Mesoblast (ASX:MSB) Valuation in Focus After Rising Ryoncil® Revenues and New US Reimbursement Pathways

Reviewed by Simply Wall St

Mesoblast (ASX:MSB) is catching investor attention following its announcement that Ryoncil® revenues are on the rise. This growth is supported by expanding physician adoption and access through both commercial and government reimbursement programs.

See our latest analysis for Mesoblast.

With momentum building off the back of Ryoncil®’s revenue growth and new CMS reimbursement pathways, Mesoblast’s share price has rebounded 16.7% over the past three months. But the real highlight is the 82.2% total shareholder return over the past year, a sharp contrast to its steep decline earlier in the year. This hints that investor sentiment is shifting on the back of tangible progress and future growth prospects.

If Mesoblast’s turnaround has you thinking bigger, this could be the perfect moment to expand your investing horizons and discover See the full list for free.

The sharp rebound in Mesoblast’s share price raises a key question for investors: is the recent optimism already reflected in today’s valuation, or does further Ryoncil® success point to more upside from here?

Price-to-Book of 3.7x: Is it justified?

Mesoblast’s price-to-book ratio stands at 3.7x, which is below the averages for both its peer group (4.5x) and the broader Australian Biotechs industry (4.6x). At its last close of A$2.66, the market is assigning a lower multiple to Mesoblast’s book value compared to many of its counterparts, suggesting relative undervaluation.

The price-to-book ratio compares a company’s market price to its net asset value, providing a sense of the market's confidence in the company’s future profit potential given its tangible assets. For biotechs, this multiple often reflects both hard assets and the implied value of future innovation that may not yet appear on the balance sheet.

Mesoblast’s discount versus peers indicates that, despite recent wins and anticipated growth, the market is cautious about pricing in its future prospects. However, trading at a lower multiple could signal either conservative expectations or an opportunity if commercialisation momentum continues to increase. No fair value ratio is available, so these peer comparisons remain the strongest benchmark.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.7x (UNDERVALUED)

However, persistent net losses and high reliance on Ryoncil revenues could temper expectations if commercial growth or reimbursement trends begin to slow.

Find out about the key risks to this Mesoblast narrative.

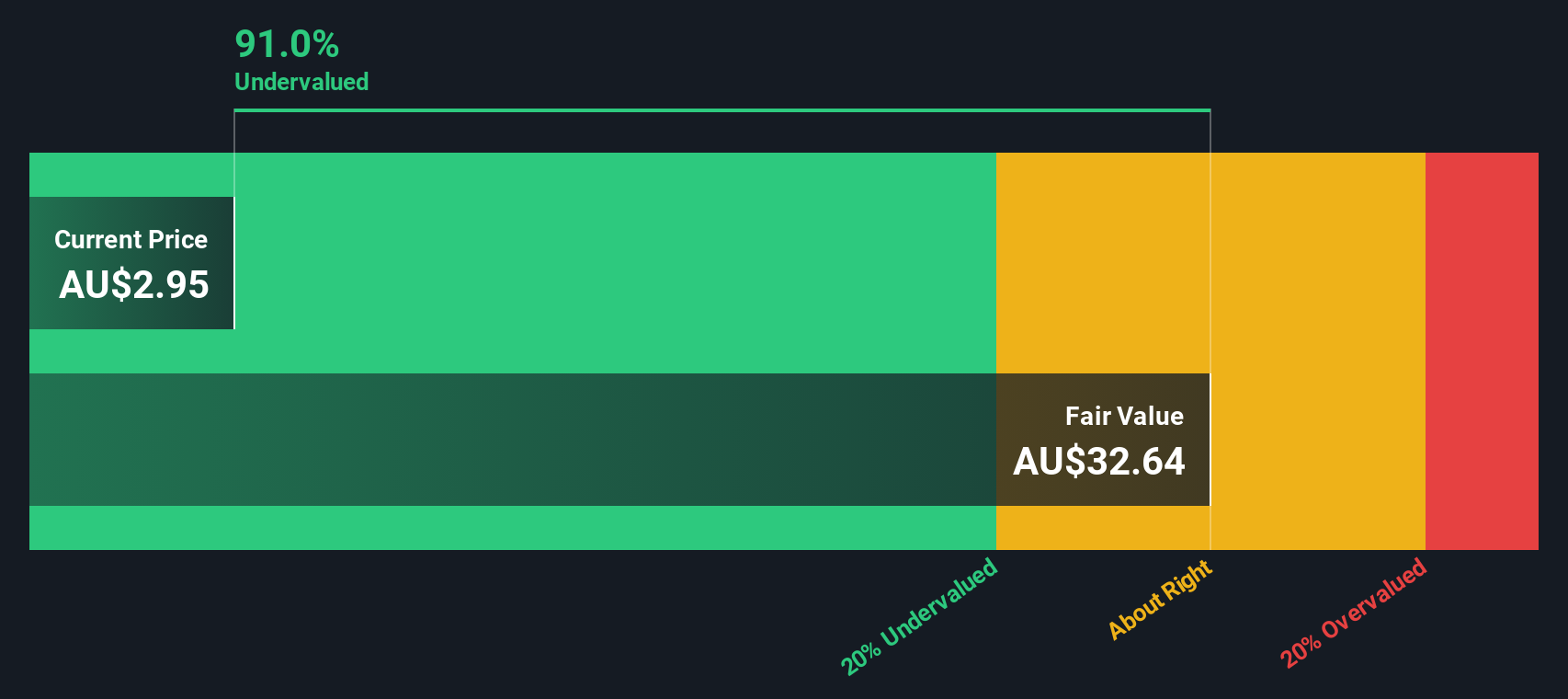

Another View: Discounted Cash Flow Tells a Different Story

Switching gears from book value to our SWS DCF model, the results are striking. Mesoblast is estimated to be trading at a 91.8% discount to its fair value, according to our model. This approach provides a much more optimistic outlook. However, does this ambitious projection truly capture the realities facing the company or overlook key risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mesoblast for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mesoblast Narrative

If you have a different perspective or want to dive deeper on Mesoblast, you can easily build your own investment case in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mesoblast.

Looking for more investment ideas?

Smart investors don't just settle on one company. Broaden your strategy by checking out our tailored shortlists below and stay ahead of the market curve.

- Accelerate your returns by targeting high-yield opportunities with these 17 dividend stocks with yields > 3% and access companies offering strong payouts above 3%.

- Spot market disruptors early when you use these 24 AI penny stocks to find AI-powered businesses primed for rapid growth.

- Strengthen your portfolio's foundation by hunting for value with these 877 undervalued stocks based on cash flows and see which stocks offer standout fundamentals at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives