The Australian market has seen mixed performances recently, with the ASX200 retreating and IT sectors showing resilience amid broader economic uncertainties, including potential US interest rate cuts and fluctuating commodity prices. In this environment, identifying high growth tech stocks involves evaluating companies that are well-positioned to leverage technological advancements and navigate current market dynamics effectively.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 11.53% | 37.56% | ★★★★★☆ |

| Infomedia | 7.00% | 20.05% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 21.20% | 24.78% | ★★★★★☆ |

| Immutep | 82.05% | 46.28% | ★★★★★★ |

| Pro Medicus | 19.62% | 21.46% | ★★★★★☆ |

| Wrkr | 53.03% | 122.27% | ★★★★★★ |

| BlinkLab | 51.29% | 56.62% | ★★★★★★ |

| Artrya | 49.83% | 59.49% | ★★★★★☆ |

| PYC Therapeutics | 16.85% | 33.76% | ★★★★★☆ |

| FINEOS Corporation Holdings | 10.00% | 57.30% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and other international markets with a market cap of A$541.34 million.

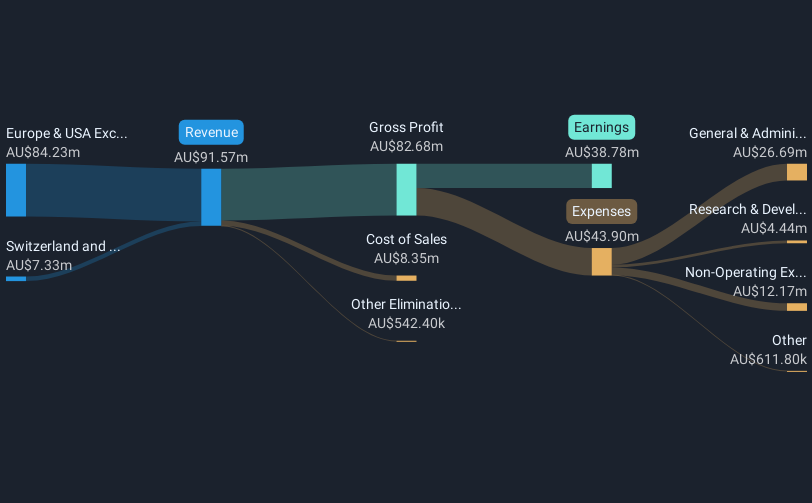

Operations: Clinuvel Pharmaceuticals generates revenue primarily from its biopharmaceutical sector, amounting to A$95.02 million. The company operates across various international markets, focusing on treatments for genetic and metabolic disorders.

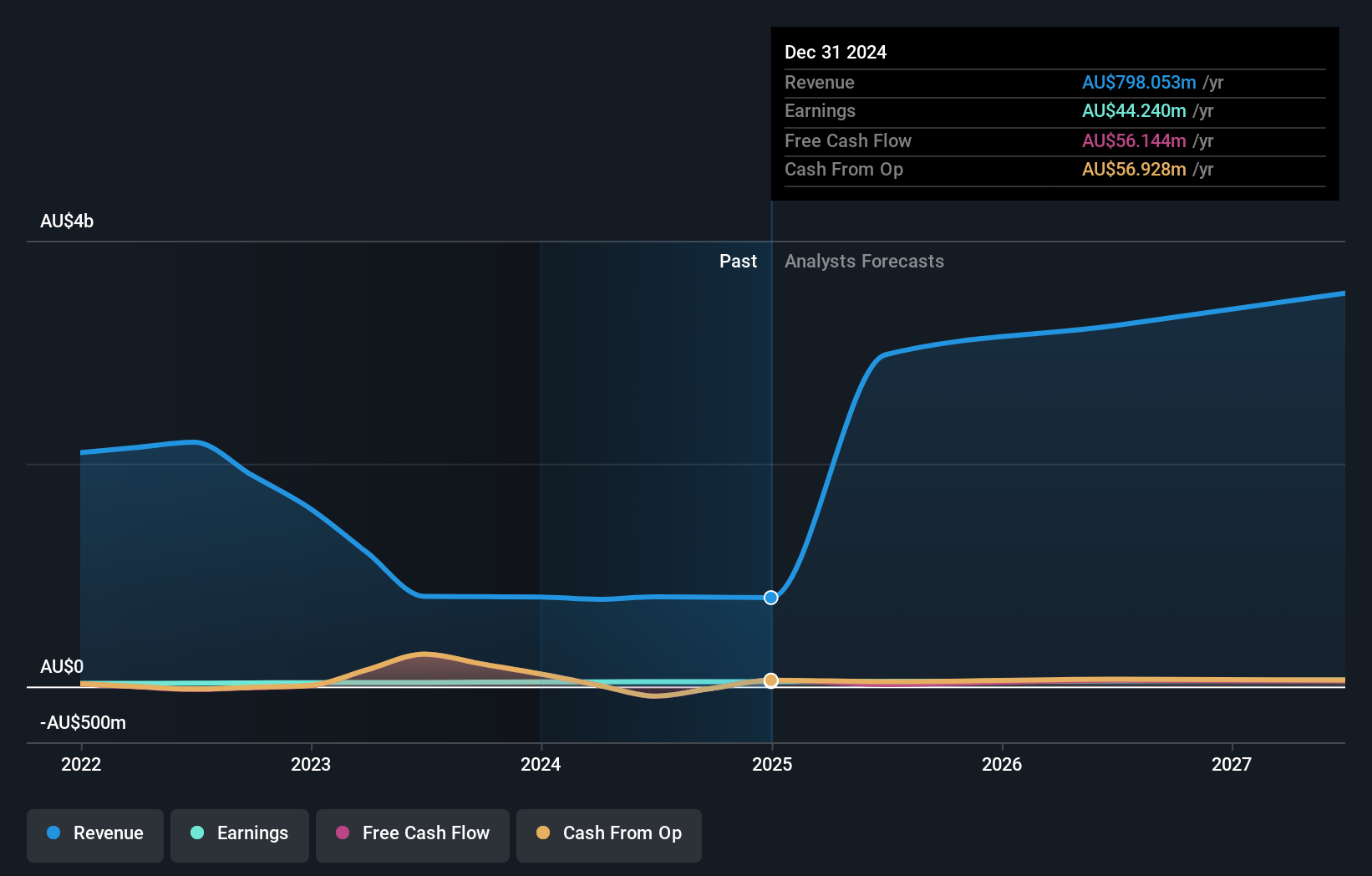

Clinuvel Pharmaceuticals has demonstrated robust financial performance with a notable revenue increase to AUD 105.3 million, up from AUD 95.31 million last year, paralleled by a slight rise in net income to AUD 36.17 million. This growth underscores its potential in the high-growth tech sector within Australia, particularly as it outpaces the general market with an expected annual revenue surge of 21.2% and earnings growth of nearly 24.8%. The firm's commitment to innovation is evident from its recent re-engagement of Dr. Philippe Wolgen focusing on product development, signaling ongoing enhancements and expansions in its offerings which could further cement its competitive position in the biotech industry.

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Data#3 Limited is an Australian company that offers a range of information technology solutions and services, with a market capitalization of A$1.46 billion.

Operations: Data#3 Limited generates revenue through three main segments: Services, Software Solutions, and Infrastructure Solutions, with the latter contributing A$508.14 million. The company focuses on delivering comprehensive IT solutions across these segments in Australia.

Data#3 Limited has demonstrated a solid trajectory in Australia's tech sector, with its recent financial performance revealing a revenue increase to AUD 853 million, up by nearly 6% from the previous year. This growth is complemented by an earnings rise to AUD 48.19 million, reflecting an annual growth rate of approximately 11%. The company's strategic focus on innovation and expansion is underscored by significant board appointments aimed at enhancing its technological and strategic capabilities. These moves signal Data#3’s commitment to maintaining a competitive edge in a rapidly evolving industry, supported by robust revenue forecasts that outpace general market trends.

- Click here to discover the nuances of Data#3 with our detailed analytical health report.

Gain insights into Data#3's historical performance by reviewing our past performance report.

Infomedia (ASX:IFM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the global automotive industry, with a market cap of A$632.03 million.

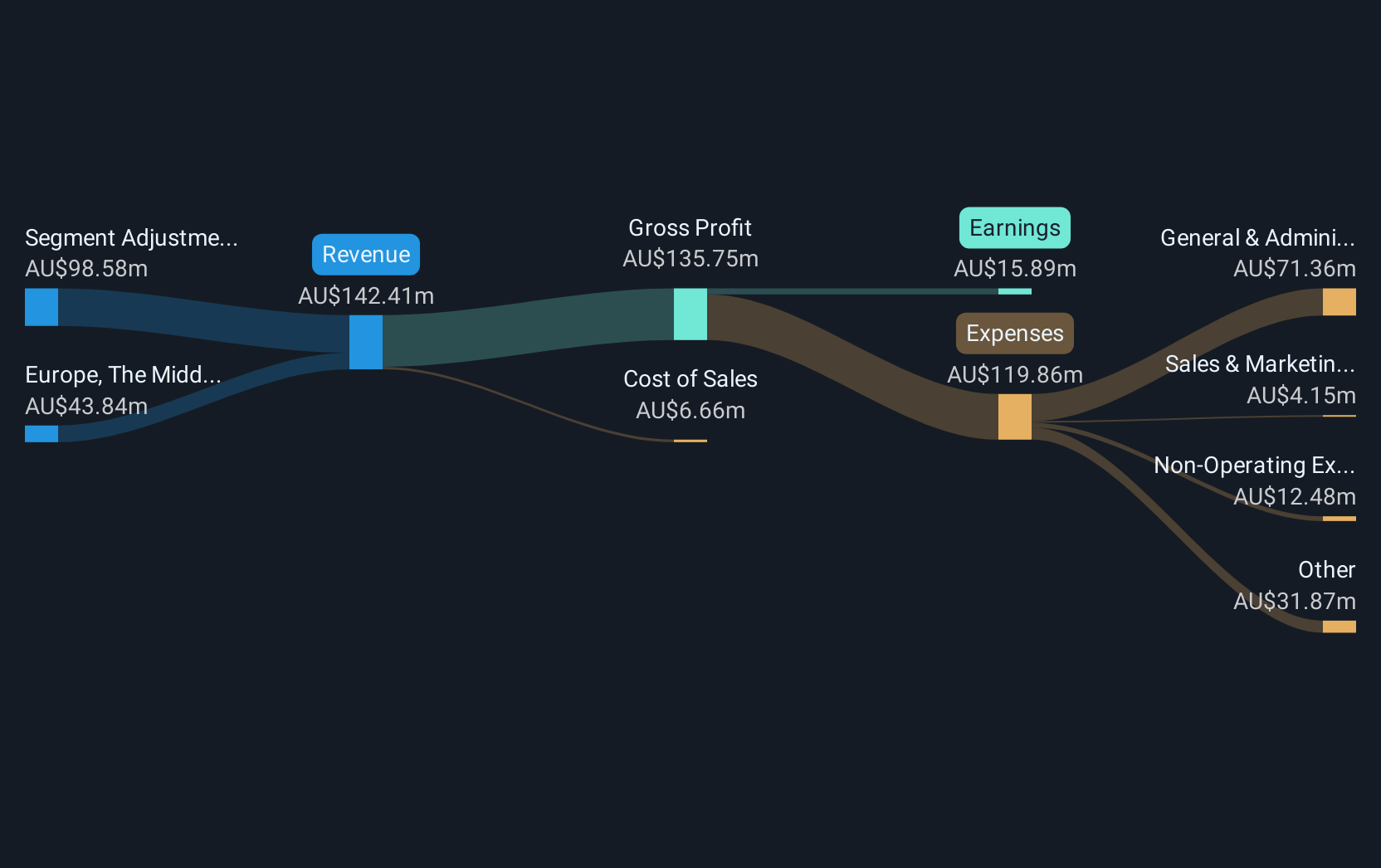

Operations: Infomedia generates revenue primarily through its publishing of periodicals, amounting to A$146.51 million. The company focuses on providing digital solutions tailored for the automotive sector, enhancing efficiency and service delivery for its clients worldwide.

Infomedia's recent performance and strategic decisions underscore its evolving presence in the tech landscape. With a notable 31.6% increase in earnings over the past year, surpassing the software industry average of 30.4%, Infomedia is demonstrating robust growth dynamics. This upward trajectory is supported by an ambitious revenue forecast set between AUD 152 million and AUD 159 million for 2026, reflecting a solid annual growth rate of 7%. Additionally, the company's commitment to innovation is evident from its R&D investments which align closely with its revenue gains, ensuring sustained development in competitive tech sectors. The recent acquisition proposal by TPG Growth Capital Asia further highlights Infomedia’s strategic value within the industry, promising new avenues for expansion and shareholder value enhancement as it prepares to delist from ASX post-acquisition approval.

- Unlock comprehensive insights into our analysis of Infomedia stock in this health report.

Understand Infomedia's track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 23 ASX High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CUV

Clinuvel Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for patients with genetic, metabolic, systemic, and life-threatening disorders in Australia, Europe, the United States, Switzerland, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives