When Will Cynata Therapeutics Limited (ASX:CYP) Turn A Profit?

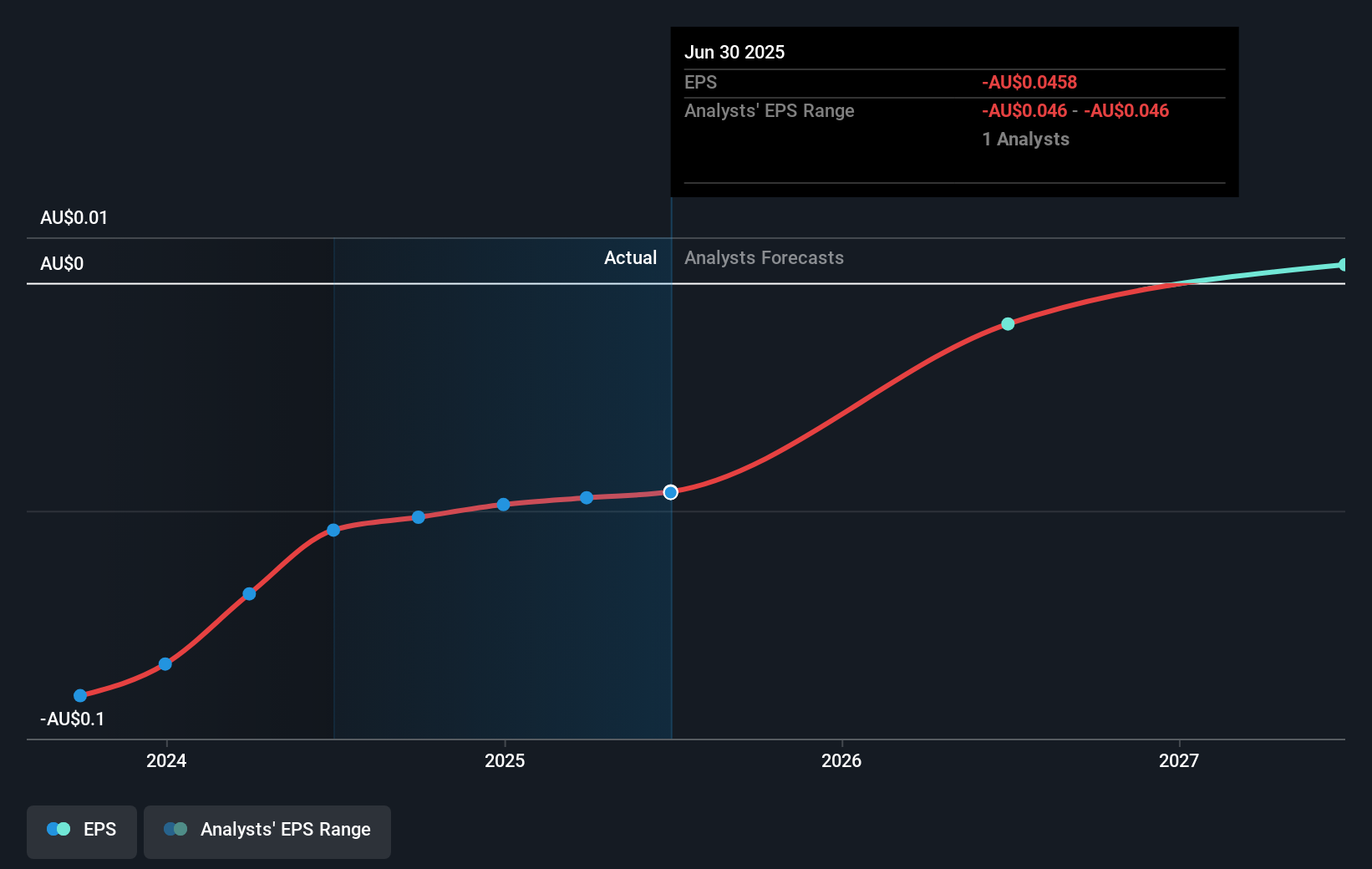

We feel now is a pretty good time to analyse Cynata Therapeutics Limited's (ASX:CYP) business as it appears the company may be on the cusp of a considerable accomplishment. Cynata Therapeutics Limited, together with its subsidiaries, engages in the development and commercialization of proprietary induced pluripotent stem cell and mesenchymal stem cell technology under the Cymerus brand for human therapeutic use in Australia. The AU$70m market-cap company announced a latest loss of AU$9.4m on 30 June 2025 for its most recent financial year result. The most pressing concern for investors is Cynata Therapeutics' path to profitability – when will it breakeven? In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

Expectations from some of the Australian Biotechs analysts is that Cynata Therapeutics is on the verge of breakeven. They anticipate the company to incur a final loss in 2026, before generating positive profits of AU$900k in 2027. The company is therefore projected to breakeven around 2 years from now. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 126% is expected, which is rather optimistic! If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Underlying developments driving Cynata Therapeutics' growth isn’t the focus of this broad overview, but, take into account that by and large biotechs, depending on the stage of product development, have irregular periods of cash flow. This means, large upcoming growth rates are not abnormal as the company is beginning to reap the benefits of earlier investments.

View our latest analysis for Cynata Therapeutics

Before we wrap up, there’s one aspect worth mentioning. Cynata Therapeutics currently has no debt on its balance sheet, which is rare for a loss-making biotech, which typically has high debt relative to its equity. The company currently operates purely off its shareholder funding and has no debt obligation, reducing concerns around repayments and making it a less risky investment.

Next Steps:

This article is not intended to be a comprehensive analysis on Cynata Therapeutics, so if you are interested in understanding the company at a deeper level, take a look at Cynata Therapeutics' company page on Simply Wall St. We've also compiled a list of relevant aspects you should look at:

- Valuation: What is Cynata Therapeutics worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Cynata Therapeutics is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Cynata Therapeutics’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CYP

Cynata Therapeutics

Engages in the development and commercialization of proprietary induced pluripotent stem cell and mesenchymal stem cell technology under the Cymerus brand for human therapeutic use in Australia.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion