- Australia

- /

- Life Sciences

- /

- ASX:EZZ

EZZ Life Science Holdings Limited (ASX:EZZ) May Have Run Too Fast Too Soon With Recent 25% Price Plummet

EZZ Life Science Holdings Limited (ASX:EZZ) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 538% in the last year.

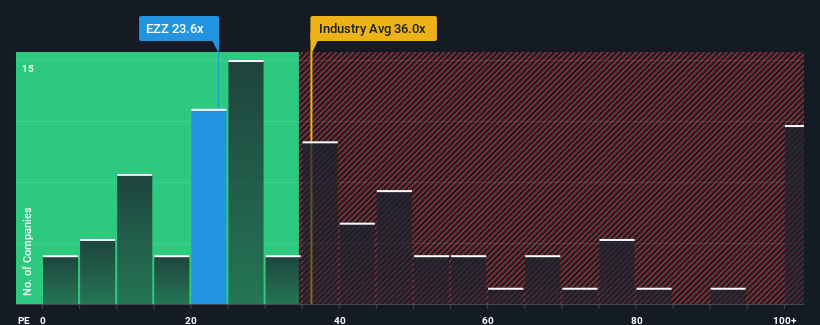

Although its price has dipped substantially, given around half the companies in Australia have price-to-earnings ratios (or "P/E's") below 19x, you may still consider EZZ Life Science Holdings as a stock to potentially avoid with its 23.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been advantageous for EZZ Life Science Holdings as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for EZZ Life Science Holdings

Does Growth Match The High P/E?

In order to justify its P/E ratio, EZZ Life Science Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 90% gain to the company's bottom line. Pleasingly, EPS has also lifted 162% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is not materially different.

In light of this, it's curious that EZZ Life Science Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On EZZ Life Science Holdings' P/E

Despite the recent share price weakness, EZZ Life Science Holdings' P/E remains higher than most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of EZZ Life Science Holdings' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 3 warning signs for EZZ Life Science Holdings (of which 1 doesn't sit too well with us!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if EZZ Life Science Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EZZ

EZZ Life Science Holdings

Engages in formulation, production, marketing, and sale of the health and wellbeing products in Australia, New Zealand, Mainland China, and South-East Asia.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives