Botanix Pharmaceuticals (ASX:BOT): Evaluating Valuation Following Leadership Changes, Product Rollouts, and Conference Updates

Reviewed by Simply Wall St

Botanix Pharmaceuticals (ASX:BOT) is drawing fresh attention this month as the company prepares for a major conference appearance, has updated investors on recent performance and product rollouts, and introduced a new joint company secretary to its leadership team.

See our latest analysis for Botanix Pharmaceuticals.

After a series of notable updates, including the appointment of a seasoned company secretary and an upcoming presentation at the Canaccord Genuity Drug & Device Conference, Botanix Pharmaceuticals has seen its 12-month share price decline sharply. However, its three-year total shareholder return remains up more than 130%, signaling that momentum has faded after earlier growth phases and recent events have yet to offset long-term weakness.

If recent biotech leadership changes have you curious about market trends, it’s an ideal time to discover other healthcare opportunities with our See the full list for free..

With shares now trading well below analyst targets and recent results revealing both rapid revenue growth and persistent losses, investors may wonder whether Botanix is undervalued at current levels or if the market has already accounted for any future upside.

Price-to-Sales of 49.4x: Is it justified?

Botanix Pharmaceuticals currently trades at a price-to-sales ratio of 49.4x, which stands out as much higher than both its industry peers and typical market benchmarks. With shares last closing at A$0.145, this steep multiple suggests investors are pricing in extraordinary growth, but market sentiment may not reflect the underlying fundamentals.

The price-to-sales ratio is an important valuation yardstick for biotech firms, especially those in early or unprofitable stages, since it compares the company's stock price to its annual revenue. In sectors like pharmaceuticals, elevated ratios often signal investors believe future revenues will scale rapidly once key product milestones are passed. However, such a lofty multiple demands either explosive future sales or exceptional competitive advantages to be justified.

Compared to the Australian Pharmaceuticals industry average of 14.9x and a peer average of 17.4x, Botanix's price-to-sales ratio is noticeably expensive. The SWS fair price-to-sales ratio estimate is 7.8x, which is far below the current market level. This implies there is considerable downside risk if the company fails to deliver standout commercial progress.

Explore the SWS fair ratio for Botanix Pharmaceuticals

Result: Price-to-Sales of 49.4x (OVERVALUED)

However, revenue growth may slow or product rollouts could miss expectations. This could put further pressure on Botanix's ability to justify elevated investor optimism.

Find out about the key risks to this Botanix Pharmaceuticals narrative.

Another View: What Does Our DCF Model Say?

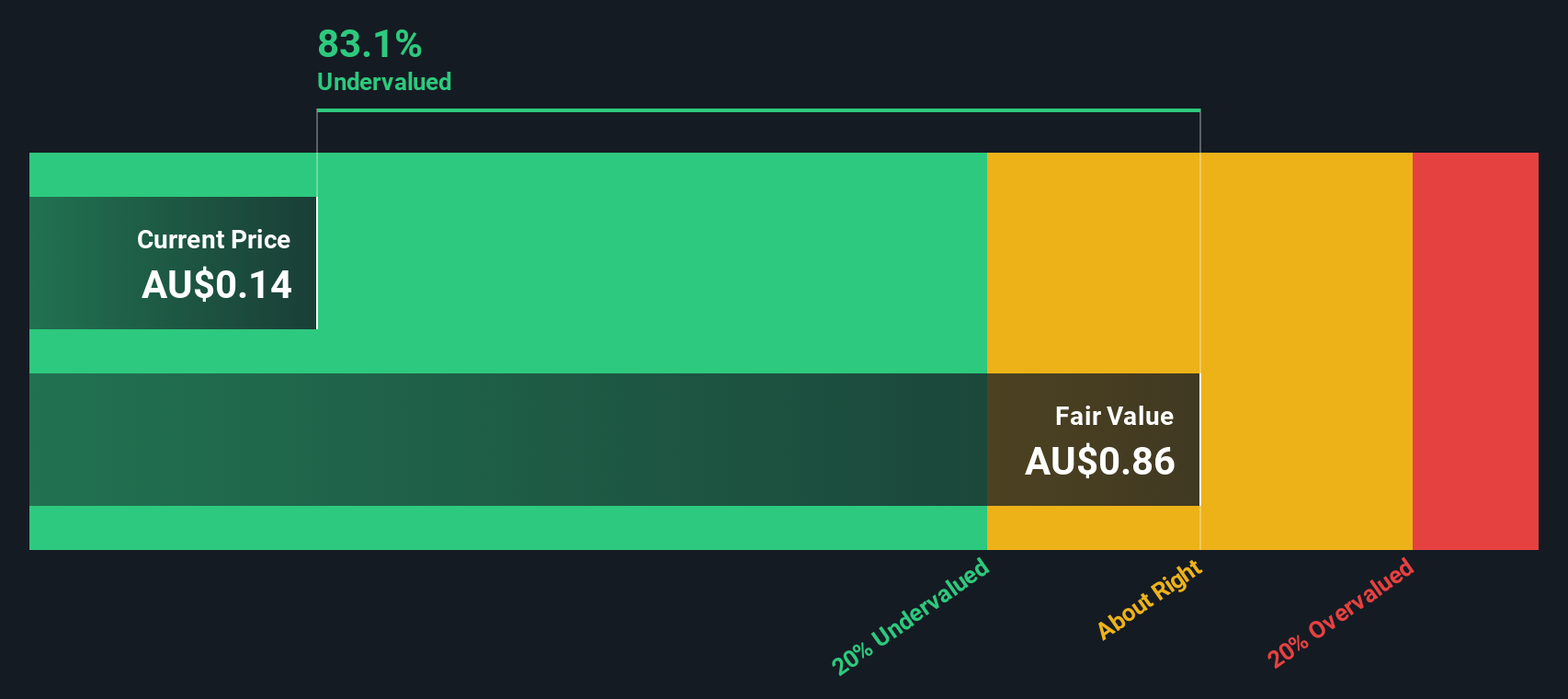

While Botanix looks expensive compared to its sales, the SWS DCF model provides a different perspective. By projecting future cash flows, our DCF estimate suggests the shares are trading about 83% below fair value. Could this large gap indicate untapped upside, or is the market observing factors that are not reflected in the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Botanix Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Botanix Pharmaceuticals Narrative

Keep in mind, if you see the numbers differently or want to investigate the details yourself, you can easily shape your own perspective in under three minutes with our Do it your way.

A great starting point for your Botanix Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss your chance to act on trends others overlook. The right stock could be one click away, and Simply Wall Street’s tools make your search easier than ever.

- Tap into tech growth by checking out AI-powered businesses thriving in tomorrow’s digital economy with these 26 AI penny stocks.

- Boost your hunt for reliable cash flow over the long term by seeing our picks for robust yield with these 17 dividend stocks with yields > 3%.

- Capture the potential of companies the market has not priced in yet through these 877 undervalued stocks based on cash flows, based on strong fundamentals and future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Botanix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOT

Botanix Pharmaceuticals

Operates as a commercial dermatology company in Australia and the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives