Melodiol Global Health Limited (ASX:ME1) Stock's 40% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Melodiol Global Health Limited (ASX:ME1) shares are down a considerable 40% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 99% share price decline.

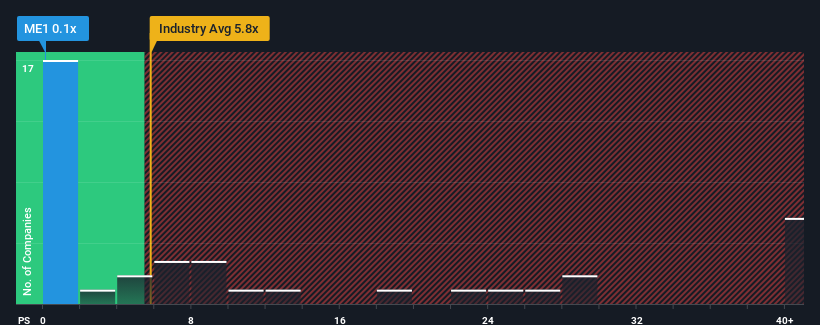

Following the heavy fall in price, Melodiol Global Health may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Pharmaceuticals industry in Australia have P/S ratios greater than 5.8x and even P/S higher than 24x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Melodiol Global Health

What Does Melodiol Global Health's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Melodiol Global Health has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Melodiol Global Health will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Melodiol Global Health's earnings, revenue and cash flow.How Is Melodiol Global Health's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Melodiol Global Health's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 203%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 33% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it very odd that Melodiol Global Health is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Bottom Line On Melodiol Global Health's P/S

Having almost fallen off a cliff, Melodiol Global Health's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Melodiol Global Health revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. We think potential risks might be placing significant pressure on the P/S ratio and share price. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

You always need to take note of risks, for example - Melodiol Global Health has 5 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ME1

Melodiol Global Health

Engages in the development, cultivation, and distribution of recreational and medical cannabis products in Europe, Canada, Australia, and the Asia Pacific.

Medium-low and slightly overvalued.

Market Insights

Community Narratives