Mesoblast (ASX:MSB): Assessing Valuation After Ryoncil Wins Permanent U.S. J-Code for Reimbursement

Reviewed by Kshitija Bhandaru

Mesoblast (ASX:MSB) drew investor attention after announcing that its product, Ryoncil, was granted a permanent J-Code by the U.S. Medicare & Medicaid Services for billing and reimbursement beginning in October 2025.

See our latest analysis for Mesoblast.

Momentum around Mesoblast has picked up following the news about Ryoncil’s new billing code and its designation as a U.S.-origin product, making reimbursement and commercial pathways much clearer for the company. While its short-term share price moves have been relatively muted, the 1-year total shareholder return of just under 1% hints that performance has been steady but not yet breaking out. Investors may be watching for signs that this recent milestone could change sentiment going forward.

If you’re curious where other biotech innovators are gaining ground, it’s worth exploring opportunities with our healthcare stocks screener See the full list for free.

But with a fresh reimbursement pathway and steady recent returns, is Mesoblast now a bargain for investors, or has the market already factored in all the future growth potential?

Price-to-Book of 3.9: Is it justified?

Mesoblast is trading at a price-to-book ratio of 3.9, sitting just below both its Australian biotech industry peers (4.1) and the peer group average (4.4). This suggests the market values its assets somewhat conservatively relative to competitors, and investors might be seeing untapped potential.

The price-to-book ratio compares a company's market value to its net assets. This is a crucial benchmark for asset-driven businesses like biotechs that are not yet profitable. For a sector where many companies are still developing products, this ratio can reveal if expectations for future value are getting ahead of reality.

Notably, Mesoblast’s current multiple being lower than the industry's could mean the market is still cautious. The market could be waiting for Ryoncil’s commercial traction or positive profitability milestones. Competitive pricing is often viewed as a margin of safety for risk-tolerant investors, but large gaps can close quickly as sentiment shifts.

Compared to both the industry average and its immediate peer group, Mesoblast looks slightly undervalued at current levels. Should sentiment improve or commercial milestones accelerate, there is room for this multiple to adjust upwards towards market norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.9 (UNDERVALUED)

However, ongoing net losses and the company’s reliance on continued revenue growth remain risks that could reduce the current optimism among investors.

Find out about the key risks to this Mesoblast narrative.

Another View: DCF Model Tells a Different Story

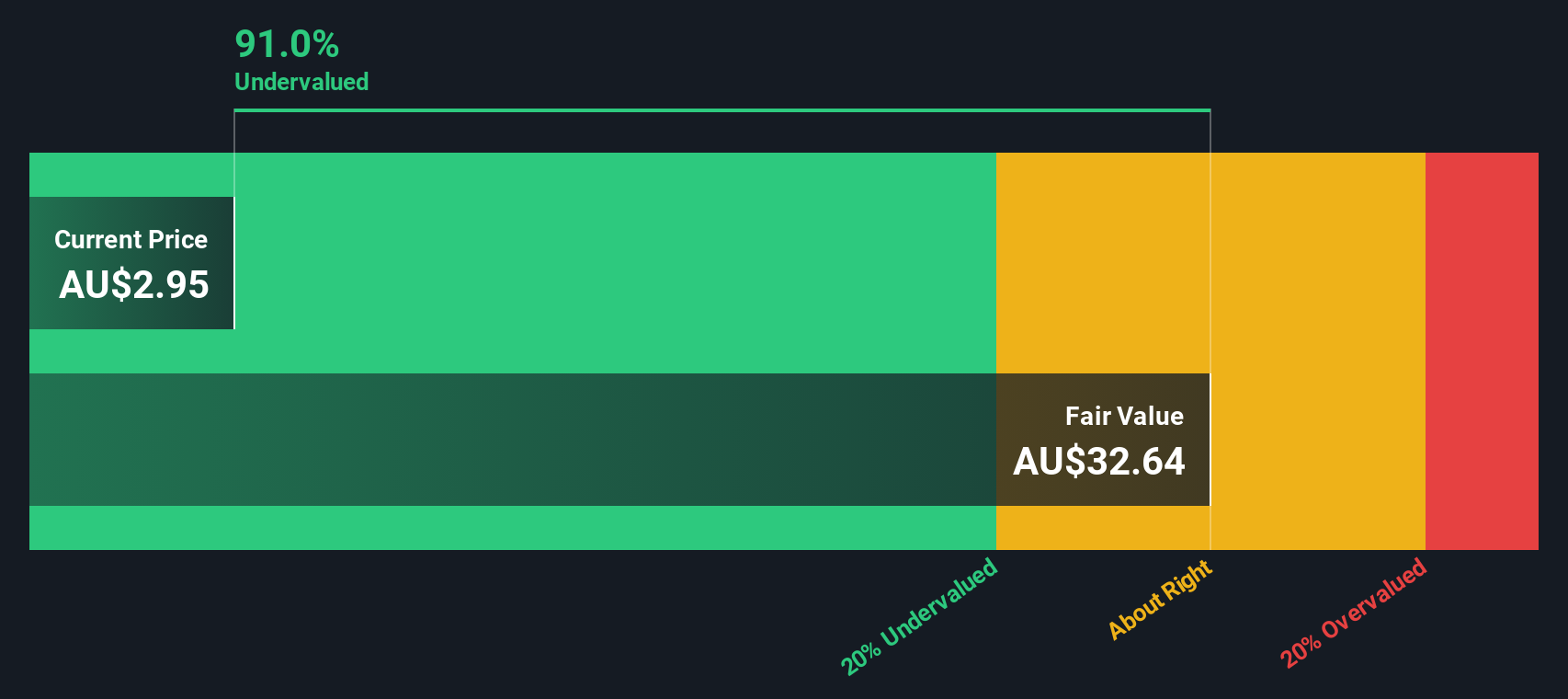

Looking at Mesoblast through the lens of our DCF model, the shares appear substantially undervalued. The SWS DCF model places Mesoblast’s fair value significantly higher than its current price, which challenges the more cautious message from the price-to-book ratio. Could the market be overlooking hidden long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mesoblast for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mesoblast Narrative

If you see the numbers differently, or want to dig deeper based on your own insights, you can easily generate your own narrative in just a few minutes. No experience required. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mesoblast.

Looking for More Smart Investing Opportunities?

Don’t let today’s opportunity be tomorrow’s regret. With so many compelling trends unfolding, it’s smart to keep your radar open to new stock ideas.

- Catch rising companies making waves in artificial intelligence and access potential game-changers with these 24 AI penny stocks before others spot them.

- Boost your portfolio’s income with reliable picks by targeting high-yield payers using these 19 dividend stocks with yields > 3%, built for those who value consistent returns.

- Stay ahead of the crowd by seeking undervalued gems the market hasn’t fully recognized. Tools like these 904 undervalued stocks based on cash flows can highlight clear opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives