Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like CSL (ASX:CSL), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for CSL

CSL's Earnings Per Share Are Growing.

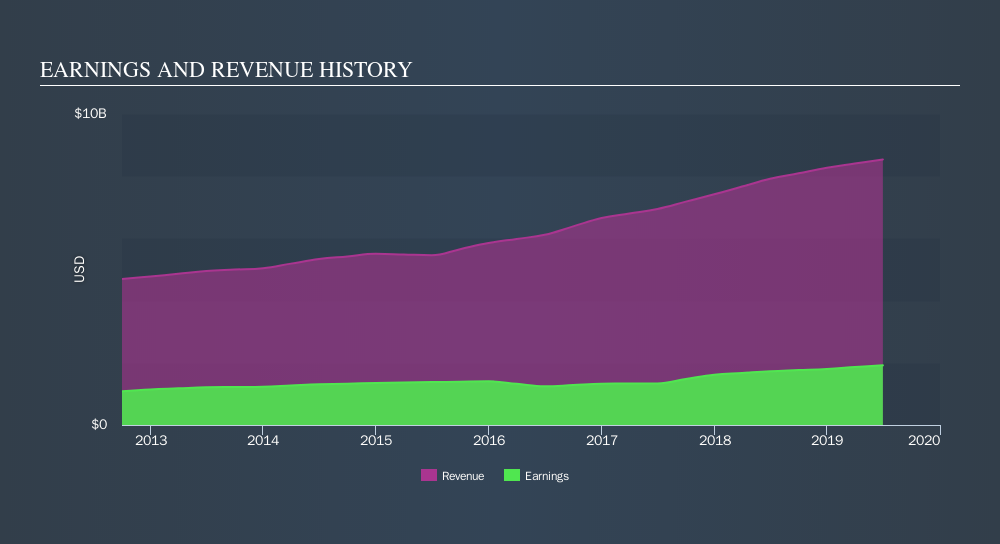

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years CSL grew its EPS by 16% per year. That growth rate is fairly good, assuming the company can keep it up.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. CSL maintained stable EBIT margins over the last year, all while growing revenue 7.9% to US$8.5b. That's progress.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for CSL's future profits.

Are CSL Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for CSL shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Non Executive Director Megan Clark bought US$40k worth of shares at an average price of around US$179.86.

The good news, alongside the insider buying, for CSL bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping US$136m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Should You Add CSL To Your Watchlist?

One important encouraging feature of CSL is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if CSL is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But CSL isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:CSL

CSL

Researches, develops, manufactures, markets, and distributes biopharmaceutical and vaccines in Australia, the United States, Germany, the United Kingdom, Switzerland, China, Hong Kong, and internationally.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives