Despite shrinking by AU$50m in the past week, Immutep (ASX:IMM) shareholders are still up 46% over 5 years

Immutep Limited (ASX:IMM) shareholders might understandably be very concerned that the share price has dropped 35% in the last quarter. But at least the stock is up over the last five years. Unfortunately its return of 43% is below the market return of 45%.

Although Immutep has shed AU$50m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Immutep

With just AU$3,930,931 worth of revenue in twelve months, we don't think the market considers Immutep to have proven its business plan. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Immutep has the funding to invent a new product before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

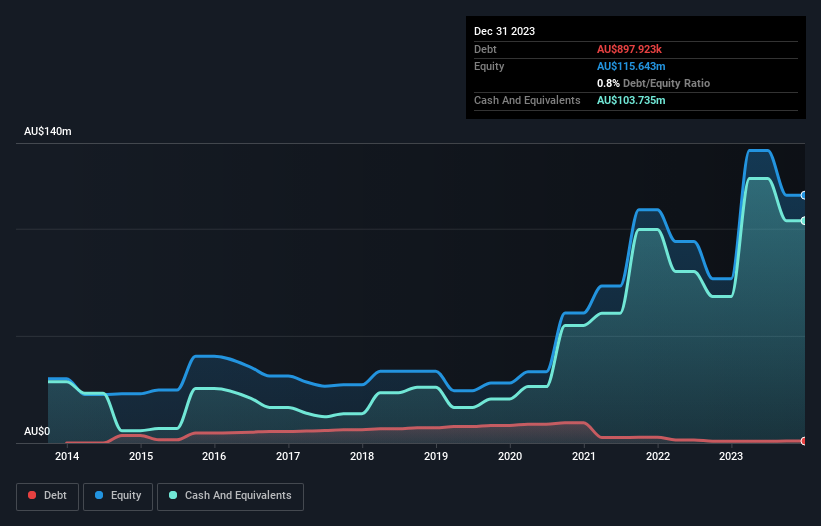

Immutep had cash in excess of all liabilities of when it last reported. While that's nothing to panic about, the company did raise more capital recently, bolstering the balance sheet since profits are not yet a reality. Given the share price has increased by a solid 130% per year, over 5 years , it's fair to say investors remain excited about the future with some additional cash available. The image below shows how Immutep's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Immutep's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Immutep hasn't been paying dividends, but its TSR of 46% exceeds its share price return of 43%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Immutep shareholders are down 1.2% for the year, but the market itself is up 8.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 8%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Immutep you should be aware of.

We will like Immutep better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IMM

Immutep

A late-stage biotechnology company, engages in developing novel LAG-3 related immunotherapies for cancer and autoimmune diseases in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives