The Australian stock market showed mixed performance recently, with utilities and energy sectors leading gains while financials lagged behind. In this fluctuating landscape, investors may find opportunities in penny stocks—an investment area that, despite being somewhat outdated as a term, remains relevant for those seeking potential growth in smaller or newer companies. When these stocks are supported by strong financials, they can offer promising prospects for investors looking to uncover hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.18 | A$102.84M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.575 | A$109.63M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.94 | A$453.29M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.30 | A$2.62B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.76 | A$465.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.01 | A$1.01B | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.01 | A$190.27M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.84 | A$148.2M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 463 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology in the United States and internationally, with a market cap of A$212.20 million.

Operations: The company generates revenue of NZ$84.70 million from its operations in developing, manufacturing, and selling soft tissue repair products.

Market Cap: A$212.2M

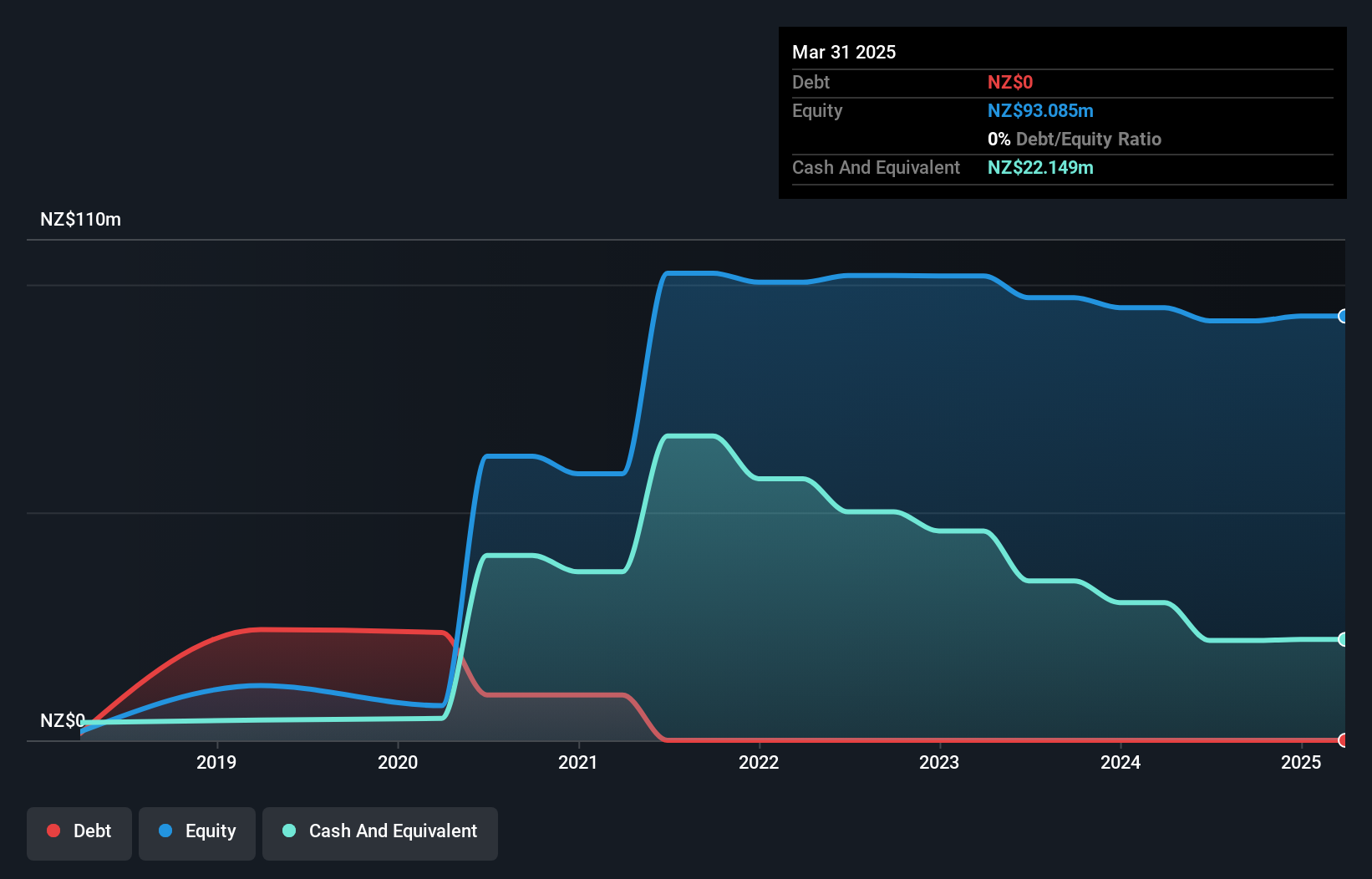

Aroa Biosurgery, with a market cap of A$212.20 million, is currently unprofitable but shows promising signs for investors interested in penny stocks. It trades at 82% below its estimated fair value and has reduced losses over the past five years by 21.2% annually, while maintaining a debt-free balance sheet and sufficient cash runway for over three years. Recent studies highlight its Endoform Natural product's efficacy in treating venous leg ulcers, potentially improving patient outcomes and reducing costs. Despite significant insider selling recently, analysts expect earnings to grow nearly 90% annually with positive future price targets.

- Click here to discover the nuances of Aroa Biosurgery with our detailed analytical financial health report.

- Explore Aroa Biosurgery's analyst forecasts in our growth report.

Immutep (ASX:IMM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Immutep Limited is a late-stage biotechnology company in Australia focused on developing novel LAG-3 related immunotherapies for cancer and autoimmune diseases, with a market cap of A$396.32 million.

Operations: The company's revenue is derived entirely from its immunotherapy segment, amounting to A$4.88 million.

Market Cap: A$396.32M

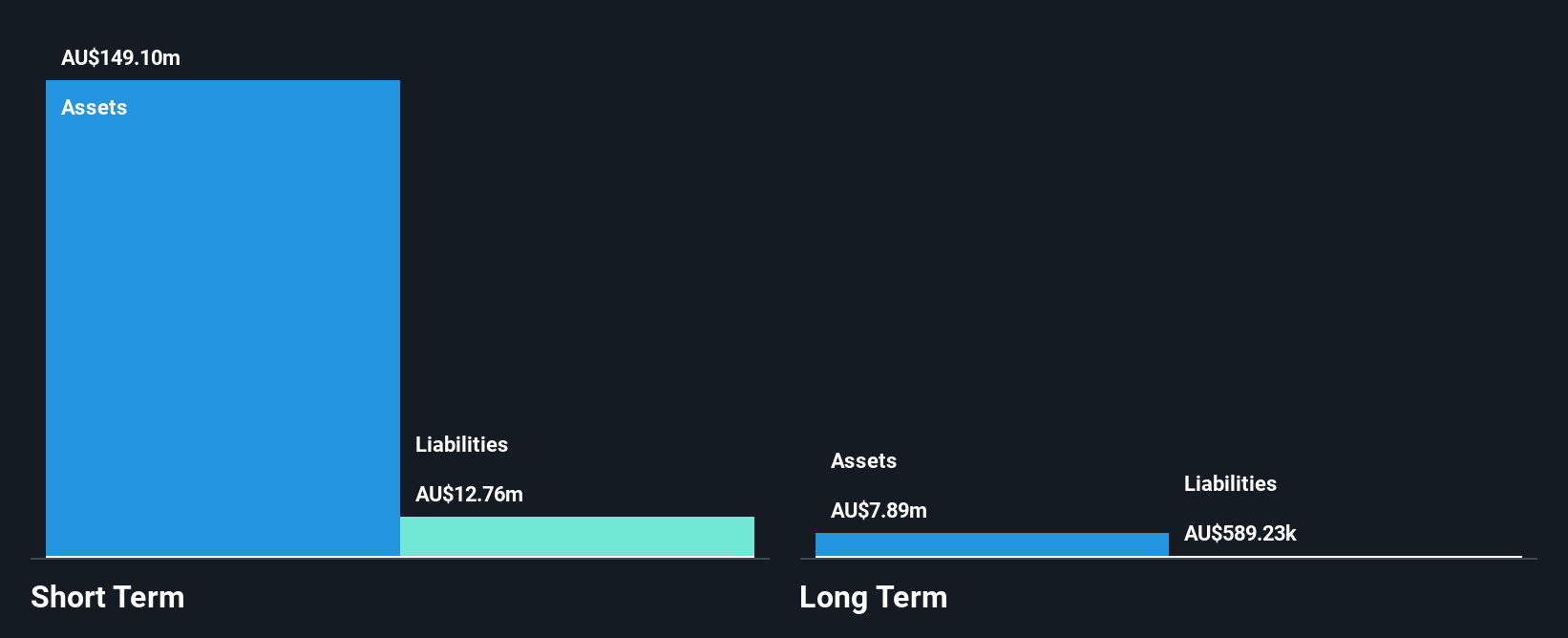

Immutep Limited, a late-stage biotechnology company with a market cap of A$396.32 million, is currently pre-revenue and unprofitable but has several promising developments that may interest investors in penny stocks. The company has recently announced positive data from its Phase I study of IMP761 for autoimmune diseases and the EFTISARC-NEO Phase II trial for soft tissue sarcoma, both showing significant efficacy. Despite its unprofitability, Immutep's short-term assets exceed liabilities significantly, providing financial stability. Additionally, it boasts an experienced management team and board while maintaining a low debt-to-equity ratio at 0.6%, indicating prudent financial management.

- Get an in-depth perspective on Immutep's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Immutep's future.

Noxopharm (ASX:NOX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Noxopharm Limited is an Australian biotech company focused on discovering and developing treatments for cancer, inflammation, and mRNA vaccines, with a market cap of A$36.53 million.

Operations: The company generates revenue of A$2.34 million from its development activities in both oncology and non-oncology fields.

Market Cap: A$36.53M

Noxopharm Limited, with a market cap of A$36.53 million, is a pre-revenue biotech company focused on cancer and inflammation treatments. Despite being unprofitable and having limited revenue (A$2.34 million), Noxopharm's short-term assets (A$5.5M) comfortably cover both its short-term (A$1.1M) and long-term liabilities (A$32K). The company benefits from an experienced management team with an average tenure of 4.5 years, although it faces challenges such as high volatility in share price and less than one year of cash runway if growth continues at historical rates, highlighting potential risks for investors in penny stocks.

- Dive into the specifics of Noxopharm here with our thorough balance sheet health report.

- Understand Noxopharm's track record by examining our performance history report.

Summing It All Up

- Embark on your investment journey to our 463 ASX Penny Stocks selection here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IMM

Immutep

A biotechnology company, engages in developing novel Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives