If You Had Bought Medical Developments International (ASX:MVP) Shares Five Years Ago You'd Have Earned 56% Returns

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Medical Developments International Limited (ASX:MVP) share price is up 56% in the last 5 years, clearly besting the market return of around 42% (ignoring dividends).

See our latest analysis for Medical Developments International

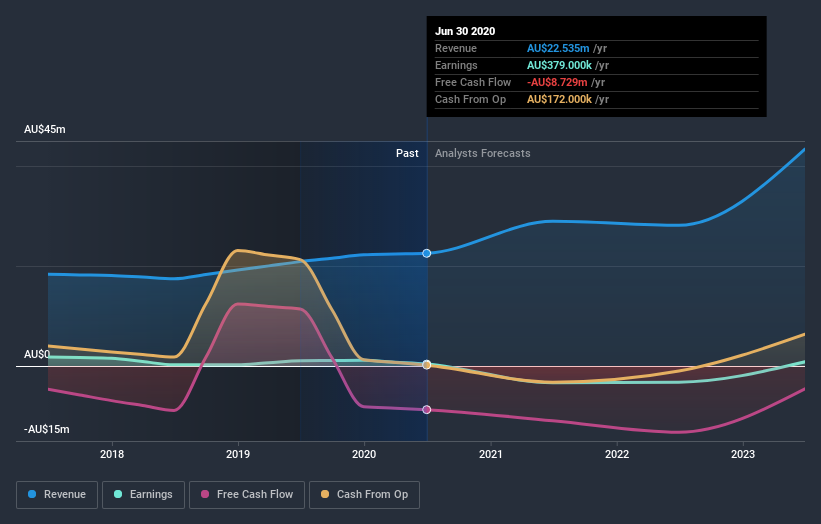

Given that Medical Developments International only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Medical Developments International can boast revenue growth at a rate of 12% per year. That's a fairly respectable growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 9% full reflects the underlying business growth. If revenue growth can maintain for long enough, it's likely profits will flow. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Medical Developments International stock, you should check out this free report showing analyst profit forecasts.

What about the Total Shareholder Return (TSR)?

We've already covered Medical Developments International's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Medical Developments International's TSR of 62% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Investors in Medical Developments International had a tough year, with a total loss of 39%, against a market gain of about 4.5%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Medical Developments International better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Medical Developments International (including 1 which is potentially serious) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade Medical Developments International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MVP

Medical Developments International

Manufactures and distributes emergency medical solutions in Australia, Europe, the United States, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives