A Piece Of The Puzzle Missing From Cann Group Limited's (ASX:CAN) Share Price

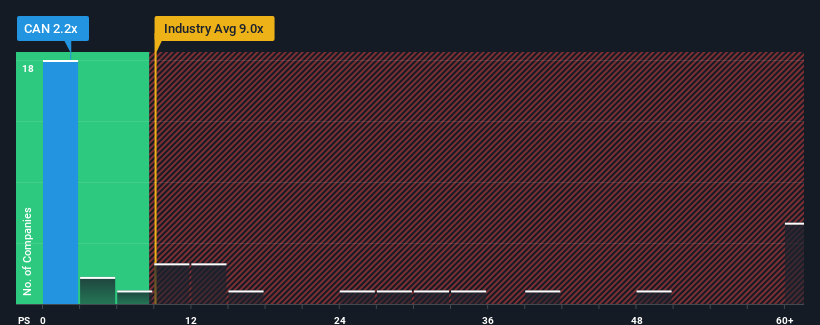

With a price-to-sales (or "P/S") ratio of 2.2x Cann Group Limited (ASX:CAN) may be sending very bullish signals at the moment, given that almost half of all the Pharmaceuticals companies in Australia have P/S ratios greater than 9x and even P/S higher than 31x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Cann Group

How Has Cann Group Performed Recently?

With revenue growth that's exceedingly strong of late, Cann Group has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cann Group will help you shine a light on its historical performance.How Is Cann Group's Revenue Growth Trending?

In order to justify its P/S ratio, Cann Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 84% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 102% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Cann Group is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Cann Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Cann Group you should be aware of, and 1 of them is concerning.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CAN

Cann Group

Engages in the breeding, cultivation, manufacture, and sale of medicinal cannabis in Australia and Europe.

Medium-low risk and slightly overvalued.

Market Insights

Community Narratives