Imugene (ASX:IMU) Is In A Good Position To Deliver On Growth Plans

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Imugene (ASX:IMU) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Imugene

When Might Imugene Run Out Of Money?

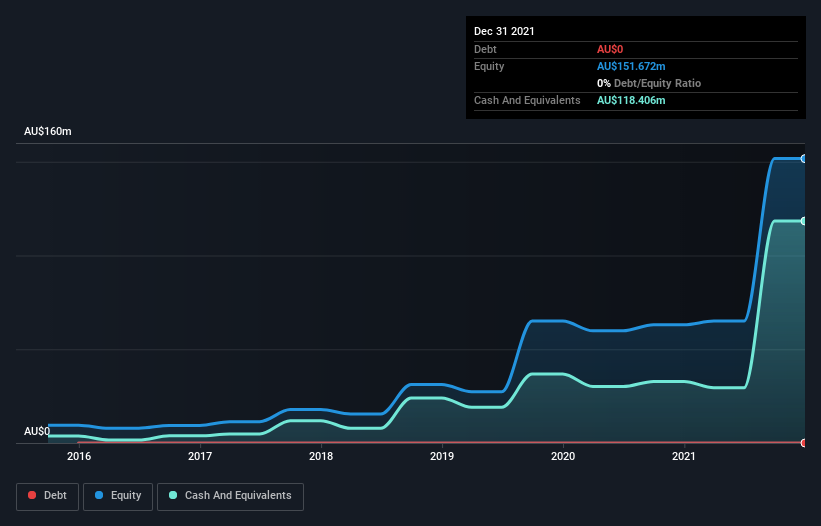

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In December 2021, Imugene had AU$118m in cash, and was debt-free. In the last year, its cash burn was AU$24m. That means it had a cash runway of about 5.0 years as of December 2021. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

How Is Imugene's Cash Burn Changing Over Time?

While Imugene did record statutory revenue of AU$8.5m over the last year, it didn't have any revenue from operations. That means we consider it a pre-revenue business, and we will focus our growth analysis on cash burn, for now. Over the last year its cash burn actually increased by a very significant 92%. While this spending increase is no doubt intended to drive growth, if the trend continues the company's cash runway will shrink very quickly. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Imugene Raise Cash?

While Imugene does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Imugene's cash burn of AU$24m is about 1.5% of its AU$1.5b market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Imugene's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Imugene's cash burn. For example, we think its cash runway suggests that the company is on a good path. While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Imugene (of which 2 can't be ignored!) you should know about.

Of course Imugene may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IMU

Imugene

A clinical-stage immuno-oncology company, develops a range of immunotherapies to activate the immune system of cancer patients to treat and eradicate tumours in Australia.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives