The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. For example, the Bionomics Limited (ASX:BNO) share price is up 86% in the last year, clearly besting the market return of around 2.6% (not including dividends). That's a solid performance by our standards! On the other hand, longer term shareholders have had a tougher run, with the stock falling 64% in three years.

See our latest analysis for Bionomics

With just AU$3,192,546 worth of revenue in twelve months, we don't think the market considers Bionomics to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Bionomics comes up with a great new product, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Bionomics has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

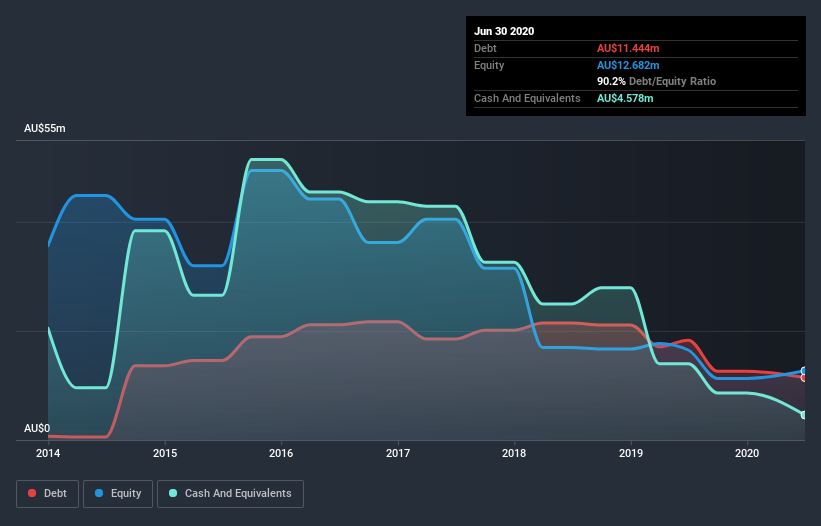

Bionomics had liabilities exceeding cash when it last reported, according to our data. That made it extremely high risk, in our view. So we're not surprised to see the stock up 106% in the last year , once the company took on some more capital. Investors must really like its potential. You can click on the image below to see (in greater detail) how Bionomics' cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

What about the Total Shareholder Return (TSR)?

We've already covered Bionomics' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Bionomics hasn't been paying dividends, but its TSR of 97% exceeds its share price return of 86%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Bionomics shareholders have received a total shareholder return of 97% over the last year. That certainly beats the loss of about 9% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 4 warning signs for Bionomics you should know about.

Of course Bionomics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Bionomics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bionomics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BNO

Bionomics

A clinical stage biopharmaceutical company, discovers and develops novel drug candidates for the treatment of central nervous system disorders and cancers in Australia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives