Michael Kotsanis became the CEO of Acrux Limited (ASX:ACR) in 2014, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Acrux

How Does Total Compensation For Michael Kotsanis Compare With Other Companies In The Industry?

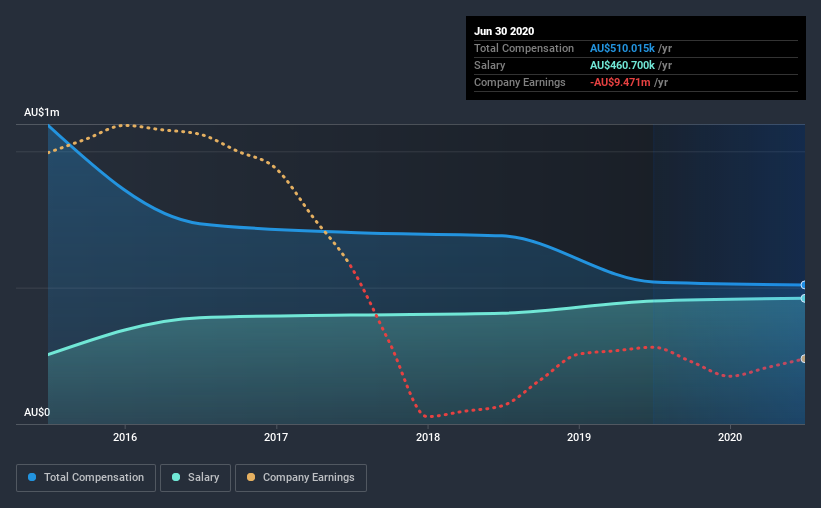

According to our data, Acrux Limited has a market capitalization of AU$30m, and paid its CEO total annual compensation worth AU$510k over the year to June 2020. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at AU$460.7k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below AU$265m, reported a median total CEO compensation of AU$414k. From this we gather that Michael Kotsanis is paid around the median for CEOs in the industry. What's more, Michael Kotsanis holds AU$175k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$461k | AU$451k | 90% |

| Other | AU$49k | AU$70k | 10% |

| Total Compensation | AU$510k | AU$521k | 100% |

Talking in terms of the industry, salary represented approximately 66% of total compensation out of all the companies we analyzed, while other remuneration made up 34% of the pie. Acrux pays out 90% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Acrux Limited's Growth

Over the last three years, Acrux Limited has shrunk its earnings per share by 5.4% per year. It achieved revenue growth of 87% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Acrux Limited Been A Good Investment?

With a total shareholder return of 21% over three years, Acrux Limited shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As we touched on above, Acrux Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But revenue growth over the last year can't be ignored. Meanwhile, we would have liked to see shareholder returns post more substantial growth. EPS growth is a further sore spot — the metric is negative over the last three years. There's certainly room for improvement, but CEO compensation seems reasonable, considering the company's steady performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Acrux you should be aware of, and 2 of them are a bit unpleasant.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Acrux or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:ACR

Acrux

Develops and commercializes generic and topically applied pharmaceutical products in Australia, Europe, the United States, and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026