- Australia

- /

- Metals and Mining

- /

- ASX:KCN

BKI Investment And 2 Other ASX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Australian market looks to end the week on a positive note, buoyed by steady commodities and a strong overnight performance on Wall Street, investors are eyeing opportunities in various segments. Penny stocks, despite their somewhat outdated name, remain an intriguing area for those seeking potential value and growth in smaller or newer companies. With solid financial foundations, these stocks can offer promising returns as they combine balance sheet strength with potential for significant gains.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.47 | A$134.7M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.19 | A$103.31M | ✅ 3 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.85 | A$52.93M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.80 | A$432.95M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.73 | A$275.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.0745 | A$38.57M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.34 | A$357.38M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$4.43 | A$1.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.79 | A$377.78M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 441 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

BKI Investment (ASX:BKI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BKI Investment Company Limited is a publicly owned investment manager with a market cap of A$1.46 billion.

Operations: BKI Investment's revenue is derived entirely from the Securities Industry, amounting to A$69.33 million.

Market Cap: A$1.46B

BKI Investment Company Limited, with a market cap of A$1.46 billion, demonstrates financial stability through its debt-free status and high-quality earnings. Despite a steady revenue stream of A$69.33 million from the securities industry, the company's recent earnings report shows a slight decline in net income to A$61.86 million from last year. The dividend yield remains attractive at 4.35%, although it is not fully covered by earnings or free cash flows, raising sustainability concerns. Recent board changes include Mr. Alexander Payne's newly recognized independence as a director, potentially enhancing governance dynamics within BKI's seasoned board structure.

- Dive into the specifics of BKI Investment here with our thorough balance sheet health report.

- Assess BKI Investment's previous results with our detailed historical performance reports.

Dimerix (ASX:DXB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dimerix Limited is a biopharmaceutical company focused on developing and commercializing pharmaceutical products for unmet medical needs in Australia, with a market cap of A$288.09 million.

Operations: The company's revenue is derived entirely from the development of occupational drug testing devices and new therapeutic agents, amounting to A$5.59 million.

Market Cap: A$288.09M

Dimerix Limited, with a market cap of A$288.09 million, remains pre-revenue despite reporting sales of A$5.59 million for the year ended June 30, 2025. The company is unprofitable with a net loss of A$13.25 million, though its cash runway is secure for over three years due to positive free cash flow. Dimerix's management and board are experienced, averaging tenures of 4.3 and 7.9 years respectively, which may aid strategic direction amidst industry challenges. The stock trades significantly below estimated fair value and remains debt-free with short-term assets exceeding liabilities by a substantial margin.

- Jump into the full analysis health report here for a deeper understanding of Dimerix.

- Understand Dimerix's track record by examining our performance history report.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties, with a market cap of A$767.12 million.

Operations: The company's revenue is primarily derived from its Chatree segment, which generated A$336.75 million.

Market Cap: A$767.12M

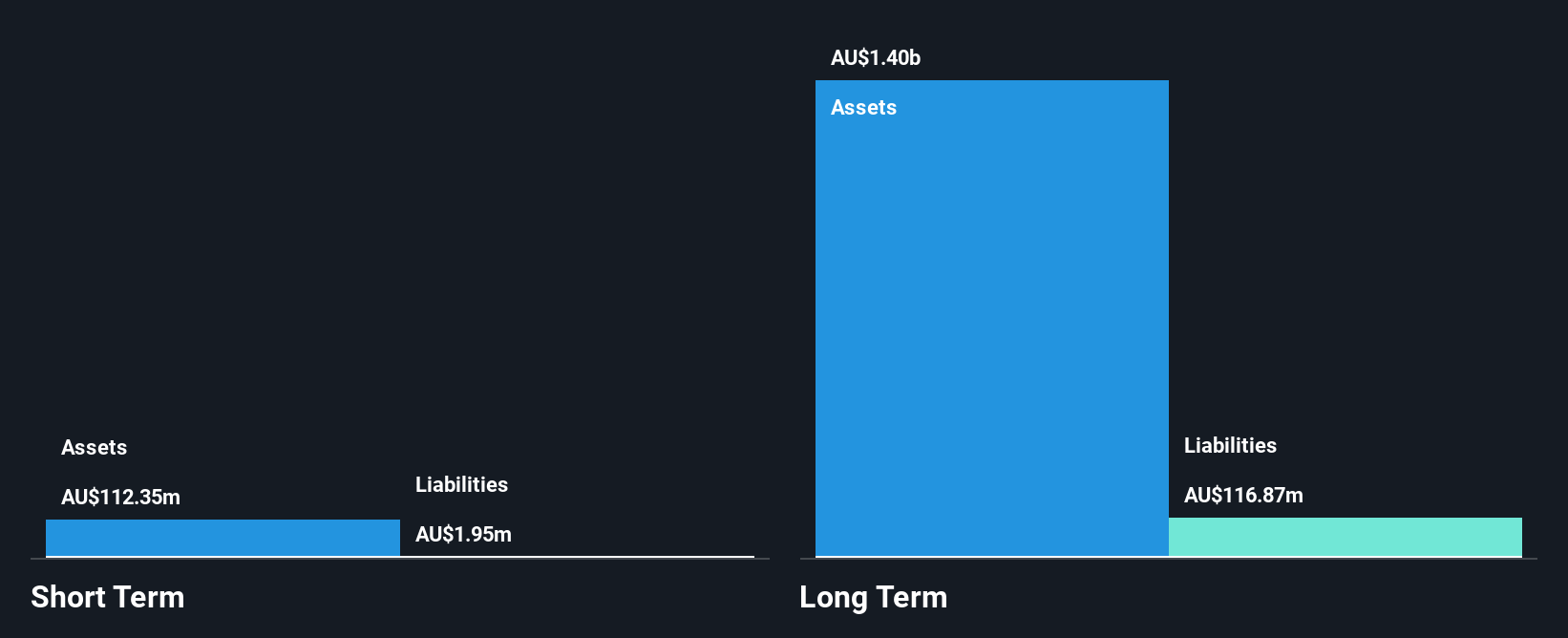

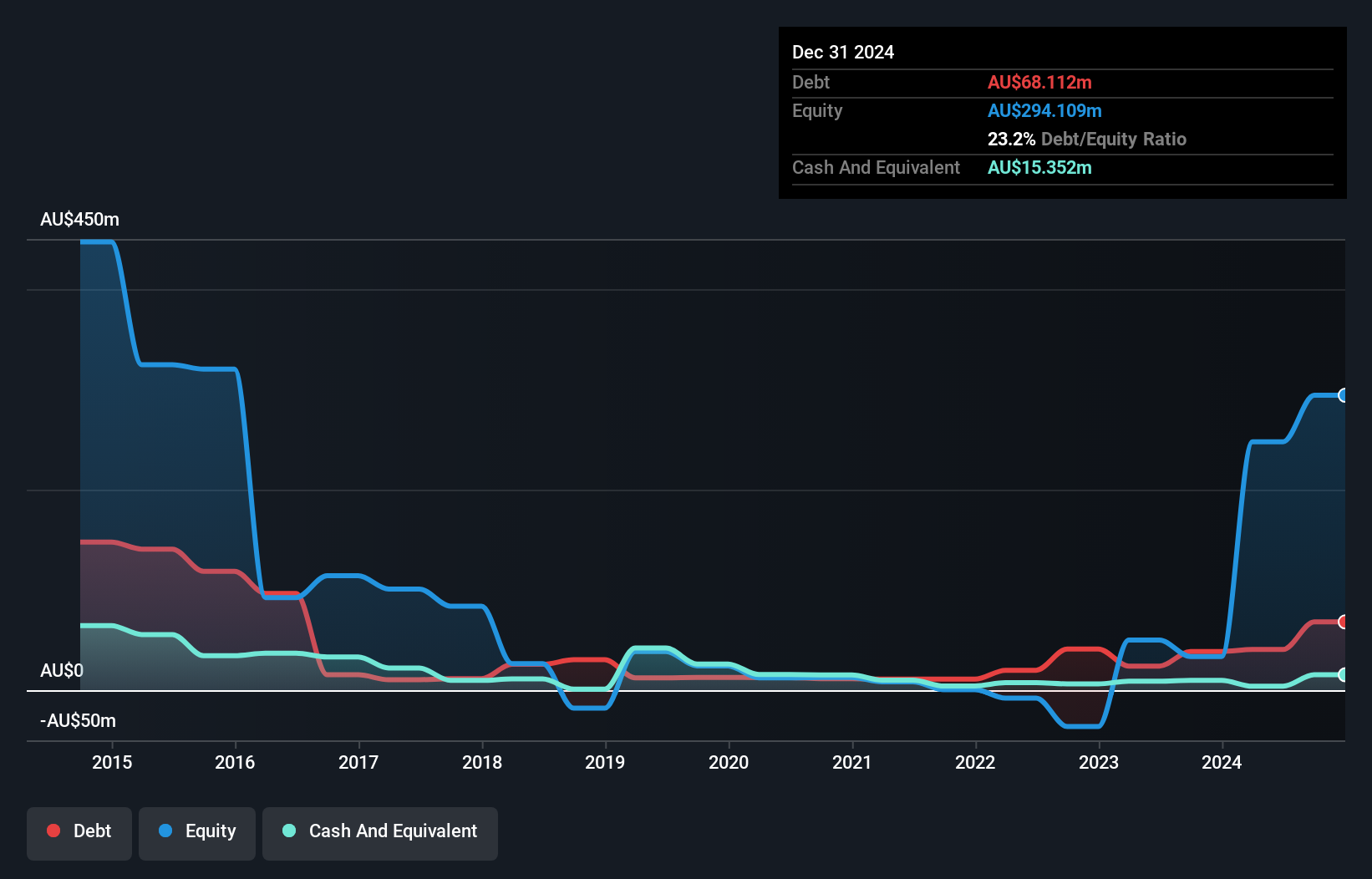

Kingsgate Consolidated Limited, with a market cap of A$767.12 million, reported significant revenue growth from its Chatree segment, reaching A$336.75 million for the year ended June 30, 2025. However, net income declined to A$29.46 million from the previous year's A$199.76 million due to reduced profit margins and earnings per share. The company has successfully reduced its debt-to-equity ratio over five years and maintains satisfactory net debt levels relative to equity. Despite stable weekly volatility and high-quality past earnings, current interest coverage remains below optimal levels, indicating potential challenges in managing financial obligations effectively.

- Take a closer look at Kingsgate Consolidated's potential here in our financial health report.

- Evaluate Kingsgate Consolidated's prospects by accessing our earnings growth report.

Key Takeaways

- Click here to access our complete index of 441 ASX Penny Stocks.

- Interested In Other Possibilities? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsgate Consolidated might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KCN

Kingsgate Consolidated

Engages in the exploration, development, and mining of mineral properties.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives