual compensation worth AU$718k over the year to June 2022. We note that's an increase of 19% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$327k.

On comparing similar-sized companies in the industry with market capitalizations below AU$306m, we found that the median total CEO compensation was AU$705k. So it looks like Patrys compensates James Campbell in line with the median for the industry. Furthermore, James Campbell directly owns AU$359k worth of shares in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$327k | AU$325k | 46% |

| Other | AU$391k | AU$277k | 54% |

| Total Compensation | AU$718k | AU$601k | 100% |

Speaking on an industry level, nearly 49% of total compensation represents salary, while the remainder of 51% is other remuneration. Patrys is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Patrys Limited's Growth Numbers

Over the last three years, Patrys Limited has shrunk its earnings per share by 27% per year. It achieved revenue growth of 149% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Patrys Limited Been A Good Investment?

Patrys Limited has not done too badly by shareholders, with a total return of 1.1%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Although the company has performed relatively well, we still think there are some areas that could be improved. We reckon that there are some shareholders who may be hesitant to increase CEO pay further until EPS growth starts to improve, despite the robust revenue growth.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 5 warning signs for Patrys (2 don't sit too well with us!) that you should be aware of before investing here.

Switching gears from Patrys, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PAB

Patrys

Develops antibody technologies for the treatment of cancer and NETosis-driven inflammatory diseases.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion