Alfie Germano is the CEO of Nanollose Limited (ASX:NC6), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Nanollose

Comparing Nanollose Limited's CEO Compensation With the industry

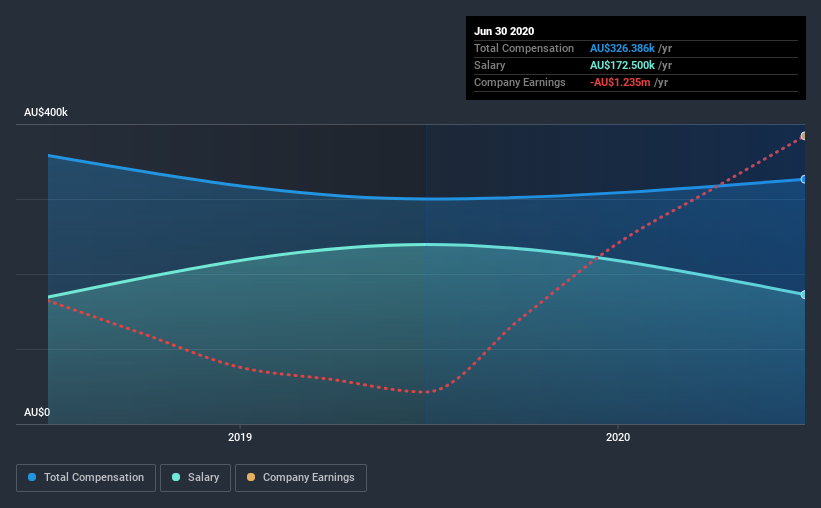

Our data indicates that Nanollose Limited has a market capitalization of AU$9.5m, and total annual CEO compensation was reported as AU$326k for the year to June 2020. We note that's an increase of 8.8% above last year. Notably, the salary which is AU$172.5k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below AU$279m, reported a median total CEO compensation of AU$443k. This suggests that Nanollose remunerates its CEO largely in line with the industry average.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$173k | AU$239k | 53% |

| Other | AU$154k | AU$61k | 47% |

| Total Compensation | AU$326k | AU$300k | 100% |

Speaking on an industry level, nearly 65% of total compensation represents salary, while the remainder of 35% is other remuneration. In Nanollose's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Nanollose Limited's Growth Numbers

Nanollose Limited's earnings per share (EPS) grew 2.8% per year over the last three years. In the last year, its revenue is up 94%.

We like the look of the strong year-on-year improvement in revenue. And in that context, the modest EPS improvement certainly isn't shabby. So while we'd stop short of saying growth is absolutely outstanding, there are definitely some clear positives! While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Nanollose Limited Been A Good Investment?

With a three year total loss of 63% for the shareholders, Nanollose Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, Alfie is compensated close to the median for companies of its size, and which belong to the same industry. Meanwhile, Nanollose is suffering from adverse shareholder returns and althoughEPS have grown over the past three years, they have not been extraordinary. We'd stop short of saying CEO compensation is inappropriate, but without an improvement in performance, it's sure to draw criticism. Shareholders will also not want to see performance improving before agreeing to any raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 5 warning signs for Nanollose (of which 4 are a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Nanollose, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nanollose might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:NC6

Nanollose

A biomaterials company, engages in the research and development, and promotion of microbial cellulose technologies in Australia.

Moderate risk with weak fundamentals.

Market Insights

Community Narratives