Did CSL's (ASX:CSL) Award-Winning Facility Redefine Its Innovation and Scale Investment Narrative?

Reviewed by Sasha Jovanovic

- CSL's Broadmeadows plasma fractionation facility in Australia was recently named the Overall Winner of the 2025 Facility of the Year Award by the International Society for Pharmaceutical Engineering, recognised for advanced automation, robotics, real-time monitoring, and digital twin infrastructure that have increased plasma processing capacity to over 10 million litres annually.

- This milestone highlights CSL's industry leadership in next-generation biopharmaceutical manufacturing and underlines its operational focus on innovation and sustainability.

- We'll examine how this industry accolade for innovation and scale at CSL's Broadmeadows facility shapes the company's broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

CSL Investment Narrative Recap

CSL’s investment appeal centers on confidence in long-term, innovation-driven growth in plasma and biologics, supported by efficiency gains and a robust pipeline. While Broadmeadows’ Facility of the Year win further demonstrates CSL’s technological edge, it does not alter the immediate catalyst of new product launches or reduce the risk from rising costs and margin pressure, areas that continue to drive sentiment in the near term.

Among recent developments, the FDA approval of ANDEMBRY stands out, directly tying to the short-term catalyst of accelerated revenue from new products. This approval aligns alongside CSL’s manufacturing progress as examples of how operational scale and product pipeline execution interact, but the long-term earnings impact from these achievements will unfold gradually.

Yet, investors should remain mindful, while CSL’s facility sets operational benchmarks, the persistent cost pressures facing the business could…

Read the full narrative on CSL (it's free!)

CSL's outlook anticipates revenue of $18.1 billion and earnings of $4.2 billion by 2028. This is based on a projected annual revenue growth rate of 5.3% and a $1.2 billion increase in earnings from the current $3.0 billion.

Uncover how CSL's forecasts yield a A$280.61 fair value, a 33% upside to its current price.

Exploring Other Perspectives

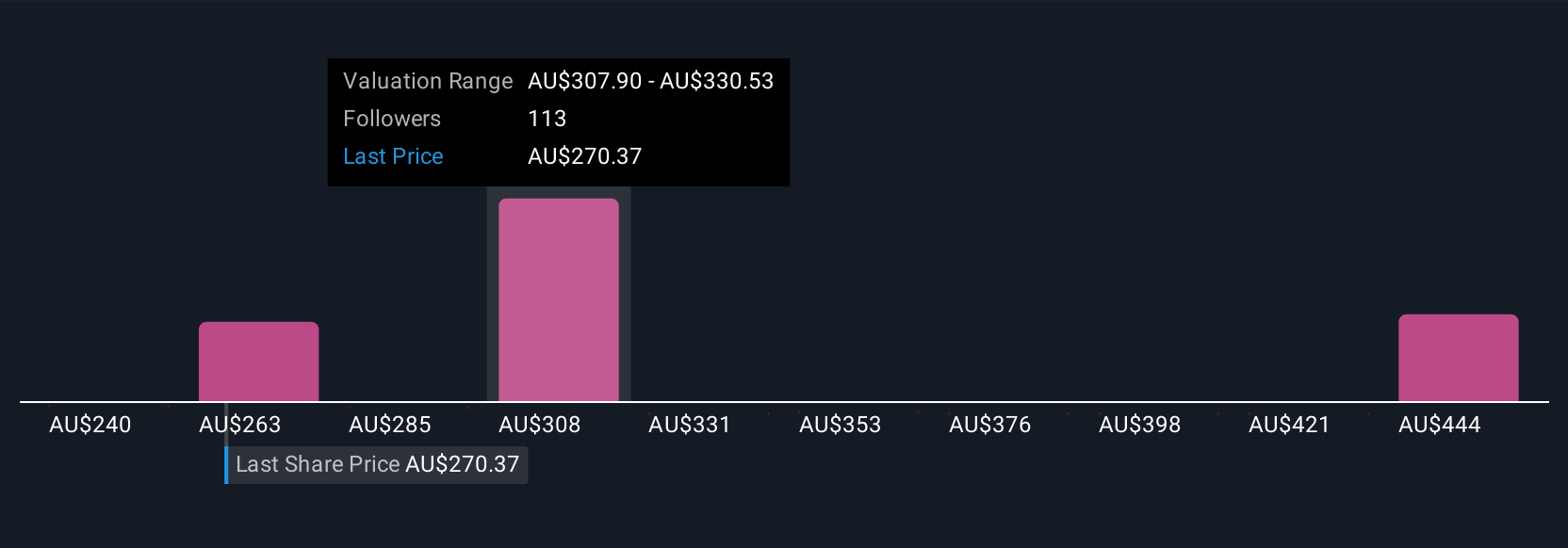

Sixteen members of the Simply Wall St Community estimate CSL’s fair value between A$240 and A$313.60 per share. With margin risks highlighted as a key concern, opinions differ widely on what drives sustainable value, explore multiple viewpoints to inform your perspective.

Explore 16 other fair value estimates on CSL - why the stock might be worth as much as 48% more than the current price!

Build Your Own CSL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSL research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CSL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSL's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CSL

CSL

Engages in the research, development, manufacture, market, and distribution of biopharmaceutical products and vaccines in Australia, the United States, Germany, the United Kingdom, Switzerland, China, Hong Kong, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives