The Australian stock market has seen modest gains recently, with the ASX200 up 0.25% and sectors like Industrials and Financials showing strong performance. Amidst these movements, the concept of penny stocks remains relevant for investors seeking opportunities in smaller or newer companies that may offer a unique blend of value and growth potential. Despite their somewhat outdated name, penny stocks can still be attractive when backed by solid financials, presenting a chance to uncover hidden value in promising companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.93 | A$91.04M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.48 | A$297.67M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.04 | A$252.05M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$330.52M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.16 | A$334.56M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$63.64M | ★★★★★☆ |

Click here to see the full list of 1,030 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Avecho Biotechnology (ASX:AVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avecho Biotechnology Limited is an Australian biotechnology company focused on developing and commercializing health products for humans and animals using its proprietary drug delivery system and Tocopherol Phosphate Mixture, with a market cap of A$12.68 million.

Operations: The company's revenue is derived from its production segment, totaling A$0.34 million.

Market Cap: A$12.68M

Avecho Biotechnology Limited, with a market cap of A$12.68 million, is pre-revenue, generating only A$0.34 million from its production segment. The company remains unprofitable with increasing losses over the past five years at a rate of 26.6% annually and has no debt obligations for the same period. Despite its financial challenges, Avecho's experienced management team (4.8 years tenure) and board (7.5 years tenure) provide stability. The company's short-term assets significantly cover both short- and long-term liabilities, ensuring a cash runway of over one year despite high share price volatility compared to other Australian stocks.

- Click to explore a detailed breakdown of our findings in Avecho Biotechnology's financial health report.

- Explore historical data to track Avecho Biotechnology's performance over time in our past results report.

LaserBond (ASX:LBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LaserBond Limited is an Australian surface engineering company focused on improving the performance and longevity of capital-intensive machinery components, with a market cap of A$69.81 million.

Operations: The company's revenue is derived from three segments: Products generating A$16.55 million, Services contributing A$23.39 million, and Technology accounting for A$2.05 million.

Market Cap: A$69.81M

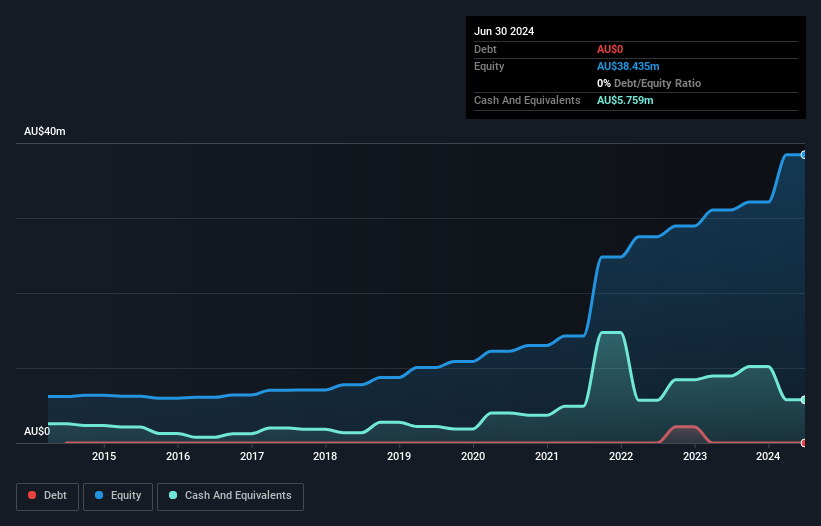

LaserBond Limited, with a market cap of A$69.81 million, demonstrates financial stability through its diversified revenue streams across Products (A$16.55 million), Services (A$23.39 million), and Technology (A$2.05 million). The company is debt-free and maintains strong liquidity, with short-term assets exceeding both short- and long-term liabilities significantly. Despite a decline in profit margins from 12.3% to 8.4%, LaserBond's earnings are projected to grow at 31.23% per year, indicating potential for future profitability improvement. The management team is experienced with an average tenure of 4.3 years, contributing to operational consistency amidst an unstable dividend history and low return on equity at 9.2%.

- Take a closer look at LaserBond's potential here in our financial health report.

- Review our growth performance report to gain insights into LaserBond's future.

PharmX Technologies (ASX:PHX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PharmX Technologies Limited, along with its subsidiaries, operates as a technology and software development company in Australia with a market cap of A$47.88 million.

Operations: The company generates revenue of A$6.42 million from its Health Services segment.

Market Cap: A$47.88M

PharmX Technologies, with a market cap of A$47.88 million, has recently transitioned to profitability, marking significant progress in its financial trajectory. The company boasts high-quality earnings and maintains a debt-free balance sheet for five years, enhancing its financial stability. Its short-term assets of A$16.4 million comfortably cover both short- and long-term liabilities, supporting liquidity. The board's average tenure of 4.7 years indicates experienced governance. Recent executive changes include the appointment of Christopher Fernandes as Company Secretary, underscoring a commitment to strong corporate governance practices amidst evolving market dynamics.

- Click here to discover the nuances of PharmX Technologies with our detailed analytical financial health report.

- Examine PharmX Technologies' past performance report to understand how it has performed in prior years.

Summing It All Up

- Click through to start exploring the rest of the 1,027 ASX Penny Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AVE

Avecho Biotechnology

A biotechnology company, engages in the development and commercialization of human and animal health related products using its proprietary drug delivery system and Tocopherol Phosphate Mixture in Australia.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives